Nasdaq futures are up just a point or so, essentially unchanged, as we approach the US cash open. Today The Fed will release minutes from the July 29-30 FOMC meeting at 2pm. The expectations are low, with traders looking for more details on the specifics of the exit strategy. The overall consensus is for full details to be released at the September meeting. Since we have testimony from Janet Yellen coming up Friday from Jackson Hole, any market reaction today is likely to be muted. Keep in mind this meeting we are receiving minutes from today took place prior to the recent uptick in geopolitical tensions.

The Nasdaq Composite, not the front month futures contract but the actual index, has pushed well into the monthly gap left behind at the start of the dot com crash. This context could be one of the factors leading to this low volume drift higher. If you think about how price behaves in a volume void or pocket, we tend to see this type of slow grind up through it. As we progress, I will be watching this index closely to see if we are destined to traverse the entire region or instead perhaps only half for now. I have noted the gap and its midpoint on the following weekly chart:

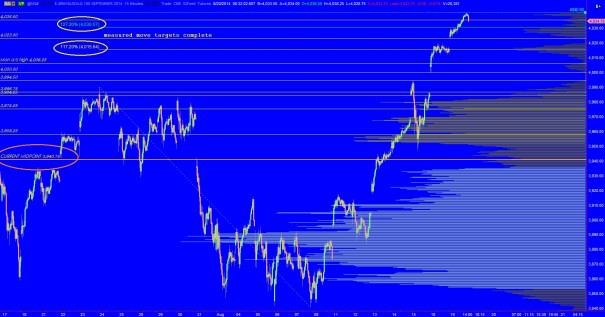

The intermediate term timeframe is bullish. We are seeing a series of higher highs and lows print since exiting a tight price compression on 08/11. The move has featured five overnight gaps in a row which exceeded the prior day range. As a result, our composite profile has some very pronounced peaks and valleys. When we eventually find sellers, the question will be how much ground are they able to cover? We can gauge the timeframe of the seller and their conviction by how many of these price levels highlighted below are recaptured by the selling. I left the measured move targets on the chart for one last look (127.2% and 117.2% Fibonacci extensions) but since we have actual price action in place now I will delete them. I have also noted the current midpoint of this move just to give some perspective to the progress made:

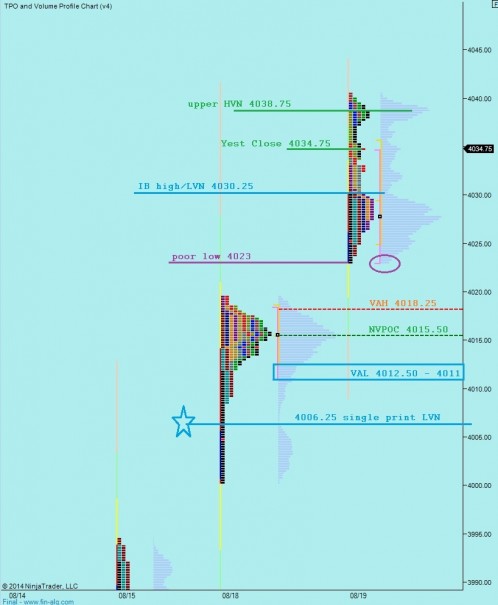

Taking our eyes even closer to the action, we can see the short term trend is higher. Not just price but also value continued to migrate higher yesterday. In its wake we left a poor low which may be vulnerable today. I have noted this price as well as other areas I will be observing today on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary hypothesis – open auction, inside range, buyers push higher to close overnight gap up to 4034.75 and test the upper HVN at 4038.75 before we rotate lower to Tuesday IB high 4030.25. A bit of churn before taking out Yesterday LOD at 4023 to test VAH at 4018.25 where we find responsive buying back up to 4040

Hypo 2- sellers reject away from Tuesday range early, take out poor low at 4023 and push to VAH at 4018.25 where we see responsive buying which gives way to additional selling down to the VPOC at 4015.50 and through to test VAL at 4012.50-4011

Hypo 3 – buyers push off the open and drive to new highs early before the FOMC meeting

GREAT seesions in AHWOA Raul! I now look forward to reading your insight each morning – and actually having clue what you are talking about. THANKS MAN.