The NASDAQ drifted higher overnight and price is currently trading outside of yesterday’s range. In terms of potential for a wide range/volatile day, this is as elevated a condition as the market can offer. Today is also option expiration which can really result in some unique auction activity. However it is ultimately order flow that dictates the direction of the market inside the day timeframe and we should be keen in our observance of it.

The long term auction continues to show buyer control. We tested recent lows last Friday and gapped when we came back to market Monday morning. We have held that gap higher all week. We need to keep this gap in mind because often these gaps get filled, settling unfinished business if you will, before the market continues elsewhere. Overall though, the market continues to find a bid on the long term timeframe and continues to auction higher.

The intermediate timeframe is balancing. Tuesday buyers were able to quell the price action which up unto Tuesday suggested sellers were in control of the intermediate term auction. After we trended higher Tuesday, we saw the late-afternoon selloff Wednesday (Yellen) which was met almost immediately with a strong buying response. This can be seen as long tails on the candles suggesting dynamic responsive buying. Since then we have consolidated and coiled right in the middle of intermediate term balance. The market is building energy for its next move with a very clean auction into value. I have highlighted our current balance and a few other observations on the following volume profile composite:

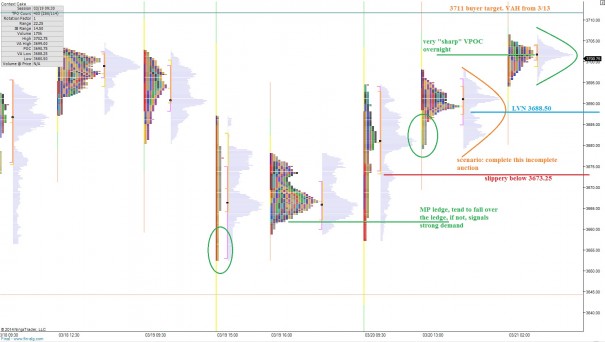

The short term auction is buyer controlled. This can be seen as value drifting higher over the last few market profile distributions. The overnight action in particular shows buyer control as it presses value up into the top of Tuesday’s action which marked the high point thus far on the week. The key for buyers is to press above 3711 and gain acceptance above the level. That could be the progress needed to invigorate initiating buys in the afternoon. Otherwise we may see more backing and filling as intermediate term players continue to slug it out. I have highlighted a few key price levels and observations on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

i think RVLT wants me back.

GUESS WHO’S BACK!?

hi!

added back a few share of ARO here:

(careful..spec..for the trade)

Status Filled at $5.55

Symbol ARO

Description AEROPOSTALE

Action Buy

popped nicely off this level to 6.10 just a few days ago..(tues..18th)

A Sweet Jeezus continuation on Pacific Ethanol after their earning spike and profit taking..

Congrats to Longs..

I do hold position and am wishing I had added back share..wowza, nice!

(+357.81%) unrealized gains

yeah sooz, get it baby