Expectancy is one of these trading concepts that rarely receives a thorough explanation on the web because it is not very sexy. However trade expectancy and position sizing are two of the most important pieces to successful trading.

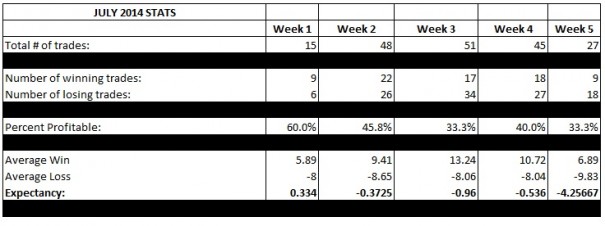

I am not preaching this lesson from the pulpit, high atop my cloud of mastery and divinity, but instead from the ground, bare foot, with the purposeful intent of advancing our trading abilities. That is my disclosure before you view my very humbling July trading expectancy. See below:

As you can see, I operated a net losing operation trading futures in the month of July, and expectancy took a radical turn for the worse last week. I will not begin to interpret this data, but instead will use this very unsuccessful data in our lesson today on expectancy. Let’s look at how expectancy is calculated:

EXPECTANCY = (Probability of Win * Average Win) – (Probability of Loss * Average Loss)

The very simple goal is to trade in a way that produces the largest expectancy number possible. It only takes some basic algebra to understand how to affect the outcome of this formula—you need to make the product of the first set of parentheses larger than the second product. We have three independent variables:

Win rate

Average Win

Average Loss

Therefore we have three areas available for improvement. We can increase our win rate, increase our average win, or decrease our average loss. (Simple, but not easy) If you start trading too tight in an attempt to decrease the average loss, then your win rate will tank and you will miss out on otherwise good trades. If you reach too far for bigger wins, then you are more susceptible to general market conditions, where price can stop working in your favor at any time—this is the nature of markets and why we spend much of our time studying the pillars of continuation, price and volume. Finally you can add filters and qualifiers for taking a trade with the effort of only taking the most “sure” trades.

Once we have an actual expectancy, we can calculate how we are likely to perform. Let’s run my numbers last month to demonstrate the concept:

Average July Expectancy = -1.16 ticks

Average Trades per day = 9.6

Trading Days in August = 21

Expected ticks earned (lost) = -233.86

As you can see, this is a tick losing enterprise, and without any adjustments this approach will lose about 11 ticks a day on average.

You can perform this basic math with any trading approach to see how your strategy fares. And you should. As a benchmark, the elite futures traders on my timeframe, the best of the best, have about a 1.5 tick expectancy.

If you are calculating expectancy on a stock or option trading strategy, it will usually make more sense to calculate your expectancy on a dollar basis as opposed to ticks because different stocks carry different daily ranges and your position sizing will adjust according to the dollar value of the instrument. Once you determine the expectancy, you simply roll it out on the # of trades you take per month. As enticing as it may be to take more trades using a positive expectancy method, BE SURE TO KEEP GOOD STATS, because you will likely see yourself deteriorating that expectation unless you keep your standards up.

Stay classy out there, and keep your expectancy on the uptick in August.

If you enjoy the content at iBankCoin, please follow us on Twitter