Nasdaq futures are up to new swing highs overnight in a session that was predominantly buyer controlled. I am preparing this analysis just after the core CPI information has been released. Most of the data came out in line with expectations and the initial reaction to these in-line numbers is more buying, putting the Nasdaq futures up to a new high on the session. The move did however find a responsive seller, and as we come into USA cash open we are just shy of pro gap territory.

Coming up today, we have House Price Index at 9am and Existing Home Sales at 10am. We will here from the Richmond Fed Manufacturing index both at 10am and after hours. We also have major earnings out after the bells coming from AAPL and MSFT to name a few.

There were a few clues about the bullish undertone yesterday if you were watching market/volume profile. On the intermediate term timeframe I noted a balance had formed last week. This balance was inside a larger balance spanning the entire month of July. The balance inside the balance was forming along the highs. Then yesterday the VPOC shifted higher, right toward the end of the session. This threw the entire 5 day (now 6 day) balance out of whack, thus requiring some upward discovery to restore balance. See below:

Here’s the slightly larger intermediate term balance, a profile spanning the entire month of July (presented yesterday in relation to all monthly profiles):

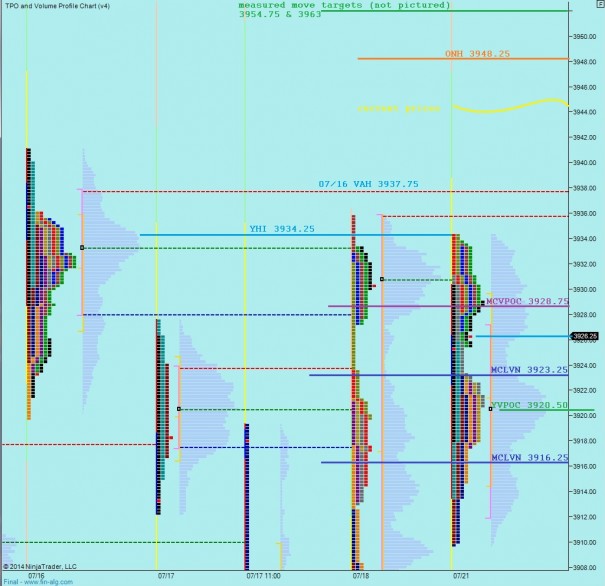

Finally I present the levels I will be observing today on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Hypo 1 – Open Auction, responsive selling push into the overnight inventory down to VAH 3937.75 where buyers are found and we auction to take out overnight high 3948.25 before balancing out around 3946

Hypo 2 – Opening drive, push through overnight high 3948.25 and continue to measured move target 3954.75 and potentially 3963

Hypo 3 – Open rejection reversal, cut through Vah 3937.75 and yesterday high 3934.25, find some responsive buying at MCVPOC 3928.75 before filling overnight gap down to 3926.25 and balancing out below 3928.75

Hypo 4 – Open test drive down, aggressive responsive selling down through MCVPOC at 3928.75 to test out lower MCVPOCs at 3923.25 and 3916.25

new highs with the knight. see.

yep