The economic calendar is quiet to start the week and many of the headline companies have already reported earnings. Thus much of what has been made known is public to the market and the market is tasked with establishing value according to these facts.

The Nasdaq has gone lower for two sessions after balancing out near annual highs. It carried some major speed to the downside and the selling managed to recapture nearly all of the progress made in July. Around lunchtime we saw our first signs of responsive buying significant enough to stick around for a few hours. Futures continued drifting higher overnight and as we approach cash open we are set to gap higher by just about 9 points.

I carefully reviewed the current intermediate term balance and highlighted the key prices levels within this balance below:

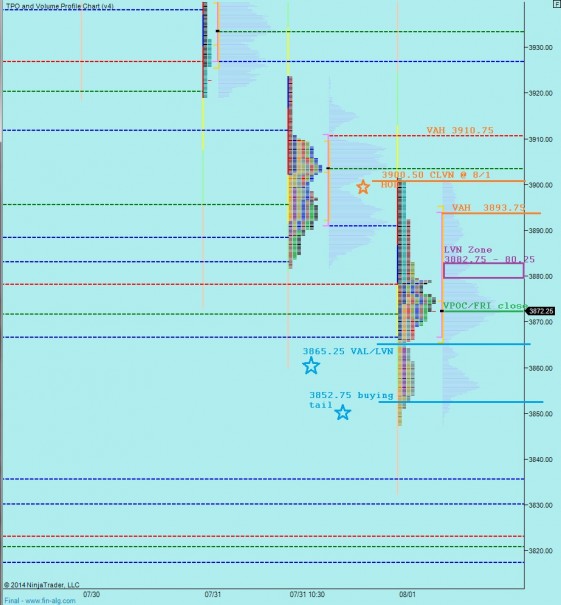

Furthermore, I have highlighted the prices levels I consider in play early on using the following market profile chart:

See the below comments for hypothetical trading scenarios as well as intraday updates.

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypo – sellers push off the open during an open auction in range, test through LVN zone 3882.75 – 3880.25 before finding responsive buying up to VAH at 3893.75 before ultimate filling overnight gap down to 3872.25 and possibly testing through to 3865.25 to make sure buyers are interested

Hypo 2 – buyers push off the open and test the CLVN at 3900.50 where we find sharp responsive selling back into Friday value for a slide through the LVN zone 82.75 – 80.25 and a test of the VPOC/close at 3872.25

Hypo 3 – selling drive pushes through VPOC close early on, pushes through the VAL/LVN at 3865.25 and tests down to buying tail at 3852.75 before finding responsive buying back up the the VPOC at 3872.25 where chop/balance ensures but ultimately breaks lower

Hypo 4 – buying drive takes out 3900.50 early and tests VAH at 3910.75 where some responsive selling is found. Prices are accepted above 3900.50 and we continue auctioning higher up to 3933.50

thus far the primary hypo playing out

good call. wfm following same sort of action. still in?

oh god yeah

hmm..?

I guess ‘My Homies’ car broke down en route to the festivities this past weekend.

Wow..that sorta stinks!

I am not on their level, yet.

Thank god for interested buyers

Everything you see will soon alter and cease to exist. Think of how many changes you’ve already seen.

“The world is nothing but change. Our life is only perception.”