NASDAQ futures are coming into Tuesday with a slight gap down after an overnight session featuring normal range and volume. Price mostly worked lower, taking back about 68.8% of the rally from yesterday before finding a bid and settling into two-way trade. At 8:30am the Housing Starts and Building Permits data was [very] slightly better-than-expected.

Also on the economic docket today we have both the 52-week and 4-week T-Bill auctions at 11:30am.

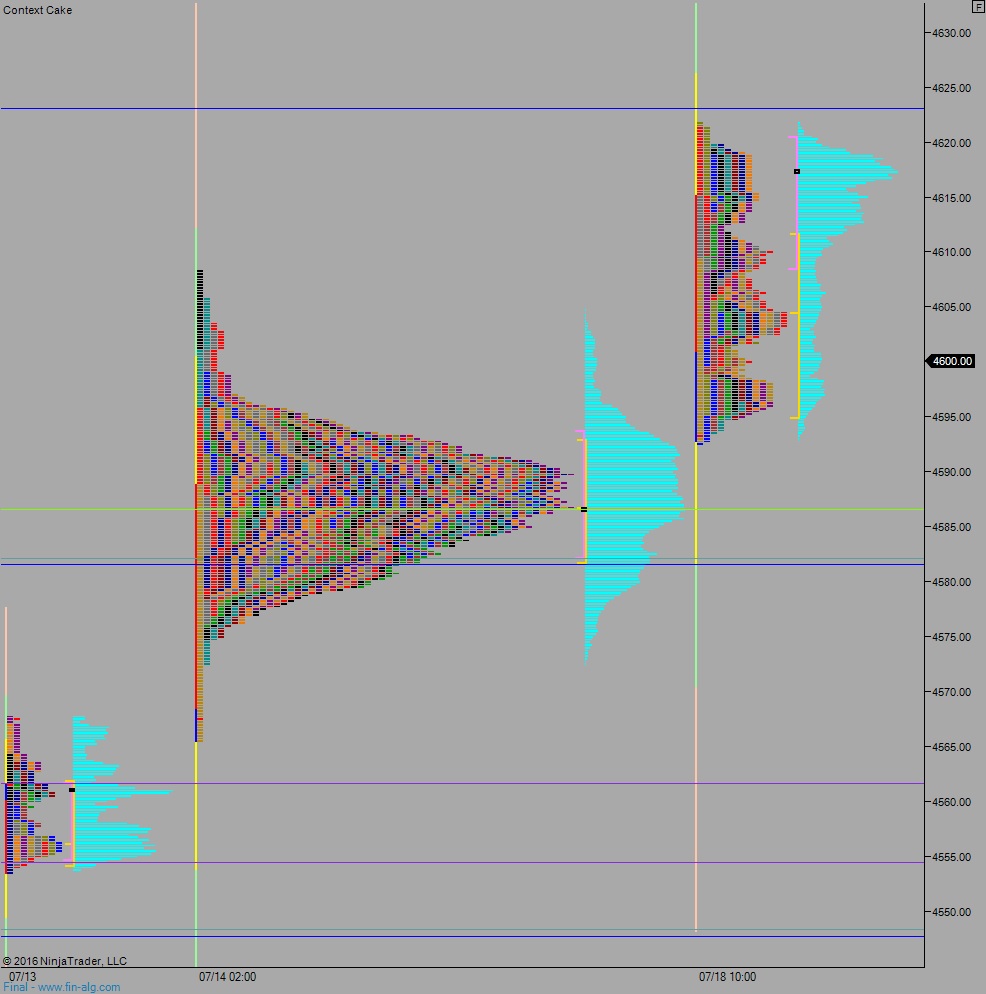

Yesterday we printed a double distribution trend up. The week kicked off with a slight gap up and buyers managed to drive higher from it—taking out last Friday’s high early on and sustaining trade above it for the rest of the session.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4607. Buyers continue higher, up through overnight high 4611.75 and tag 4617.25 before two way trade ensues.

Hypo 2 buyers close the gap up to 4607 then stall out. The market rolls over and takes out overnight low 4592.50 and continues lower to target 4586.75 before two way trade ensues.

Hypo 3 sellers gap and go lower, take out overnight low 4592.50 early on and work price down to 4582.25 before two way trade ensues.

Hypo 4 some kind of liquidation takes hold. Sellers sustain trade below 4582 setting up a liquidation down to 4591.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: