We have been observing the intermediate term closely this week after seeing a mini balance form within a larger balance thus forming the compression and potential for price discovery. This all took place near the top end of the larger balance making the opportunity for a discovery higher distinct. Yesterday we pressed right to the edge of the stratosphere (around 3974.25 according to balance analysis) and overnight more buying came in which is pushing us to new swing highs. The timing of the buy flow lines up with the Euro Zone releasing their PMI data at 4am however we are seeing action based upon earnings as well as speculative heat in Chinese burritos and biotech.

I have noted very little on the intermediate term chart. We are climbing a wonderful wall of worry one gap at a time. The overnight gaps are a bit unsettling to say the least, however the foundation formed prior to this advance is as well-structured as we have seen since April. See below:

You can see the buyer control on the intermediate term as a series of higher highs and lows:

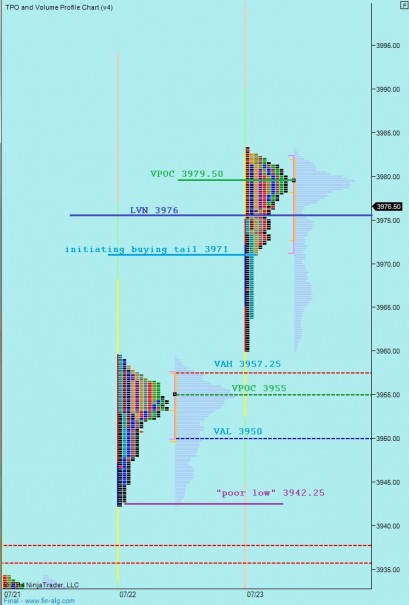

The question today is will we sustain a third gap higher, or will we discover a responsive seller strong enough to begin the process of backing and filling? I have highlighted the key price levels I will be observing on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – responsive selling on the open, a push down to yesterday VPOC 3979.50, some murky two-way action gives way to a full gap fill down to 3976.50 and through to test LVN at 3976 where responsive buyer come in and we spend the rest of the day balancing around VAH 3982

Hypo 2 – more aggressive responsive selling on the open, push down through overnight gap and LVN at 3976, then some murky two-way trade around VPOC 3979.50 before giving way to some intraday initiative selling to test the buying tail at 3971. Break the tail and test down to 3964 for a responsive bid

Hypo 3 – open drive higher, strong buying off the open and off to the races

Hypo 4 – open rejection reversal, cut through yesterday’s range early and work through the open gaps below