A little bit of softness in the overnight session as we continue to hover along at the all-time highs in the stock market. Overall however, we’re consolidating after more impressive progress higher by the bulls. If we are indeed to see the market roll over and price correct lower, there are a several levels of support the sellers need to reclaim.

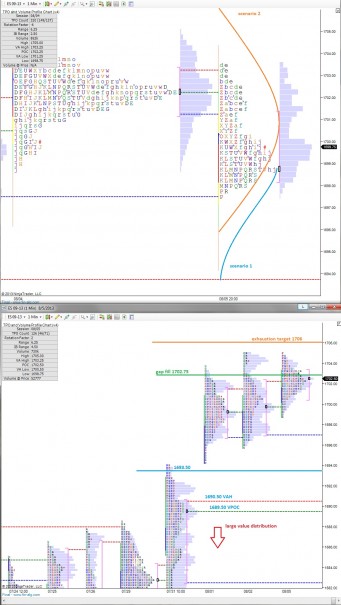

One piece of context to keep in mind early on is the gap above created by the overnight weakness. I’ll certainly be on watch for buyers to trade us back up to 1702.75 early on considering its close proximity to our current trade price.

On the downside, I’ll be looking for signs of buyers at 1693.50, Thursday’s low, and also our current August low. Actually, the August low is 1694, but my profiles tell me to watch two ticks lower. I know it’s a bit granular but it matters.

Any sustained trade below 1693 could result in a larger rotation lower, taking us down to 1690.50 then 1689.50. Failure at these levels puts us back inside the large value distribution we built prior to making fresh highs.

To the upside, I’m still very interested in 1706. We’re starting to show signs of buyer exhaustion, and that levels represents the exhaustion point according to my data. Should this be proven untrue by strong order flow, I’ll be impressed.

I’ve highlighted a few scenarios I could see playing out today and important price levels on the following market profile charts:

If you enjoy the content at iBankCoin, please follow us on Twitter