[youtube://http://www.youtube.com/?v=-x8xxcvmvsM#t=34 450 300]

Comments »Marc Faber: “Insiders are Selling Like Crazy…”

“Beginning by disavowing Mario Gabelli of any belief that rising stock prices help ‘most’ people (“Fed data suggests half the US population has seen a 40% drop in wealth since 2007“), Marc Faber discusses his increasingly imminent fears of the markets in this recent Barron’s interview.

Quoting Hussman as a caveat, “The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak. There’s no calling the top,” Faber warns there are a lot of questions about the quality of earnings (from buybacks to unfunded pensions) but “statistics show that company insiders are selling their shares like crazy.”

His first recommendation – short the Russell 2000, buy 10-year US Treasuries (“there will be no magnificent US recovery”), and miners and adds “own physical gold because the old system will implode. Those who own paper assets are doomed.”

Via Barron’s,

Faber: This morning, I said most people don’t benefit from rising stock prices. This handsome young man on my left said I was incorrect. [Gabelli starts preening.] Yet, here are some statistics from Gallup’s annual economy and personal-finance survey on the percentage of U.S. adults invested in the market. The survey, whose results were published in May, asks whether respondents personally or jointly with a spouse have any money invested in the market, either in individual stock accounts, stock mutual funds, self-directed 401(k) retirement accounts, or individual retirement accounts. Only 52% responded positively.

Gabelli: They didn’t ask about company-sponsored 401(k)s, so it is a faulty question.

Faber: An analysis of Federal Reserve data suggests that half the U.S. population has seen a 40% decrease in wealth since 2007.

In Reminiscences of a Stock Operator [a fictionalized account of the trader Jesse Livermore that has become a Wall Street classic], Livermore said, “It never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight.” Here’s another thought from John Hussmann of the Hussmann Funds: “The problem with bubbles is that they force one to decide whether to look like an idiot before the peak, or an idiot after the peak. There’s no calling the top, and most of the signals that have been most historically useful for that purpose have been blaring red since late 2011.”

I am negative about U.S. stocks, and the Russell 2000 in particular. Regarding Abby’s energy recommendation, this is one of the few sectors with insider buying. In other sectors, statistics show that company insiders are selling their shares like crazy, and companies are buying like crazy.

Zulauf: These are the same people.

Faber: Precisely. Looking at 10-year annualized returns for U.S. stocks, the Value Line arithmetic index has risen 11% a year. The Standard & Poor’s 600 and the Nasdaq 100 have each risen 9.4% a year. In other words, the market hasn’t done badly. Sentiment figures are extremely bullish, and valuations are on the high side.

But there are a lot of questions about earnings, both because of stock buybacks and unfunded pension liabilities. How can companies have rising earnings, yet not provision sufficiently for their pension funds?

Good question. Where are you leading us with your musings?

Faber: What I recommend to clients and what I do with my own portfolio aren’t always the same. That said, my first recommendation is to short the Russell 2000. You can use the iShares Russell 2000 exchange-traded fund [IWM]. Small stocks have outperformed large stocks significantly in the past few years.

Next, I would buy 10-year Treasury notes, because I don’t believe in this magnificent U.S. economic recovery. The U.S. is going to turn down, and bond yields are going to fall. Abby just gave me a good idea. She is long the iShares MSCI Mexico Capped ETF, so I will go short.

…

What are you doing with your own money?

Faber: I have a lot of cash, and I bought Treasury bonds.

…

Faber: I have no faith in paper money, period. Next, insider buying is also high in gold shares. Gold has massively underperformed relative to the S&P 500 and the Russell 2000. Maybe the price will go down some from here, but individual investors and my fellow panelists and Barron’s editors ought to own some gold. About 20% of my net worth is in gold. I don’t even value it in my portfolio. What goes down, I don’t value.

…

Which stocks are you recommending?

Faber: I recommend the Market Vectors Junior Gold Miners ETF [GDXJ], although I don’t own it. I own physical gold because the old system will implode. Those who own paper assets are doomed.

Zulauf: Can you put the time frame on the implosion?

Faber: Let’s enjoy dinner tonight. Maybe it will happen tomorrow.

…

There is a colossal bubble in assets. When central banks print money, all assets go up. When they pull back, we could see deflation in asset prices but a pickup in consumer prices and the cost of living. ….”

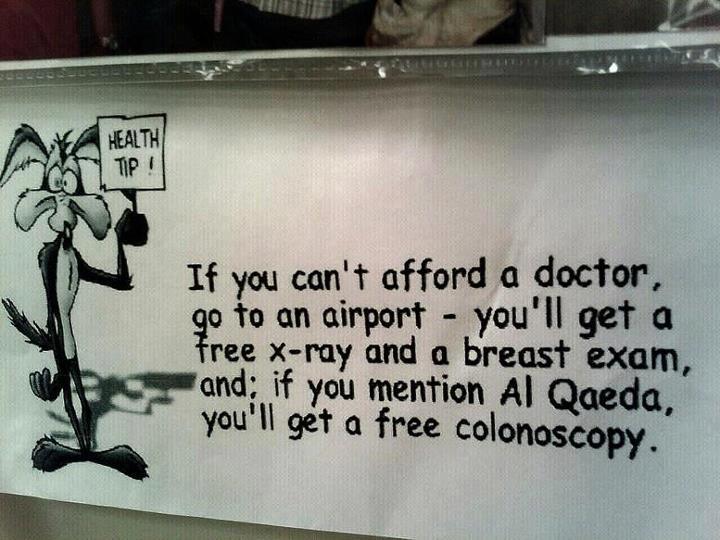

Comments »A Novel Approach to Fighting Terrorism

Comedy Files: LOL

[youtube://http://www.youtube.com/watch?v=0VD33jRpeMM#t=290 450 300]

Comments »Documentary: Love, Reality, and the Time of Transition

[youtube://http://www.youtube.com/watch?v=UrAgb1-UKQ8 450 300] [youtube://http://www.youtube.com/watch?v=_-Yz6Nxqw2o 450 300]

Comments »Eat Your Wheaties

Comedy Files: TSA Complaint

[youtube://http://www.youtube.com/watch?v=uMMGgQ1RFpc 450 300] [youtube://http://www.youtube.com/watch?v=9Iwks6LNbkw 459 300]

Comments »Revolution Interrupted

[youtube://http://www.youtube.com/watch?v=zPlPIsWMkDA#t=571 450 300] [youtube://http://www.youtube.com/watch?v=u21DO0qn9h8 450 300] [youtube://http://www.youtube.com/watch?v=EUw4HS53eHY 450 300]

Comments »Getting Hosed in the U.K.

“The Association of Chief Police Officers says that the need to control continued protests “from ongoing and potential future austerity measures” justifies the introduction of water cannon across Britain for the first time….”

Comments »iMinority Report

Gold And Silver Tumble Most In A Month

http://www.zerohedge.com/news/2014-01-21/gold-and-silver-tumble-most-month

Comments »Follow the Money

One of the Greatest Researchers Ever, Professor Antony Sutton

[youtube://http://www.youtube.com/watch?v=7GhPsJCXPqY 450 300]

Comments »Comedy Files: Beware of “Tall Whites”

“Maybe conspiracy theorist Jim Garrow was right about the impending revelation of alien contact.

A semi-official Iranian news agency reported Sunday that former National Security Agency contractor Edward Snowden had revealed documents proving that extraterrestrial beings had secretly controlled U.S. domestic and international policy since at least 1945.

The FARS news agency reported that nearly 2 million “top-secret documents” revealed by Snowden to Russia’s Federal Security Services (FSB) “confirmed” that an alien race known as “tall whites” was behind American efforts to create a global electronic surveillance system to hide their presence and eventually control the planet….”

Comments »Documentary: Home

“When the Last Tree Is Cut Down, the Last Fish Eaten, and the Last Stream

Poisoned, You Will Realize That You Cannot Eat Money”

~Cree Indian Prophecy

[youtube://http://www.youtube.com/watch?v=o9gK2fOq4MY 450 300] Comments »Documentary: Crossroads- Labor Pains of a New World View

[youtube://http://www.youtube.com/watch?v=5n1p9P5ee3c 450 300] [youtube://http://www.youtube.com/watch?v=pls_luhVdAw 450 300]

Comments »

Scientists Find Evidence of the Universe Being a Giant Hologram

[youtube://http://www.youtube.com/watch?v=biU3W0w2Oq0 450 300]

Comments »The Truth is That Psychopaths are Psychopaths

“A foolish faith in authority is the worst enemy of the truth.

Indeed, scientists have shown that people will go to absurd lengths – and engage in mental gymnastics – in order to cling to their belief in what those in authority have said.

Part of the reason so many are so vulnerable to naive belief in authority is that we evolved in small tribes … and we assume that the super-elites are just like us.

In reality, there are millions of psychopaths in the world … and they are largely running D.C. and on Wall Street.

These people have no hesitation in lying to promote their goals.

The Assistant Secretary of Defense for Public Affairs told Morley Safer of 60 Minutes and CBS News:

Look, if you think any American official is going to tell you the truth, then you’re stupid. Did you hear that? — stupid.

And studies show that the super-rich lie, cheat and steal more than the rest of us.

Who’s to Blame … Big Government or Big Business?

Conservatives tend to believe that the captains of industry are virtuous and that the government can’t be trusted.

Liberals tend to believe that government servants are virtuous and that corporations can’t be trusted.

But the truth is that psychopaths are psychopaths … whether they’re in the private sector or government….”

Comments »Silver Turns Red For The Year

http://www.zerohedge.com/news/2014-01-08/silver-turns-red-year

Comments »The F Bomb Hits Missouri

Comments »