Nearly every day you can find a trader on twitter expressing their belief that markets are manipulated. This type of dialogue is a major risk to your emotional dialogue. Instead of claiming corruption, focus on exactly what is happening in the marketplace through the lenses of auction theory.

We go heavy on context here on the Raul blog every morning and this work pays huge dividends. It is always a pleasure to share my thoughts and have them read, but rest assured I do this for my own selfish benefit.

Yesterday the market extended upon our Tuesday rally by printing a moderate gap higher and sustaining the gap throughout the entire session. We had range extension on the day which tells us new initiating buy flow came into the market during the day. However, the midday buy flow was not dynamic enough to press us higher and into a second distribution. Instead a two-timeframe trade ensued with locals and other time frame participants conducting trade amongst one another. The final daily print resembles a letter-P suggesting a short squeeze.

This action makes even more sense when you observe the course prices have taken since starting the year. We printed a lower high on 01/09 and a lower low on 01/13. This type of action will do two things—it causes longs to capitulate and sell and it causes new shorts to initiate positions. Sellers may have gotten a bit ahead of themselves. Net inventory may have become too short while we were still inside of an intermediate term balance. When the snapback rally erupted, a reentry by the long term controller (buyers), it happened fast and left shorts and underexposed longs in a pinch (RIP @tlMontana, this was one of her specialties). Thus the market algorithms drove price above the 01/09 lower high because that is where the buy stop orders were.

See? No manipulation at all. The best part is, the market can still put more pain onto the shorts. We have a secondary upside algorithmic target based on the year-end swing highs. The market may want to eventually press into this.

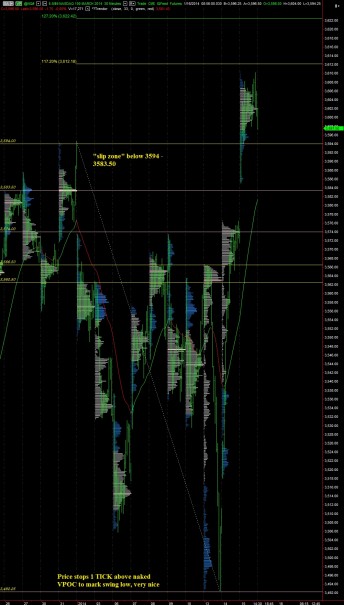

Taking to the NASDAQ futures, I have highlighted the upside target I mention above in yellow and green. We are trading just above our intermediate term balance. Just like orbital gravity, it becomes less powerful the further we get from it. The slingshot move made this week would be like swinging around the earth several times then flinging a ship into outer space. That is something to keep in mind. However, the mean revision force is still in place, and we may see price retrace a bit. If we are breaking out of balance sooner then later, my expectation is for price to fail to fill yesterday’s gap up. Talking exact prices, my expectation is for our naked VPOC at 3583.50 to hold. Should this occur, I will be pressing longs hard.

Secondary support exists at 3574.00 and we could still work out of this intermediate term balance while holding this level. I have highlighted these price points, as well as some max pain algorithmic upside targets, and a few other levels that intrigue me on the following volume profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

SRPT from 11/13 Scoop.at $12.169

doesn’t seem so STOOOoopid today(?)

HoD morning sesion(+123.41%)

To think that Mr P..asked this ridiculous question, via ST, who is stupid enough to buy this stock at 15..13..12..?

Don’t Listen To People that feel it a MUST to comment on every stock that’s trending up/down..when they have ‘NO’ idea what they are even talking about!

just a quick shout yo you, Sir Raul, for having sympathy on that death spiral(FDA news related)from days leading up to that bottom.

I was made whole on this position awhile back and have YoY made multiple +1000%..not boasting just telling the truth.

Have a great day all you Beautiful People.

(was going to write about this last night AH when it was up +22% after close and decided against it) I’m sure many of you caught this move..

Love Eddie V..

(played this tune on the evening after that huge gap DOWN..very LOUDLY..;)

http://youtu.be/qQXP6TDtW0w

.

also mentioned I would add back share once after being made whole and SPRT comes in a bit..

I did that as well..here:

SAREPTA THERAPEUTICS INC COM

Acquired 01/07/2014

Price: $17.9299

😉

sorry I did ‘NOT’ post that entry..here on your pages, Sir Raul

🙁

*session..oopsa ^