The overnight session in the S&P was again quiet, setting a range only 3.75 handles wide. The interesting observation is where the small range took place—at and above yesterday’s high. The market is hanging high into the Fed today after poorly rotating lower during yesterday’s session. This did two things—it made shorting very difficult and a losing venture, and left the dip buyers on the sidelines.

Therefore, my expectation is for early dips to be bought through the natural demand of underwater shorts being made whole (perhaps partially whole) and eager buyers putting fresh money to work. Given the implications of the Fed meeting today however, we must also be aware of a rug pull scenario where we slash through levels of support as the market attempts to digest the announcement.

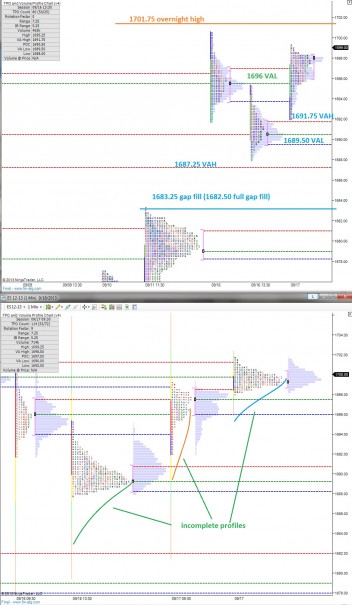

I’ve highlighted a few scenarios for today which may be rendered ineffective if we begin trending, but still are context to keep in mind, and key price levels on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter