The globex market opened back up for business this morning at 6am and was greeted by an early bid which drove prices higher. In the short term we have become overbought and it will be interesting to see how these conditions are met as we approach regular trading hours.

Seeing price swing a fresh high in the premarket provides an interesting bit of context for bulls to hang their hat on, as the likelihood of making swing highs during non-cash trading hours is low. This type of context is not always actionable, however, as the mornings swing high cold hold for days and even perhaps weeks prior to being eclipsed. Therefore the premarket swing high is interesting from a context perspective, but not necessarily actionable from a timing perspective.

Price is currently trading entirely outside of Tuesday’s range suggesting we our coming into a market which is out of balance. This creates a higher risk/reward environment then a market opening in prior range.

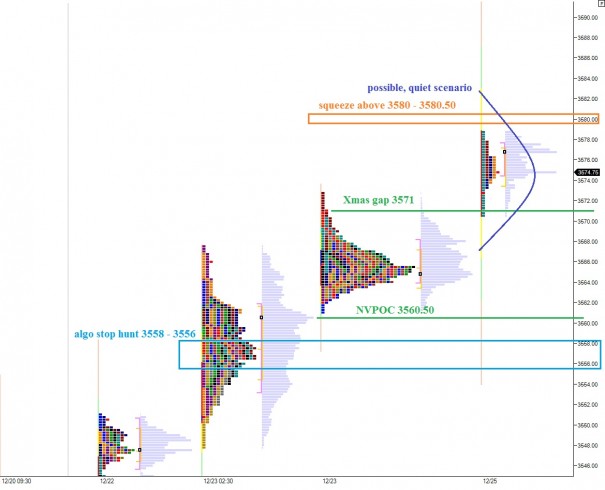

Early on, my expectation is to see sell flow work into the market. On the NASDAQ, I am looking for order flow to take price back into Tuesday’s value and perhaps through our entire range, putting any newly initiated longs underwater. Sell stop hunter algorithms will be targeting 3558 – 3556. This price zone is just below Monday’s VPOC at 3560.50. The VPOC still stands naked after buyers reacted just above the level on Christmas eve.

Should we instead see buyers driving off the open, I will be testing their might verses 3580 -3580.50. If price is sustained above this level early on, it would be wise to avoid any fade or gap fill intraday shorts. A gap fill would take prices down to 3571. Given the close proximity of the gap, my expectation is for a fill to occur today.

I have highlighted a few of the levels on the following 24-hour market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter