During the week long market profile webinar we talked about ‘the story’ and how when we choose to focus on the market activity in the context of an auction we react in planned ways. As the market moves we can constantly return to reading context by asking ourselves a few questions:

- What has the market done?

- What is it trying to do?

- How good of a job is it doing?

These questions help us answer the final question which determines how we react, if at all—what is the market likely to do from here?

You truly need to see this in action, like seeing a big rotation and running through the questions real time, to see the effect it has on your mental vision. You return to these questions, you use market profile as a tool for seeing the auction, and the process provides a logical decision making process.

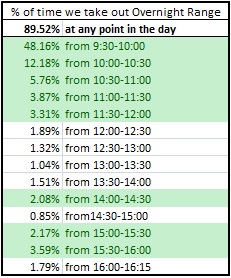

Probabilities can be just as logical a basis for decision making. They are statistics derived from past market behavior and it is reasonable to include them as part of a decision process. For example, if the overnight low breaks 89.52 % of the time and you have entered a short position which is working in your favor and is within a few points of the overnight low, then pressing for at least a 1-tick break of the overnight low makes sense, especially if the session has matured a bit, increasing the probability of a break. These little inches we fight for add up to miles when it comes time to calculate expectancy.

Relying on these foundations (logos, as the Greeks called it) for trading will yield better results and a more objective eye. Imagine your statistic does not fulfill because that is the simple nature of the markets. This resistance to the laws of large numbers will speak to the context too.

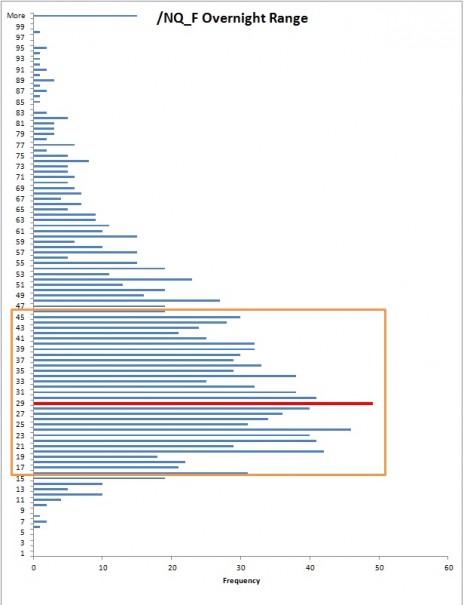

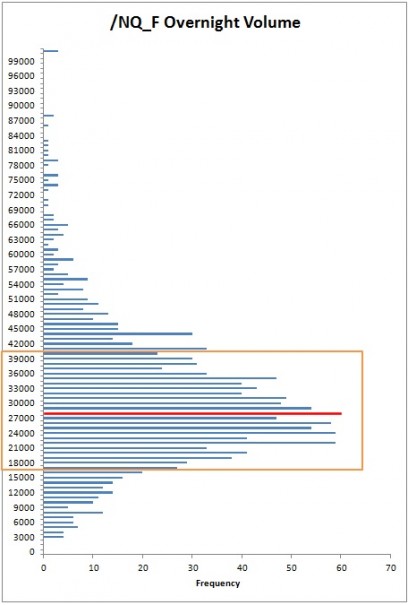

Enough emphasis on why statistics matter, yes? Without further adieu, I have performed a study on five years of trade in the Nasdaq futures. The raw data has been pulled from the IQ Feed servers via their symbol @NQ# which is the continuous contract. Some key points:

- Overnight high/low break occurred 89.52% of the time, with 73.28% of breaks occurring before noon

- The normal volume on an overnight session is between 17-39k contracts

- The normal range of an overnight session is between 16-46 points

How often do you go over this data and the data from your last post “Expectancy Shows The Obstacles” as part of your trading plan?

expectancy weekly when trading futures, monthly for stock and options.

this data I usually rework quarterly

but right now I am in back to school mode so we prep it a month early, yes?