Part of the reason I work with market profile is it allows me to envision how the day might progress. The idea is simple. Going back and reviewing a market profile chart shows you how markets often trade in statistical bell curves. Therefore, if you come into a session with a slightly incomplete bell curve, you and visualize what type of trade would be needed to smooth it out.

The economic calendar is quiet to start the week and earnings are starting to roll in. But for all intents and purposes Nasdaq futures will be left to their own device today due to limited external factors.

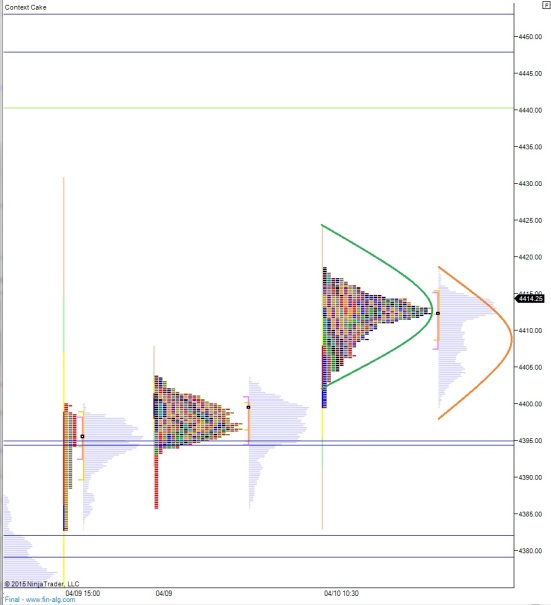

What was constructive about last week was how we auctioned each price level thoroughly before advancing to the next. The prior auctions that took place from about 4377 – 4425 were fast jerks through price. When instead each level is debated as we go, it sets a better foundation. See below:

Heading into today, my primary expectation is for buyers to continue exploring higher prices. However, I will be looking for signs of responsive sellers ahead of 4425 and two way trade to ensue. This is the green hypo on the below chart.

Hypo 2 is buyers continue exploring higher prices, trade up through 4425 early on and sustain trade at these levels before setting up a second leg to 4440.

Hypo 3 is sellers go to work off the open and churn us down below 440 before finding responsive buyers and 2-way trade ensues. This is the orange hypo on the below chart.

Hypo 4 sellers take out 4395 early and set up a fast leg down to 4382.25.

Chart & Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

hypo 2 complete, stretch targets are 4448 and 4453