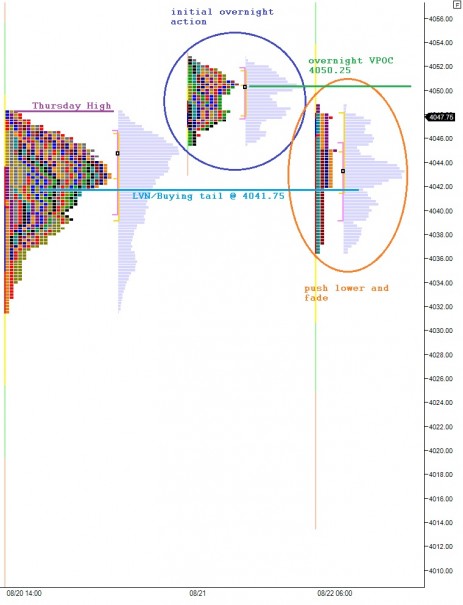

Nasdaq futures are basically flat after an odd overnight session. There were no economic releases overnight but right about 2am we saw a big push by the sellers. UPDATE: The overnight push is being attributed to 17 Russian trucks crossing the Ukrainian border without authorization. The move has since been faded back up and in its wake we have an interesting overnight profile to aid our early context. Have a look:

Today’s price action could produce a large range as we have the risk associated with hearing from Janet Yellen, head of the Federal Reserve. The market has demonstrated a consistent proclivity to move abruptly during such talks which is why it is reasonable to carry such expectations into today’s trade. She will be speaking at 10am and just to keep you sharp into the afternoon, we also have Mario Draghi speaking at 2:30pm from the same venue. These two central planners carry words which are paramount to market participants. Keep this context in mind as you make decisions today.

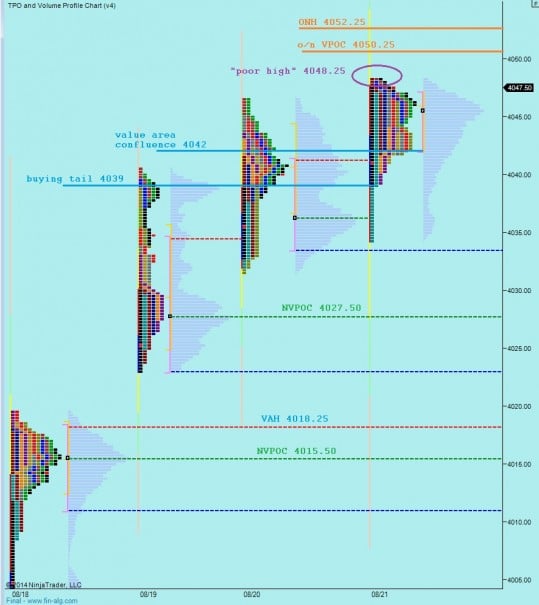

You can see the market starting to pause this week ever since Tuesday afternoon’s rally. Since then we have churned sideways essentially, with a slight upward drift. The resulting footprint is balance with a blunt upper taper on balance which may suggest a bit of upside is needed to settle this imbalance. Not much, however, just a bit. We are likely to see new development not too long after 10am. However, I will be keeping an eye on how we treat this micro composite of balance early on. I have also noted about 50 points worth of support levels to the downside. Should we “bunker bust” through these, some caution is merited:

On the Market Profile chart we most clearly see the structure of the auction, which reveals a hint of buyer control yesterday. There was a buying tail and a poor high which suggests a bit more upside could occur. Pair this with the overnight high exceeding yesterday’s high and you have the likelihood, even if it does not stick, to see higher prices today. The key will be how we develop IF we trade new highs—are they rejected sharply or do we accept the prices via sustained trade? If we do, then we could see much higher price given the gap zone we are trading inside of dating back to the year 2000. I have highlighted the market profile levels I will be observing below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Pre Fed Hypos:

Primary Hypothesis – buyers push off the open and take out poor high 4048.25 before targeting ONVPOC @ 4050.25 and possibly overnight high 4052.25. If they cannot at least exceed this high by 3-4 ticks then caution of a failed auction back down through VA confluence at 4042 and a test of the conviction buyer at 4039

Hypo 2 – sellers press off the open to test the VA confluence at 4042 where we find responsive buying back up to close overnight gap to 4047.50 before stalling inside of Thursday range ahead of Fed

Hypo 3 – sellers drive off the open, press below buying tail at 4039 and set up a test of naked VPOC at 4027.50

Hypo 4 – buyer drive off the open, take out overnight high and continue pressing higher into the year 2000 gap

Post Fed Hypos:

Primary hypo – sellers push into weekly bulls, testing their conviction by pressing down to NVPOC at 4027.50 and down through to test Wednesday Low at 4022.75. If we do not see a buyer response here then a gap fill all the way down to VAH 4018.25 where we see a sharp buying reaction back up to about 4039 to close out the week

Hypo 2 – muted response to Yellen, we sustain trade above buying tail at 4039 and continue a slow, summer grind higher to about 4055 (see taper hypo on 2nd chart above)

Hypo 3 – drive higher to close out the week, leaving cautious money to chase at the start of next week

Pre fed primary hypo just played out in 15 minutes