The futures were active overnight, albeit slightly quieter then we have seen in recently. We do not have any major premarket news on tap, thus our early analysis should hold relevant into the opening print.

As the USA comes online, the equity futures are trading slightly lower with the NASDAQ down 1.5 and the S&P down 0.75. For the duration of this post, I will be focusing on NASDAQ futures via the /NQ contract.

We came into last week on the tail of strong sell flow from the week prior. A gap lower on Thursday the 01/23 resulted in an odd print because afternoon strength took prices to the high of the session at the close. The next day we gapped lower and printed a trend day down. This marked the beginning of sellers taking control of the intermediate term auction. We continued lower on Monday before finding some responsive buyers in what I perceived as panic trade lower. The rest of the week the market began balancing out, and by Friday the intermediate term control was back in balance. I have pictured the above commentary on the following chart:

The trading has been framed within the context of the sentiment cycle chart option addict introduced and often referenced. I have been under the impression that action quickly worked through discouragement and climbed the wall of worry before ultimately printing aversion on Friday morning where we bought the dip. If this is the case, I want to see quiet market action over the next few days—denial taking hold.

The other possibility is we have not even begun to see panic. If this is the case, the market should accelerate rapidly to the downside, soon, blowing through intermediate term and long term control. This is very much a possibility and a would be remiss to ignore this possibility. I have a line in the sand at 3440.50 but should price begin accelerating violently to the downside, I may begin reducing exposure well before then. Let’s run through who controls the auctions on various timeframes:

Long term control: buyers—this can be seen as a series of higher highs and lows on a weekly chart. However, the daily chart is not as pristine as it was from October to now because we have made a lower low verses late December-to-early-January

Intermediate term control: BALANCE—we have a near-perfect bell curve intermediate term. It is 87.5 points in range with a VPOC at 3494, which is slightly below the midpoint at 3498.

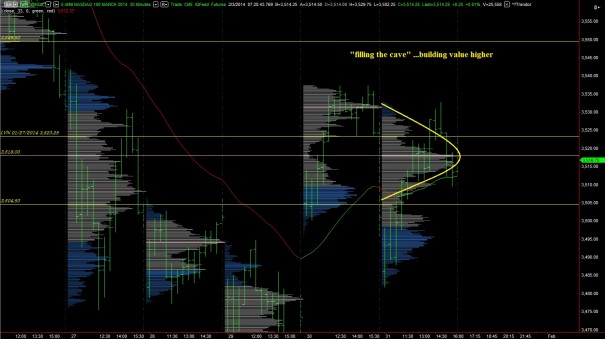

Short term control: buyers—buyers were able to get price back above the 33ema and hold value within the higher print. This can be seen on the following chart, where the last two days of market action migrated value higher:

Overnight control: BALANCE with a slight seller edge—we have printed a bell curve overnight. The sellers had a slightly better rotation factor then buyers.

Net of all of this context, you can see there is a power struggle going on, with balance dominating the conversation. Thus we must monitor intermediate term balance. The open is key too. It can give us early cues of who is in control on the day. Is it two-timeframe action, back and forth, or do we see a strong drive from the long term buyer control? Or does the seller come in and drive lower for an hour, reasserting their control on the intermediate term?

The key, in my opinion, is velocity of price movement, and the following value and its relevant levels:

If you enjoy the content at iBankCoin, please follow us on Twitter

Status Filled at $101.37

Symbol UVXY

Description PROSHARES TR II ULTRA VIX SHORT TERM FUTURES ETF NEW

Action Sell

still holding…

http://youtu.be/H1tRB7-aBr8

not the most uplifting tune..but Hey!