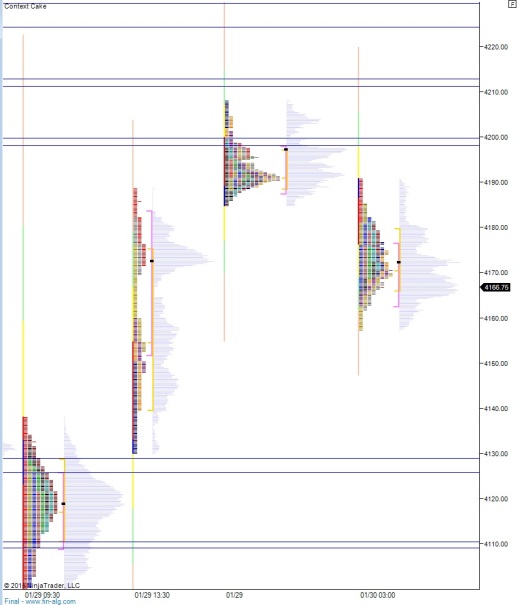

Nasdaq futures are lower as we head into cash open on an abnormal 50 point range and normal volume. At 8:30am the GDP data released was below expectations and we saw a brief pop in futures which was ultimately faded. As we come into the opening bell prices are on the low of the globex session.

Yesterday buyers were put on their heels early in the session as price pushed down into the lower edge of a multi week range and managed to turn. Price then took back more than half of the selling on Wednesday to finish the day up near the highs. Overall the week has been seller dominated since the big gap down on Tuesday.

Heading into today, my primary expectation is for buyers to push into the overnight inventory and work up to 4171.50. Here I will be looking for signs of responsive sellers (responsive relative to the opening print, initiative in nature verse yesterday’s close). They will look to target the MCVPOC at 4144.50 where we will churn through lunch.

Hypo 2 is sellers drive off the open push down through MCVPOC 4144.50 down to 4125.75 where we find responsive buyers back up to MCVPOC 4144.50 and churn through lunch.

Hypo 3 is stronger buyers push on the open, take out 4171.50 and target a full gap fill up to 4185.75. If they can sustain price above 4171.50 then look to target overnight high 4208 and stretch target of MCHVN 4233.25.

Hypo 4 is a drive down, take out 4125.75 and target a break of Thursday’s low 4095.75.

Levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

Well Raul.did you make money on

automatic short friday

clawed back some territory on my oil longs, and FEYE and TWTR did me well.

In the futures I misread the early strength and took 3 quick stops fighting that early fade, called it a day.