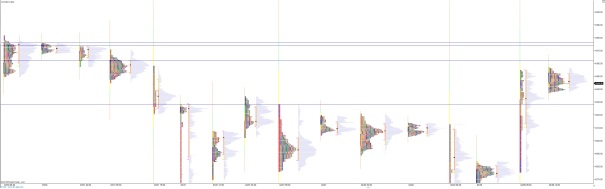

Nasdaq futures are priced to trade flat/higher at the open after a normal-looking overnight session. Price spent most of globex in 2-way trade contained in the upper quad of yesterday’s trend day. Price managed to take out yesterday’s high a few times before ultimately falling back to the middle of range.

Intermediate term, we are trading neutral. We’ve spent the last 3 weeks oscillating but not really going anywhere. Instead we are bouncing along the tips of prior resistance. Bulls have struggled to confidently convert the prior resistance into support but have managed to hold the line thus far.

The nature of yesterday’s push higher means the ground below is us unstable all the way down to about 4280. Thus as enthusiastic as the rally was, bulls will want to see additional progress made away from this fast region. Conversely, the structures above are well established value curves suggesting it will take sustained demand to work through the thick supply.

Heading into today, my primary expectation is for buyers to make a move for overnight high 4357. If they do so, then look for a test up to 4362.25 where we find responsive sellers and 2-way trade ensues. The market may go into “wait and see” mode sooner than some anticipate with Wednesday afternoon’s FOMC minutes scheduled.

Hypo 2 is sellers push the overnight lows 4337 and work toward 4328.25 before finding responsive buying and stabling out, perhaps even printing a neutral day.

Hypo 3 is sellers accelerate us down below 4328.25 and set up a trend back down the zipper, all the way down to 4280.

Hypo 4 is buyers sustain trade above 4362.25 and continue on to test 4374.25 – 4375.75.

If you enjoy the content at iBankCoin, please follow us on Twitter