The speed in the market is starting to dry up. That’s usually a predictive signal that we’ve used coming out of market corrections and fast declines.

The speed stands out to me (or lack thereof), and the $VIX is trying to remain under $20. I think if it trades to $17, there might be a quick upside response, as the overall $VIX trend has been sloping upward since October. Thus far though, it seems the market likes the idea of losing speed here.

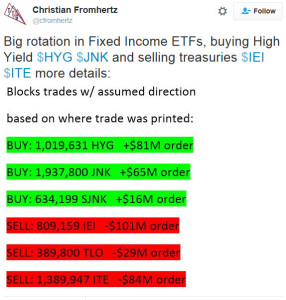

One other item I thought was interesting today, take a look at this rotation from treasuries to high yield. Hat tip @cfromhertz

I got stopped out of crude oil in my sleep last night and never got a spot to get back on. I’m dealing with some serious FOMO over here not being in this. Caught a massive move late last week and think there’s more upside coming. I’m on high alert for a dip buy.

I got stopped out of crude oil in my sleep last night and never got a spot to get back on. I’m dealing with some serious FOMO over here not being in this. Caught a massive move late last week and think there’s more upside coming. I’m on high alert for a dip buy.

Still like the action in biotech, watching china names too.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

Thoughts on $AAPL for a trade?

Meh. You can own it here…but its sat here for months.

What do you think of $DK OA? Volume pocket is interesting and has great seasonality oin March.

Never a fan of chasing. I couldn’t get past that detail here.

(Sorry Jeff) but in light of the action in China, I would take the other side and short the lift in BIDU and BABA — they look like nothing more than month end prop jobs.

I have no beef with that. My $BABA weeklys from Friday are in good enough shape here.

OA,

Any thought on PCLN?

Tried to catch this move on Friday with a weekly option. That was all I was thinking.

Thoughts on EA? I have April puts currently.

Was on my bearish list in Jan. I’d probably bet against it here at this spot.

Are selling weekly credit spreads on Thursday or Friday the most conservative trade?

Without a convincing close over 1951 SPX, are we not still at risk of breakdown? Since everyone in the modern world was watching 1950 wouldn’t that be a great spot for a false breakout?

Sold QQQ Mar 102 puts….nearly 40% gain.

Beast. Nice trade. Great timing.

Taking off the AAPL Mar 95 puts — keeping the AMZN 550 weeklys

You’ve been nailing bro!

Hard to play the bear side when I’m so freaking bullish…methinks today’s marks the final washout in VRX which will in turn make the biotech’s buyable as the calendar turns into March.

Rally on —

So many bullish divergences in the tape today. Keeping traders engaged at lows here today. Vulnerable to a gap up.

Just curious.. why do you think VRX is holding back the whole BIO space when its issues are purely self-inflicted?

Stocks that are taking up headline space in a sector weigh on the overall sentiment of the group.

Yeah, what OA said…lol.

Interesting to see VRX trade up nearly $2 after SEC investigation was disclosed. I believe today’s action was a rush by many to get VRX off their sheets before month end. End of the day was exaggerated by margin selling.

Shares trade $75+ by end of this week

With volability coming in I sold most of my NFLX, WYNN, & SHAK.

Neutral interest rates by buying equal amount of TLT. Catches the divvy as well.

BEgan accumulating SCO at 157.75. 1/8 position. Hedge against long oil position.

Lovely reversal of fortune the past 2 days.

The TNA buy?

The reversals the past 2 days always make me want to flip it and pick up more shares at the end of the day. This action strikes me as shaking the tree so fewer and fewer people are on board for the move up.

RUT continues to trade better mainly because it got so beaten down and the assumption is recession. If not then a move back into balance makes sense to me (ie 1150).

P&F updated to a 1230 target now.

When reviewing charts tonight be sure to dial out to a monthly view to get a different perspective…

I got turned onto SHAK + DNKN (and PNRA) after reviewing their monthly charts over the weekend. Each of these companies are beneficiaries of sub-$2 gasoline environment and the bullish monthly technical action tells me these names will continue to attract investment dollars in the months to come.

Get some!

I would agree if they all weren’t so expensive. And DNKN coffee is horrible.

I really like the restaurants but valuations are sky high. PNRA is at like 35x EPS with a 3% growth rate. CAKE is one of the best run restaurants but again valuations are quite high. I’ve never been to an empty Cheesecake Factory

There is a market for $2 coffee regardless of your opinion of DNKN’s coffee. In a market where participants are struggling to identify direction, one could argue that MCD has been leading the market ever since its breakout in Oct 2015.

My takeaway: Climb aboard when the PNRA’s and CAKE’s of the world start to play follow the leader and don’t let valuation analysis / paralysis cloud your view.

valuation is essential to long term gains. I avoided disaster in all of the high valuation stocks that got crushed in 2014 / 2015 by focusing on valuation.

having said that, companies like PNRA / CAKE probably won’t get crushed unless we get a recession.

My emotions got the best of me after hours and I sold TNA for a small gain at $46.8ish. Bought some TLT after hours as well.

Damn emotions.

Looks like the emotions got the best of me as usual. Tough market.

Got out of tlt and back in tna

Light, sweet

OA- you using this dip in crude to get in now?

Bot BAC weekly $13 calls

Guess FANG is still alive. Missed stupid easy AMZN day trade.