The buyers got a bit ahead of themselves early yesterday afternoon when they pressed prices up through the highs. Once doing so, they uncovered a strong responsive seller who patiently let price come to her and then erased over 20 points of progress in the final 30 minutes of trade lasting from 3:45-4:15pm. That pulse of selling carried over into the overnight session where the brief pop in prices after weaker-than-expected Chinese PMI data was faded and prices continued drifting lower. On our economic radar for today’s trade is ISM Non-manufacturing composite at 10am as well as Factory orders at the same time.

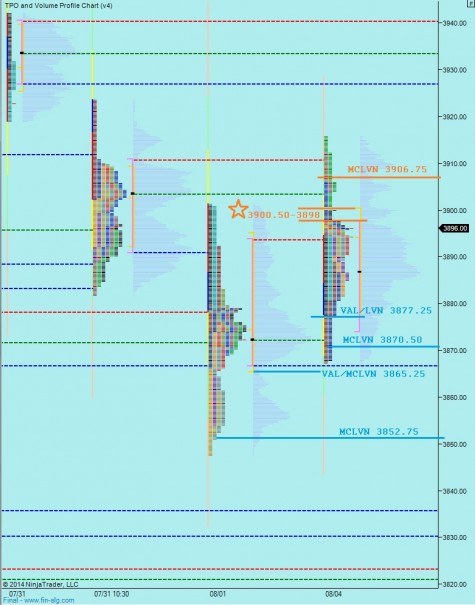

The intermediate timeframe is spreading out like discovery is taking place, but as a pile of volume-at-price it still resembles balance. The balance we can observe dates back to the start of July, has a low slung VPOC just below our current prices, and we are currently muddling through the thick value zone. I have highlighted the key price levels below which will serve as sign posts as the story unfolds:

You can see the intense indecision on yesterday’s market profile which has long tails on both sides of value. This is the nature of a neutral day which has a real lack of directional conviction. I have noted the price levels I will be watching early on below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypothesis – buyers push off the open into the overnight shorts, but initially stall just above the VPOC at 3886.75 and rotate down to test the VAL at 3877.25 before making another attempt at a full gap fill up to 3896 and possibly beyond to test 3900

Hypo 2 – sellers pressure off the open, taking out the VAL at 3877.25 and testing the buying tail/MCLVN at 3870.50 where we find responsive buying back up through the VPOC at 3886.75 and work toward a gap fill to 3896

Hypo 3 – strong buying drive off the open closes the overnight gap to 3896 early and presses into responsive seller by sustaining trade above 3900, some consolidation before a test of yesterday’s high at 3915.75

Hypo 4 – gap-and-go drive lower, slash through overnight low @ 3879.50 as well as MCLVN down at 3870.50 before a small counter rotation occurs that ultimate gives way to an initiative selling down to HVN at 3855

Very nice so far

looking more like hypo two if we start to see some responsive buying down here, we are lingering a bit much

wfm going full brooklyn hipster today..great call there, congrats

Uncle Carl rumors putting some pep in the Tom’s(R) shoe wearing WFM step, thanks

Carl, good to seeee youuu

that was a 3857.75 print – was that a shakeout or harbinger?