The discovery process is ongoing in the Nasdaq futures, where contracts are currently trading a bit higher verse the close of Monday trade. The lack of consensus can be seen on the 24 hour market profile which is not coming into balance. The imbalance can also be seen on the intermediate term volume composite, where our current action resembles the toothy peaks and valleys of a ridged mountain range. As we approach the open of US cash trade there is only the Case-Shiller Home Price index to anticipate. After the open at 10am is the Consumer Confidence report. Twitter is set to report earnings after the bell.

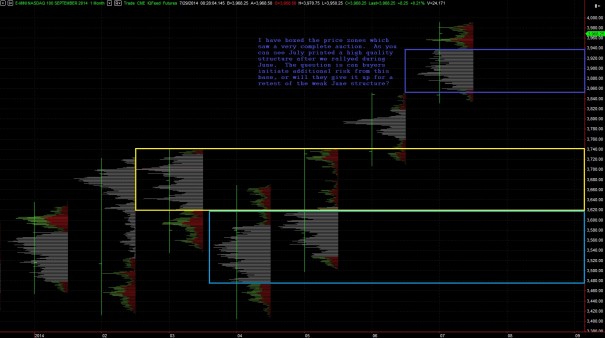

With three trading days left in the month of July, let us take a look at the monthly volume profile print:

We can see the longer term trend being controlled by buyers who, after slugging it out for the first five months of the year, have pressed prices higher. Bringing our attention in closer, we observe the intermediate term trend. This is where the real battle has been taking place for the past 5-6 days. The local, or day trader/dealer, is not the only participant in our current conditions. Instead we are seeing day-timeframe levels ignored and instead the intermediate term levels being honored. This behavior can shift any moment, but for now the price levels on the intermediate term timeframe are the most relevant, see below:

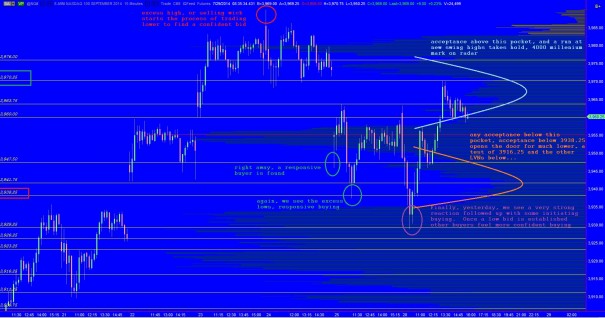

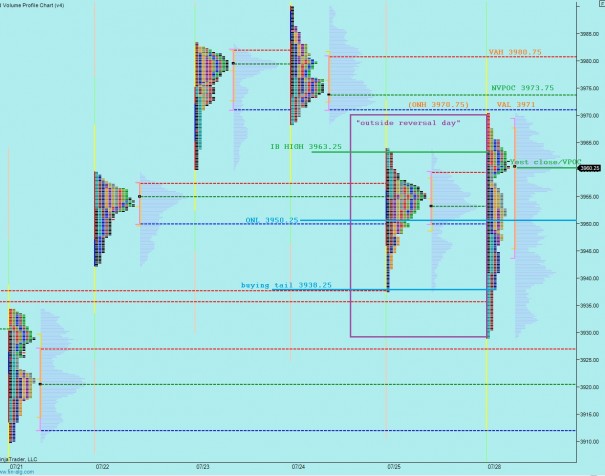

Finally, we can observe the following market profile levels, and how we interact with them, to determine if we re-enter a local-to-local chop-like environment. If we see these short term levels as well as today’s developing value area honored and disputed, then we can assume longer timeframe participants have backed off until they again are motivated into action. See below:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – sellers push off the open into the overnight long inventory, close the overnight gap to 3960.25 before finding responsive buying up through the overnight high (ONH) at 3970.75 to target the NVPOC at 3973.75 and the composite LVN at 3976. Price balances out above 3970.25 setting up a move for new swing high

Hypo 2 – sellers push down through yesterday’s close 3960.25 and test composite VPOC at 3955. A small counter rotation struggles with yesterday’s IB high 3963.25 and fails to capture ONH at 3970.75 before ultimately sliding down through ONL 3950.25 to test composite LVN at 3947.50. Responsive buyers are found here and we auction, two-way, near the composite VPOC 3955

Hypo 3 – buyers test higher off the open, capture overnight high and achieve target NVPOC at 3973.75 before stalling out and finding responsive buying to close the overnight gap to 3960.25 and a test of the composite VPOC at 3955

Hypo 4 – strong drive up off the open, captures the composite LVN at 3976 and sustains trade above this price before making a run for new swing highs

Hypo 5 – open rejection reversal, drive lower, take out ONL 3950.25 and press into buying tail at 3938.25 where a responsive buyer is found but ultimately overwhelmed by sell flow which tests yesterday’s low at 3938