Overnight the /ES held firm and appreciated a bit while the /NQ recaptured the losses incurred after the AAPL earnings. Both indices are trading near their respective highs as we come into Tuesday’s trade.

The nature of our current trade is balanced and becoming quite mature. The market is nearing a point where it needs to press the extremes of balance to determine if in fact value needs to migrate higher or lower. Early on the buyers have a chance to press into an already committed seller (see prior posts) with their positioning early on today.

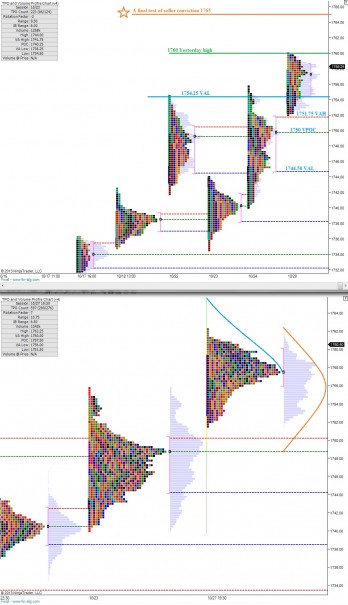

I have highlighted 1765 as the final stand for the profiled seller. Should this level give way, I believe we are in store for another exploration higher. I will be watching trade around this area closely and also how some of the well set up stocks behave if we trade into these levels.

There’s plenty of support down below, but the most significant level to my eye is the mezzo century mark at 1750. Should the VPOC at 1750 fail to hold prices, we may see a swift rotation lower as the large seller becomes emboldened.

So today is simple:

– Mature balance

– Ready to test extremes

– 1765 and 1750 are your extremes

– TRADE ACCORDINGLY

I have highlighted a few scenarios and important price levels on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter