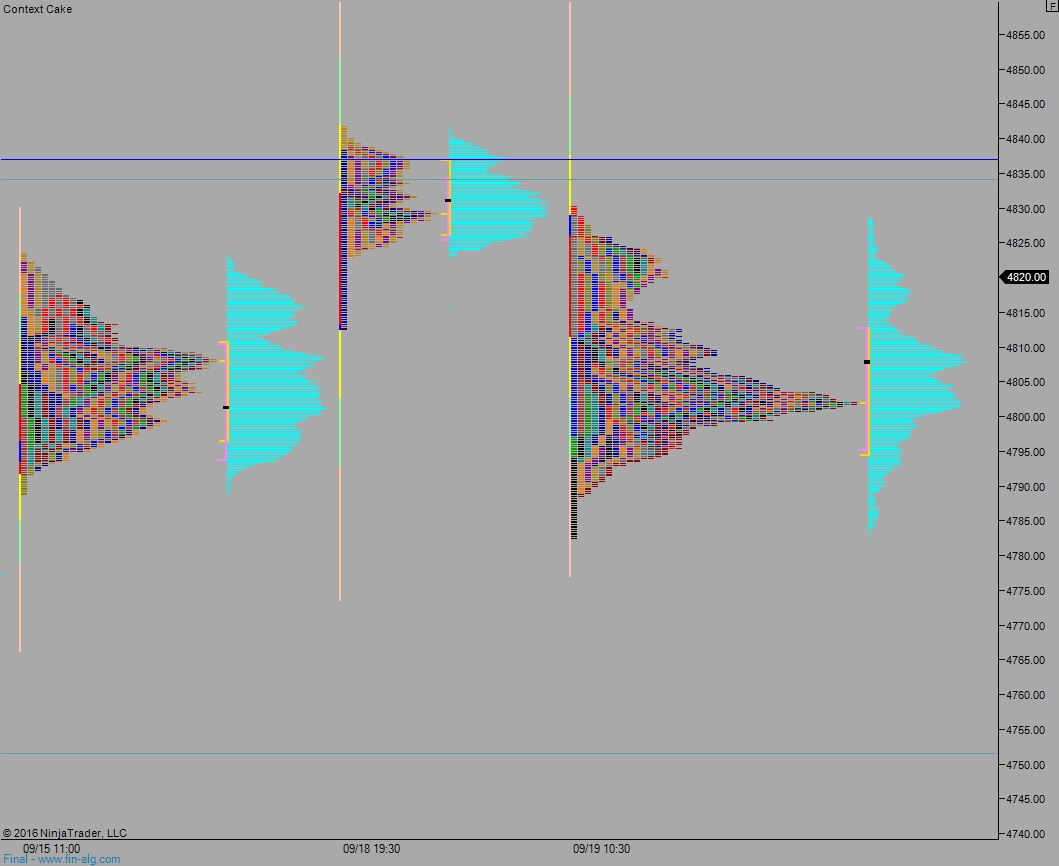

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring an elevated range on normal volume. Price probed near the week’s low before finding a buyer and pressing up near the week’s high before ultimately coming into balance. At 7am MBA Mortgage application came in well below last week’s reading.

Today is Fed Day. At 2pm they will release their rate decision. Other than this major announcement, we have crude oil inventory at 10:30am.

Yesterday we printed a normal variation down. It was a tight, range-bound day but it was controlled by sellers.

Heading into today my primary expectation is for sellers to work into the overnight inventory, down to close the overnight gap at 4798 before finding a a buyers and marking time until the 2pm Fed announcement.

Hypo 2 buyers gap-and-go. They take out overnight high 4830.25 and work up to 4867 as we await the FOMC rate decision.

Hypo 3 strong selling closes overnight gap 4798 early and continues, down through overnight low 4788.50. Look for buyers down at 4779 and two way trade to ensue.

Hypo 4 full on liquidation trigger. There is a slip zone below 4779 that extends down to 4760.

Levels:

Volume profiles, gaps, and measured moves: