Friday featured a blunt shaped profile as the S&P resisted the urge to sell off instead opting to properly auction the toothy area from Thursday’s afternoon thrust. However it sustained the level on the lowest volume since starting the year. Sustaining those levels was telling of the demand for equity exposure. However we want to be aware of price levels that could signal a change in risk appetite.

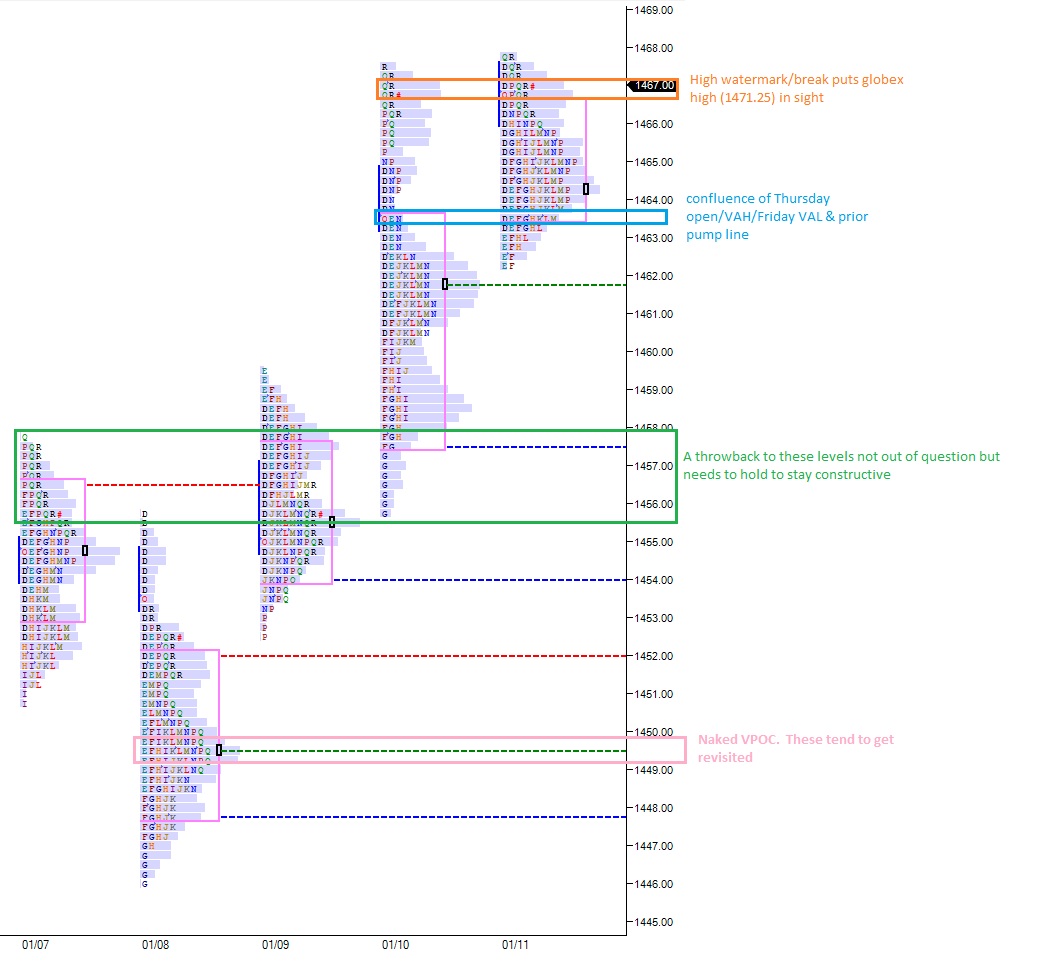

Given the progress we saw last week, the risk range below has increased significantly. I’ve noted in blue our first key area of support. Coming into the US morning we’re seeing the Globex session off nearly six handles after making new highs at 1471.25 overnight. As of 8am, we’re set to open near this first level of support. Thus how we open will be very informative of the early tenor of market participants.

Should we break the Friday VAL (noted below in blue) it will be a quick trip to the naked volume control point. If buyers aren’t present here we could see a quick rotation through Thursday’s value area and a test of our major support for the week noted in green. Seeing us back in the 1450’s should not be a cause for closing out all long exposure, but we should closely observe the markets behavior at these levels should they trade.

If you enjoy the content at iBankCoin, please follow us on Twitter