When we examined the forest tree-by-tree yesterday, it was evident risk appetite was strong. After two days of sustaining control in the marketplace, sellers were countered by aggressive buy flow Wednesday. The action started with a strong opening drive. All of my upside targets were met by 10:15 AM. It was at this point I hypothesized a trend day was setting up.

The trend context made sense at the time, but it also made it difficult for me to palate the sharp selling reversal. My thoughts became jumbled and I missed the opportunity to fade the second range extension on the day. The aggressive selling push was futile because we had already made range extension higher after a strong opening drive.

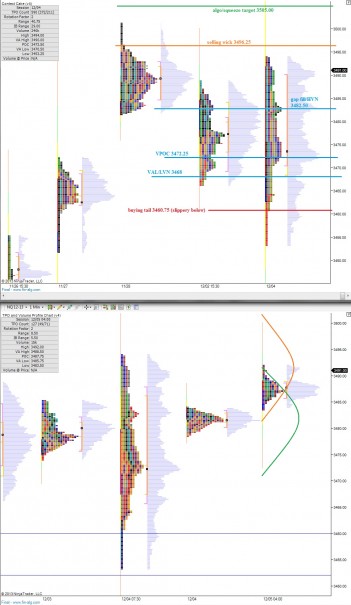

The very fact that we set such a wide initial balance higher, driven by the buyers was strong indication of their returning confidence and control. Taking the net sum of the market profile pieces, we can see the buyers gained almost complete control:

Our value area is overlapping/higher

Our close was higher

There is a large buying tail

The only piece missing is a migration of volume point of control higher. This point of contention is critical today. Will price revert back to value lower, or will value migrate higher with prices?

As of 8:15am, we are set to open outside of value on the upside. Overnight, buyers gained control after a balanced session of trade and the result was a higher distribution. This is a high risk environment where price can move beyond what we often consider normal. Therefore it is vital we have price levels in mind to guide our context.

I have highlighted key support zones on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

raul- do you do this analysis on the s&p or russell as well?

S&P not the russel, but lately I focus on the NASDAQ most because most of my stocks are nestled in its bosom

“The aggressive selling push was futile because we had already made range extension higher after a strong opening drive” ..would love more clarity on how the range expansion is important to false breakdown/outs.

Remember when this happened in the room a while back? The logic is the force behind the first range extension on the day is controlling the day. When the range extension is disrupted in the opposite direction a wild balancing battle ensues, which gives us almost an 80% probability of reverting to the mean before the market does anything else.

These tend to occur at or near inflection points too.

Yes, now I remember. Thank you for describing it again. I should probably turn down the Phish and I would remember better. 😉

Hi Raul, what is your exit plan for YELP ? new high or 68is ? Thanks.

scale at 1/4 @ 66 and 1/4 @ 72….keep a burner on and hopfully get some dips to size back into

Thanks ! My SCTY ripping today : )