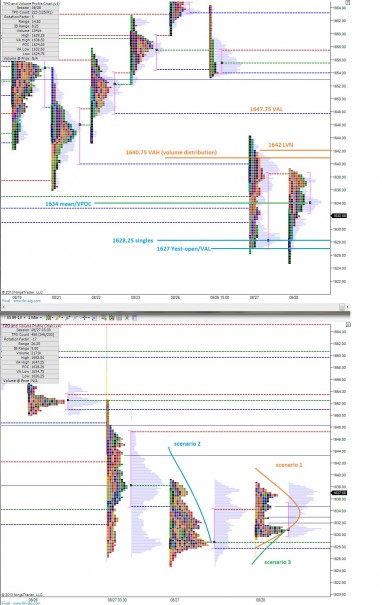

The overnight market in the S&P was unable to breach either the high or low from yesterday’s RTH session which tells me there were no new developments overnight and the market is balancing out.

Part of the balancing process is forming a range or bracketed trade. It’s important to envision where this bracket may exist so we can fade the extremes back to the mean. The first level above that I could see behaving as resistance early on is the range from 1640.75 – 1642. Taking out yesterday’s high could trigger some buy stops on shorts which could lead to a temporary squeeze to these levels. These levels would then make an excellent short entry. They also coincide with the value area high of 08/27’s volume distribution.

Bracket lows could be between 1627.75 – 1625.75. We could take out the overnight lows which could trigger stop orders to temporarily press us lower, allowing for a quality long entry.

That puts our mean, or midpoint, right at about 1634. Therefore we could target this level during our mean revision trades.

This is only an idea based upon the context of balance. Should the market receive news that gyrates us out of balance, we could see more directional volatility. I’ve mapped out a few scenarios on the below 24 hour profile and opportunistic price levels on the following RTH profile:

If you enjoy the content at iBankCoin, please follow us on Twitter