NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring normal range and volume. Price worked lower until about 3am, right down to the MCVPOC at 4805 before printing a v-shaped bounce back to Tuesday’s close. At 7am MBA Mortgage Applications came in lower than last week’s reading.

Also on the economic calendar today we have Existing Home Sales at 10am, crude oil inventories at 10:30am, a 2-year Note auction at 11:30am, and a 5-year Note auction at 1pm.

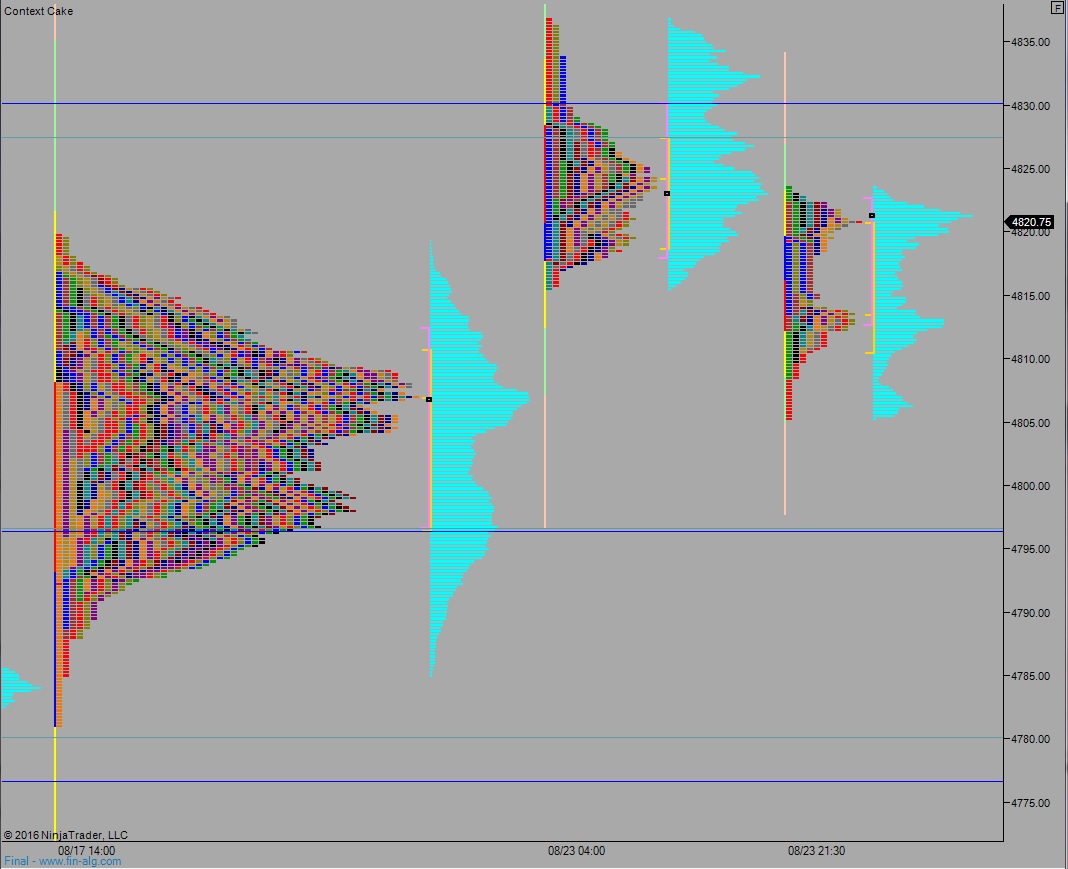

Yesterday we printed a normal variation down after taking out swing high. The nature of this move, taking out swing high then swiftly reversing, elevates the possibility of a failed auction, a price pattern that has marked inflection points in recent history.

Here’s a look at the potential failed auction on the NASDAQ:

Note: the same event happened on the S&P 500 yesterday.

Heading into today my primary expectation is for sellers to push into the overnight inventory and take out overnight low 4805.25. We’re going to test down through our balance and probe the other side of it, most likely, now that the topside has failed. Look for a move down to 4796.50 before two-way trade ensues.

Hypo 2 buyers show up in the VPOC zone from 4805 – 4795 and we chop about in this region all day.

Hypo 3 buyers show up around 4812.50 and the push up through overnight high 4823.50. They continue higher, up through Tuesday’s high 4836.75, effectively negating the failed auction. Look for sellers up at 4839 and two way trade to ensue.

Levels: