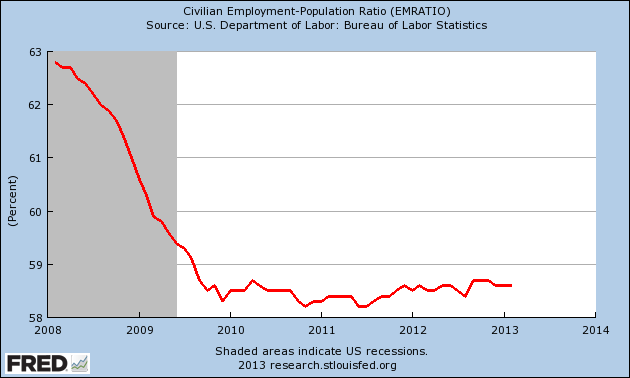

Fun times for employment in the great recovery…..

Comments »Last Week’s Unemployment Report Was Really a Loss of 60k Jobs

Those that are not in the labor force outnumbered jobs created.

So really we lost 60k jobs.

Why markets celebrate this horrible reality is beyond imagination.

Comments »1/3rd of the U.S. Workforce are Now Temp Workers, Recovery Contingent

“(MoneyWatch) With job growth still weak in the U.S., another trend poses both an opportunity and a challenge for American workers: The explosion in temporary and part-time employment.

To be sure, such jobs can ameliorate the high unemployment that has plagued the economy since the 2008 financial crisis. Yet labor experts also say that the surge in what they refer to as “contingent” work signifies a historic shift away from the kind of long-term employment that workers once expected and that helped power the rise of the American middle class.

“What’s changed in the last 20 years is that there’s been an unraveling of job security in the labor market, as well as a diminishment of benefit packages and a deterioration of stable, reliable wages and promotion pathways,” said Katherine Stone, a law professor at the University of California, Los Angeles, and labor specialist. “There’s been a really fundamental shift in the nature of employment — it’s a sea change. Whether you’re talking about the expanded use of short-term employees, temporary workers, project workers, contractors or on-call workers, the use of workers who don’t have regular jobs has increased a lot.”

Two new studies highlight the rise of the temp economy. First, job-search company CareerBuilder reported Thursday that 40 percent of employers surveyed plan to hire temp workers in 2013. Of that number, 42 percent of those employers say they hope to make some of those workers permanent, full-time employees. CareerBuilder lists several job categories in which hiring of temps is growing, including sales representatives, office clerks, manufacturing assemblers, nurses, home health aides, truck drivers and office clerks.

Meanwhile, a study by consulting firm Challenger Gray & Christmas found that employers in February said they planned to cut more than 55,000 jobs, with over 21,000 of those slated to come from the financial services industry and a healthy dose from defense contractors and aerospace firms. That represented a 37 percent increase in planned layoffs over the same period last year.

The Bureau of Labor Statistics defines contingent employees as “those who do not have an implicit or explicit contract for ongoing employment.” By contrast, people who don’t continue working because they are, say, returning to school or retiring would not be considered contingent.

Estimates of the number of contingent workers in the U.S. can range widely, depending on how they are defined. But recent data suggest that roughly a third, and perhaps up to 40 percent, of American workers are in part-time, contract or other non-standard jobs. Recruiting firm MBO Partners projects that there will be 23 million contingent workers by 2017, up from roughly 17 million today.

That phenomenon presents problems for workers and society as a whole. Temp and other contingent jobs frequently mean lower wages than those earned by their permanent counterparts, and there are typically no health care or retirement benefits. Lower wages sap people’s purchasing power and limits personal consumption, which in turn discourages companies from hiring and slows economic growth…..”

Comments »$GOOG’s Motorola to Pink Slip 10% of Workforce

“After laying off 4,000 Motorola employees last year, representing around 20 percent of the total workforce, Google just announced that it would increase job cuts by a further 10 percent — now representing 1,200 people. The WSJ intercepted an internal email laying out the motivations behind this move.

“Our costs are too high, we’re operating in markets where we’re not competitive and we’re losing money,” said a Motorola spokesperson in the internal email. The business division is still losing a lot of money every quarter and it impacts Google’s bottom line.

Employees in the U.S., China and India will be affected. Since the acquisition, many Google executives have changed position to help run Motorola. But the turnaround hasn’t happened yet.

For Q4 2012, Motorola generated revenues of $1.51 billion, which represents a dip from previous quarters. And the company reported $353 million of GAAP operating loss….”

Comments »The Labor Force Participation Rate Fell, Overall Employed Also Fell

“Today, nonfarm payrolls blew past expectations. Payrolls added in February amounted to 236,000 versus economists’ predictions of a 165,000 gain.

However, the labor force participation rate ticked down slightly to 63.5 percent from 63.6 percent.

It’s not a big drop in the participation rate, but it is notable because it was accompanied by a substantial decline in the overall size of the labor force.

People reported not in the labor force rose to 89.304 million in February from 89.008 million in January….”

Comments »Unemployment Rate Climbs For People With Bachelor’s Degrees And Higher

“Today’s jobs report was not all good news.

While the overall unemployment rate for most categories fell, two categories saw their rates rise: teenagers and those with bachelor’s degrees and higher.

To be clear, the unemployment rate is a very low 3.8 percent for the latter category.

But it is nevertheless a concern as student loan delinquency rates continue to surge.

Here’s the table from the BLS…”

More on the Stellar Non Farm Payrolls Number

“Payrolls increased more than forecast in February and the jobless rate unexpectedly fell to a five-year low of 7.7 percent, a sign U.S. employers were undaunted by the budget impasse inWashington.

Employment rose 236,000 last month after a revised 119,000 gain in January that was smaller than first estimated, Labor Department figures showed today in Washington. The median forecast of 90 economists surveyed by Bloomberg projected an advance of 165,000. The jobless rate dropped from 7.9 percent. Hiring in construction jumped by the most in almost six years.

Automakers and home-improvement retailers are among those announcing plans to take on more staff, which will lead to gains in incomes that may help the world’s biggest economy weather federal cutbacks and higher taxes. Today’s data may ratchet up debate among Federal Reserve policy makers, who are looking for “substantial” progress in the labor market to determine whether to maintain record stimulus.

“There’s a lot of dry tinder in the economy,” Robert Dye, chief economist at Comerica Inc. in Dallas, said before the report. “If companies are experiencing growth in orders, they’re going to be able to look past these broader fiscal concerns. We’re still going to need to see ongoing solid gains in employment and steady drops in unemployment before the Fed eases off the gas pedal.”

Employers also boosted hours worked, and earnings picked up for American workers.

Payroll projections ranged from gains of 121,000 to 260,000 following an initially reported 157,000 increase in January, according to the Bloomberg survey.

Payroll Revisions….”

Comments »Non Farm Payroll: Prior 157k, Market Expects 165k, Actual 236k….Unemployment Rate 7.7%…Futures Double

Challenger, Gray, & Christmas Say Planned Job Cuts Rise 37%, Second Month of Upticks

“FOR RELEASE AT 7:30 A.M.ET,MARCH 7, 2013

Job Cuts Up Second Month in a Row

FEBRUARY CUTS RISE 37% TO 55,356

CHICAGO, March 7, 2013 –Planned job cuts increased for the

second consecutive month in February as U.S.-based employers announced

workforce reductions totaling 55,356, up 37 percent from 40,430 in January,

according to the report released Thursday by global outplacement

consultancy Challenger, Gray & Christmas, Inc.

The February total was 7.0 percent higher than the 51,728 job cuts

announced the same month a year ago. It was the highest monthly tally

since last November, when announced layoffs reached 57,081.

Employers have now announced 95,786 job cuts so far in 2013. That

is 9.0 percent fewer than the 105,214 job cuts through the first two months

of 2012.”

Unemployment in France Hits a 13 Year High as Growth Slows

“French unemployment climbed to a 13- year high in the fourth quarter as companies eliminated tens of thousands of jobs to cope with a stalled economy.

The jobless rate based on International Labor Organization standards rose to 10.6 percent from a revised 10.2 percent in the previous three months, national statistics office Insee in Paris said today. Excluding France’s overseas territories, the rate was 10.2 percent, compared with a median forecast of 10.1 percent in a Bloomberg News survey.

Faced with an economy that fell back into recession early last year and risks doing so again, companies such as PSA Peugeot Citroen (UG), Renault SA and Alcatel-Lucent are slashing payrolls. That’s adding pressure on President Francois Hollande who is trying to retain support of unions while attempting to revamp Europe’s second-largest economy in the wake of the region’s sovereign debt crisis.

“Unemployment will likely rise further in coming months, with the peak only coming at the end of the year or early next year,” said Joost Beaumont, an economist at ABN Amro in Amsterdam. “The economy may gain some traction in the second half but it’s unlikely to be enough to induce companies to start hiring in a serious way.”

Hollande, elected last May, has said he aims to revive growth and reduce joblessness by the end of his five year mandate by improving French competitiveness.

His Socialist government yesterday endorsed a plan to overhaul French labor law to add flexibility in legislation that lawmakers will vote on later this month.

‘Preserve Jobs’…”

Comments »The Hollowing Out of Private-Sector Employment

“The financial and political Aristocracy will continue to do more of what’s failed because they have no alternative model that leaves their power and wealth intact.

Frequent contributor B.C. has provided five charts that reflect the hollowing out of the private-sector employment. This has profound implications for education, taxes, housing and inequality.

Many people point to offshoring/global wage arbitrage as the key driver of stagnant wages and employment in the U.S., and this is certainly a factor. But we would be remiss not to note the other equally important drivers:

1. A system in which inefficient quasi-monopolies/cartels (defense, healthcare, education) are protected by a debt-based, expansionist Central State.

2. The exhaustion of the consumption/debt-based economic model.

What no one dares admit is that the U.S. economy is burdened by overcapacity(too many malls, restaurants, MRI machines, etc.) and too much debt, much of which was taken on to fund mal-investments (McMansions in the middle of nowhere, duplicate medical tests, costly weapons systems the Pentagon doesn’t even want, etc.)

Consider this thought experiment. Suppose the offshoring of jobs was suddenly banned; only U.S. workers could be hired (setting aside that this is impossible in an economy where 50%-60% of U.S. corporate sales, profits and labor are non-U.S.; how are corporations supposed to compete in markets that generate 60% of their sales/profits if they can’t hire local workers?)

Does a ban on offshoring suddenly make it profitable to hire more employees in the U.S.? No, it doesn’t. Healthcare costs are still double those of our global competitors America’s Hidden 8% VAT: Sickcare (May 10, 2012), and stagnant wages and high debt levels leave few opportunities for big profits.

Instead of developing new products and services, corporations either slash labor costs or belly up to the State trough of favored cartels: defense, healthcare and education. It is no mystery why these three State-protected sectors have seen costs skyrocket in a low-inflation, low-growth economy: college tuition has leaped by 1,100% above inflation and healthcare has risen 600% above the CPI (consumer price index).

Once the State enforces quasi-monopolies and cartels, inefficiencies rise because the feedback from reality (i.e. price) has been severed. This is how you get an economy where a biopsy costs $70,000, new fighter aircraft cost $200+ million each (six times the previous top-of-the-line fighter) and a conventional (i.e. non-Ivy League) college education costs $120,000 – $200,000…..”

Comments »ADP Employment Report Looks Good, Futures Spike

|

|||||||||||||

| Market Consensus before announcement ADP private payroll employment posted a 192,000 gain for January private payrolls versus its revised total for December of 185,000. The BLS figure for January was a 166,000 increase. |

|||||||||||||

Initial Claims & a Second Look at GDP

GDP revised higher by 0.1%. Consumption was revised lower.

Initial Claims drop 22k to 344k. Markets expected 360k, Last month figure was 366k

Comments »German Jobless Rates Unexpectedly Declines on Growth Revival

“German unemployment unexpectedly fell in February amid signs that Europe’s biggest economy is returning to growth after a contraction at the end of last year.

The number of people out of work fell a seasonally adjusted 3,000 to 2.92 million, the Nuremberg-based Federal Labor Agency said today. Economists had predicted unemployment to be unchanged, the median of 33 estimates in a Bloomberg News survey showed. Theadjusted jobless rate held at 6.9 percent this month after the January rate was revised up from an initially reported 6.8 percent…”

Comments »Bernanke Expects High Unemployment Until 2016…HINT, HINT

“Day two of Federal Reserve Chairman Ben Bernanke‘s semi-annual Congressional testimony on monetary policy is now over.

Today, Bernanke went before the House Financial Services Committee.

Yesterday, in a testimony before the Senate banking committee, Bernanke sought to downplay concerns over the size of the Fed’s balance sheet, largely as expected. He told senators that the benefits of quantitative easing outweigh the costs and that stocks don’t appear overvalued at these levels.

During the Q&A session with the House Committee today, Rep. Maxine Waters asked Bernanke about the effects of sequestration. Bernanke replied, “My suggestion for your consideration is to align the timing better with the problem.” …”

Comments »The Fed Has Yet to Take a Bow for Stimulating Job Growth in Housing and Autos

“Federal Reserve Chairman Ben S. Bernanke has something to tout before Congress in hearings this week: job growth in the auto and housing industries.

Consumers rely on loans to buy cars and homes, so these segments of the economy are among the most responsive to Bernanke’s strategy of holding interest rates low and pressing on with bond purchases of $85 billion a month.

“The rate-sensitive sectors, most notably housing and autos, are kicking into a higher gear,” said Mark Zandi, chief economist for Moody’s Analytics Inc. in West Chester, Pennsylvania. “This reflects the Fed’s aggressive monetary policy and resulting rock-bottom interest rates,” along with “working off the excesses of the boom and bubble.”

Bernanke and his colleagues on the Federal Open Market Committee have pledged to continue buying bonds until the labor market improves “substantially.” Climbing employment in construction and vehicle manufacturing bolsters the case that asset purchases can help spur the improvement….”

Comments »Will Obamacare Increase Unemployment ?

“ObamaCare will act as a neutron bomb on employment in the U.S. for two basic reasons.

America’s Hidden 8% VAT: Sickcare (May 10, 2012)

Can Chronic Ill-Health Bring Down Great Nations? Yes It Can, Yes It Will (November 23, 2011)

Why “Healthcare Reform” Is Not Reform, Part I (December 28, 2009)

Why “Healthcare Reform” Is Not Reform, Part II (December 29, 2009)

Sickcare is unsustainable for a number of interlocking reasons: defensive medicine in response to a broken malpractice system; opaque pricing; quasi-monopolies/cartels; systemic disconnect of health from food, diet and fitness; fraud and paperwork consume at least 40% of all sickcare funds; fee-for-service in a cartel system; employers being responsible for healthcare, and a fundamental absence of competition and transparency.

U.S. Carmakers Hang Up the Help Wanted Sign

“A few years ago, American automakers cut tens of thousands of jobs and shut dozens of factories simply to survive.

But since the recession ended and General Motors and Chrysler began to recover with the help of hefty government bailouts and bankruptcy filings, all three Detroit car companies including Ford Motor Companyhave achieved one of the unlikeliest comebacks among industries devastated during the financial crisis.

Now steadily rising auto sales and two-tier wage concessions from labor have spurred a wave of new manufacturing investments and hiring by the three Detroit automakers in the United States. The latest development occurred on Thursday, when Ford said it was adding 450 jobs and expanding what had been a beleaguered engine plant in Ohio to feed the growing demand for more fuel-efficient cars and S.U.V.’s in the American market.

Ford, the nation’s second-largest automaker after G.M., said it would spend $200 million to renovate its Cleveland engine plant to produce small, turbocharged engines used in its top-selling models. Ford plans to centralize production of its two-liter EcoBoost engine — used in popular models like the Fusion sedan and Explorer S.U.V. — at the Cleveland facility by the end of next year.

Its move to expand production in the United States is yet another tangible sign of recovery among the Detroit auto companies. Industrywide sales in the United States are expected to top 15 million vehicles this year after sinking beneath 11 million in 2009.

Last month, G.M. announced plans to invest $600 million in its assembly plant in Kansas City, Kan., one of the company’s oldest factories in the country. And Chrysler, the smallest of the Detroit car companies, is adding a third shift of workers to its Jeep plant in Detroit.

The biggest factor in the market’s revival has been the need by consumers to replace aging, gas-guzzling models. ”Pent-up demand and widespread access to credit are keeping up the sales momentum,” said Jessica Caldwell, an analyst with the auto research site Edmunds.com….”

Comments »The EU Forecasts 12% Unemployment in Italy

“Italy’s economy will shrink again this year and unemployment will continue rising in 2014 to reach 12 percent, European Commission forecasts show.

In its fourth recession since 2001, Italy’s gross domestic product will fall 1 percent this year after a 2.2 percent decline in 2012, the Brussels-based commission said today in its latest forecasts. That’s deeper than the 0.5 percent contraction it predicted in November. The economy may grow 0.8 percent in 2014, the commission said.

Prime Minister Mario Monti’s austerity policies, aimed at shrinking the euro area’s second-biggest debt load afterGreece and spurring competitiveness, have been the focal point of the election campaign that ends tomorrow. With the economy shrinking, candidates including Monti have fought over how much to roll the squeeze back….”

Comments »EU: Rising Unemployment Will Shrink Eurozone GDP

“The euro-area economy will shrink in back-to-back years for the first time, driving unemployment higher as governments, consumers and companies curb spending, the European Commission said.

Gross domestic product in the 17-nation region will fall 0.3 percent this year, compared with a November prediction of 0.1 percent growth, the Brussels-based commission forecast today. Unemployment will climb to 12.2 percent, up from the previous estimate of 11.8 percent and 11.4 percent last year.

Economic and Monetary Affairs Commissioner Olli Rehn said authorities must press on with reforms to end the region’s debt crisis and help the recovery. While “hard data” has been disappointing, there also has been more encouraging “soft data” that points to better times, he told reporters today.

A strengthening of the euro economy later this year may be led by Germany, where investor confidence rose in February to a 10-month high. The commission’s weak outlook reflects government austerity measures and efforts by companies and consumers to reduce debt. The European Central Bank said today banks will next week return 61.1 billion euros ($80.5 billion) of its second three-year loan, a measure introduced to aid lending at the depths of the financial crisis.

“We clearly have a decoupling with different recovery trends, with Germany certainly recovering at a much faster pace,” saidMarco Valli, chief euro-area economist at UniCredit Global Research in Milan. “We still have a lot of noise and volatility in the monthly data, but the bottom line is that the euro zone as a whole has already turned.” …”

Comments »