NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price held Wednesday’s range while working lower. At 8:30am Durable Goods orders came in well above expectations, and Initial/Continuing Jobless claims data was better than expected.

Also on the economic docket today we have Service/Composite PMI at 9:45am then a 7-year note auctino at 1pm.

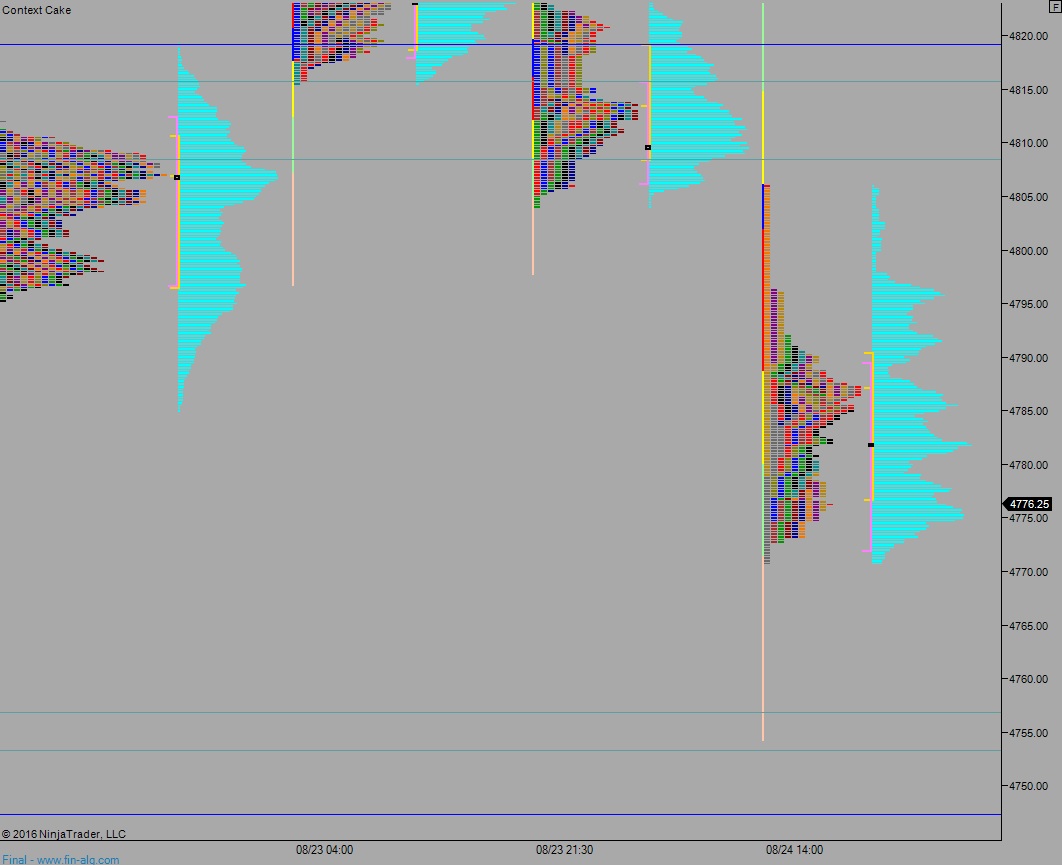

Yesterday we printed a double distribution trend down. This came on the heels of a failed auction Tuesday and confirmed the pattern, which will be considered a live pattern as long as price sustains below 4816.

Heading into today my primary expectation is for sellers to make an early push lower and attempt to trigger a liquidation. This attempt ultimately fails, and we print a sharp reversal back up to 4800 before two way trade ensues as investors wait for Jackson Hole on Friday.

Hypo 2 buyers push into the overnight inventory off the open and close the gap up to 4787.50. Buyers sustain trade above 4800 setting up a move to target 4808 before two way trade ensues.

Hypo 3 full-on liquidation, down to 4757 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Nice. How long have you been watching ndaq like this for?

2 years full time