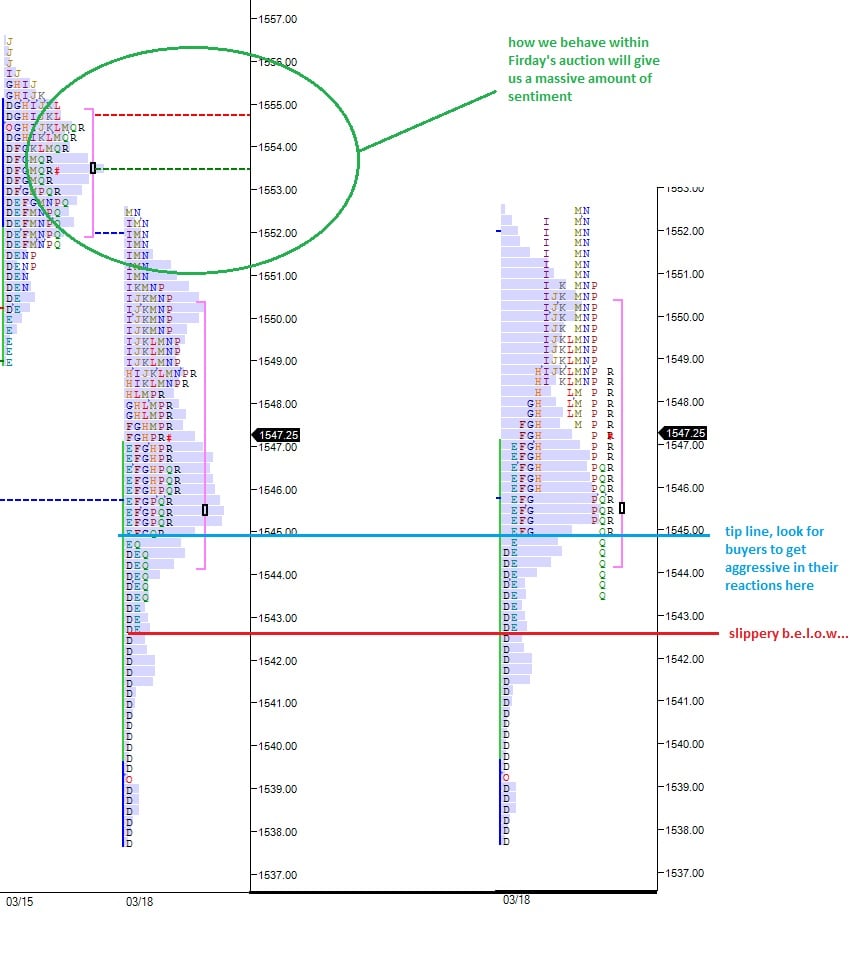

For me, the time when we’re trading within the range of a previous auction is where my edge is the sharpest. The reason being I can get close to the action and laser focus on where participants have made themselves known. With that in mind, and to tune out unnecessary noise, today I present only the previous two sessions of trade.

I’ve highlighted below what can only be described as an aggressive reaction by the buyers. They woke up Monday with the futures bouncing off their Sunday lows and they came to the market with buy orders. It wasn’t until we reached Friday’s value area low that the flow of sell orders was enough to stop the liquidity march higher. The afternoon attempt to dictate price lower by the sellers was shut down, and another aggressive buying reaction footprint was left on the profile.

Should the buyers not behave in the same manner at the levels highlighted below, that tells me something has changed. What has changed? Don’t care bro, something. The sentiment of the buyers has changed in a material way and they’re backing off their bids.

Up above, the sellers cleared were a greater force and stopped price in its tracks. Keep in mind, however, that this was after a 14 handle intraday rally. Today is a big POMO day with $2.75 – $3.50 billion in outright Treasury Coupon purchases (source: ZH). Should all that liquidity find its way into equities, we need to closely monitor price behavior within last Friday’s range and act accordingly.

Trade well, be water.

If you enjoy the content at iBankCoin, please follow us on Twitter