Nasdaq futures are down as we head into Friday trade, with the bulk of the selling taking place just after market close yesterday on the heels of earnings from AMZN, BIDU, and SBUX. Since then we had some decent economic data from the UK which brought in a bit more selling, a minor extension, and at 8:30am we saw USA Durable Goods Orders release slightly better than consensus. The latest data received a somewhat muted response.

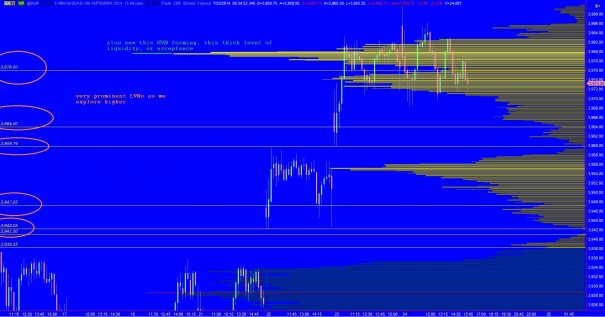

The intermediate term timeframe participants have been very active this week. Their behavior shows up in the day types we have been seeing—normal days and neutral days. The normal days suggest they like to make their move early and then they do little else for the rest of the day. The neutral day on Monday was the only session we saw activity throughout the entire session. With that in mind, and the weekend edging closer, it makes sense to not rush nor force many trades today because the order flow may simply dry up—leaving you to be pushed around by big algos who eat ticks. Also, since the intermediate term is active, it makes sense to observe the intermediate term timeframe closely. We have some very prominent low volume nodes in the wake of our most recent advance, and any one of these might be a candidate for testing today. Also note the large acceptance forming up near the highs. Will this volume overhang become supply left behind or will we use it as a base for another leg? See below:

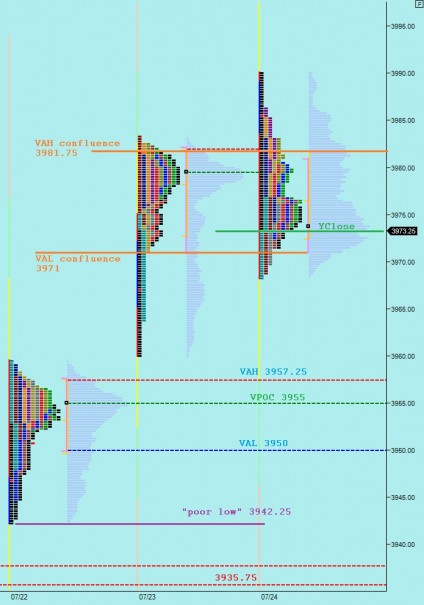

Had I been trading yesterday, then I would have been looking for an afternoon short. The profile yesterday shows an excess high or selling wick. Since the day never range extended, one might have hypothesized some selling would come in toward the end of the day. However, balance held and we printed value inside of Wednesday’s value. We are set to gap well below Wednesday/Thursday value, and it will be interesting to see if we poke back up into the area or not. I have highlighted these prices, as well as other prices I will be observing on the following market profile chart:

Hypo 1 – an early selling push, some profit taking on the week down to test VAL 3950 where we find responsive buyers back up to 3957.25 and test out the composite LVNs at 3959.75 & 3964 and potentially a gap fill up to 3973.25

Hypo 2 – test higher early, up to 3959.75 where sellers hold back order flow and push us down through VAL 3950 and target a break of the poor low at 3942.25

Hypo 3 – selling drive off the open, take out the poor low at 3942.25 early on and continue on to test 3935.75 and ultimately target composite HVN down at 3929

Hypo 4 – buying drive, press through volume pocket LVNs at 3959.75 and 3964 and fill the overnight ga to 3973.25 early and through the upper HVN at 3980 before resting on the top end and finding another leg up to finish the session

hypo 1 currently in play