It seems like the market was trying for lower yesterday but the pesky buyers were not having it. The market gapped lower and a fresh batch of buyers stepped in and auctioned price higher all day. Morning buyers had it easy. They spent the morning targeting a gap fill and the afternoon featured a little dip after the FaceBook noise where eager side liners could grab the wave. They were rewarded too as the index pushed to new highs before eventually settling near the value area high from Monday.

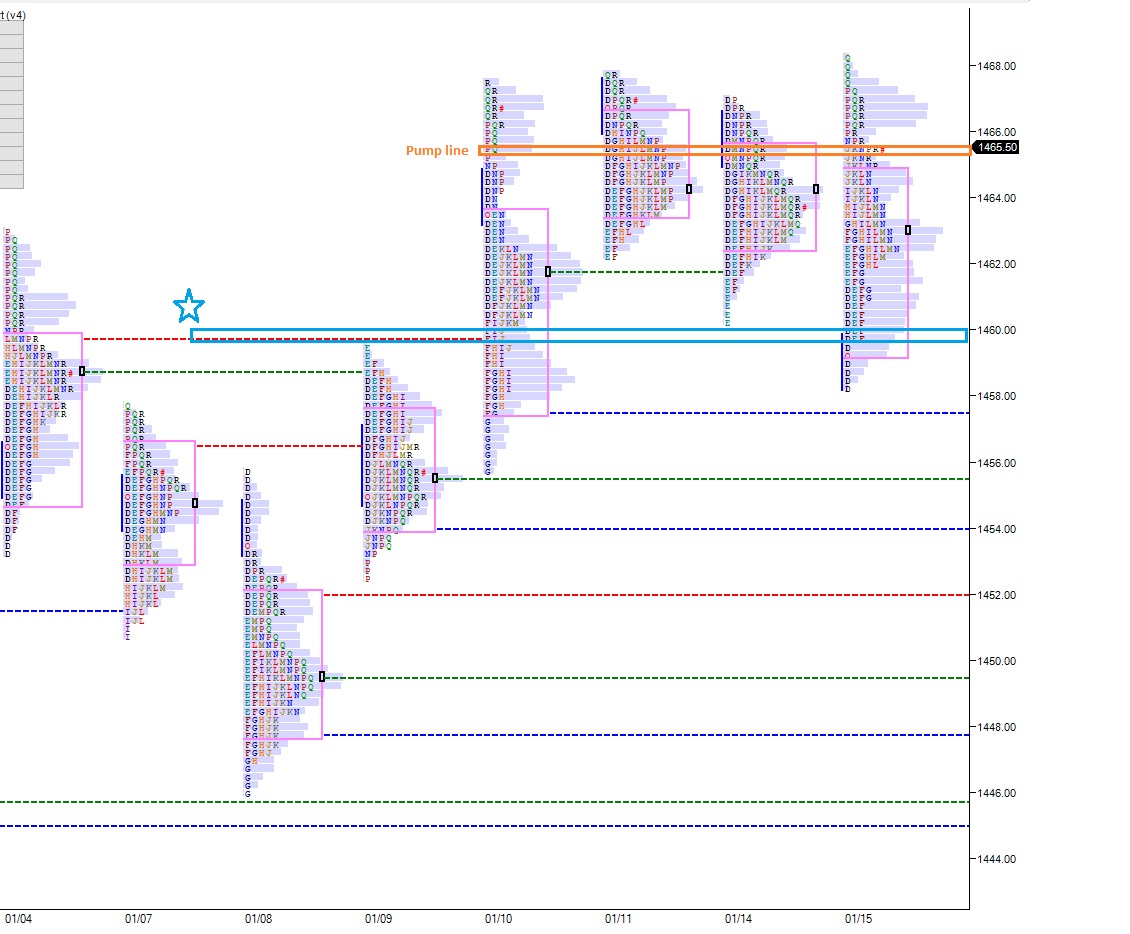

The profiles are overlapping, building potential energy.

That behavior into the close does signal resistance however. Looking closely at the auction above 1466 yesterday we can glean insight. Late day chasers, perhaps swing traders positioning for an overnight play were punished for their lack of discipline. Or it was a little short squeeze. Either way, it created excess above and we closed within yesterday’s range. That is why yesterday’s closing print at 1465.50 is our key resistance next time we go for a new pump.

The globex session has mostly glided lower, but Goldman just crushed estimates. As of 8am 1460 has been support. This level also is in confluence with the single TPO prints yesterday. If this level can’t hold the market will begin exploring lower.

If you enjoy the content at iBankCoin, please follow us on Twitter