Stock trading down 20%

Comments »Q4 Guidance in a Chart; Can You Say South ?

FLASH: Cummins Warns

Netflix Getting Obliterated in Pre- Market After Earnings Report

UPS Reports a 14% Increase Profits on a 8% Rise in Revenues

3M Misses by $0.09; Stock Gets Hammered in Pre Market

Check This Cool Interactive Earnings Chart

DuPont Reports a 23% Increase in Profits

BP’s Profits Fall Less Than Expected

Deutsche Bank Beats Estimates With Gains in Consumer Banking

UBS Reports a Smaller Decline in Profit Despite The Rogue Trader Loss

ALERT: The Conference Call of the Century Begins is Underway, $NFLX

FLASH: Texas Loses Again

Reports Q3 (Sep) earnings of $0.60 per share, excluding $0.09 in items, $0.03 better than the Capital IQ Consensus Estimate of $0.57; revenues fell 7.3% year/year to $3.47 bln vs the $3.31 bln consensus. Co issues guidance for Q4, sees EPS of $0.43-0.51, excluding $0.15 in non-recurring items, vs. $0.54 Capital IQ Consensus Estimate; sees Q4 revs of $3.26-3.54 bln vs. $3.32 bln Capital IQ Consensus Estimate. TI’s third-quarter 2011 gross profit and operating profit were negatively impacted by costs associated with lower levels of factory utilization in the quarter as the company lowered production in response to weaker demand, as well as charges for inventory obsolescence on certain custom programs. These were partially offset by a net benefit resulting from proceeds from ongoing insurance claims associated with the March earthquake in Japan. The company used $450 million in the quarter to repurchase 14.1 million shares of its common stock and paid dividends of $148 million. “Our revenue for the third quarter was higher than we expected though, overall, the quarter was below the seasonal average. We expect the same in the fourth quarter as economic uncertainty continues to weigh on demand in almost every major market segment in which we operate. We are well prepared to continue to gain share in our core businesses, no matter the economic conditions.”

Comments »FLASH: STM Guides Down

Reports Q3 (Sep) earnings of $0.09 per share, excluding non-recurring items, $0.01 worse than the Capital IQ Consensus Estimate of $0.10; revenues fell 8.1% year/year to $2.44 bln vs the $2.49 bln consensus. Co issues downside guidance for Q4, sees Q4 revs of $2.15-2.30 bln vs. $2.55 bln Capital IQ Consensus Estimate. Regarding guidance, co said, “Reflecting both revenue and a higher level of unsaturation at our facilities as we make further adjustments to reduce inventory, we anticipate a gross margin range of about 33.5%, plus or minus 1.5 percentage points. We anticipate that 2011 will still be a year of revenue and operating income growth in several businesses, in particular Automotive and MEMS, despite the weaker second half. As evidenced by our year-to-date results, we continue to build on the progress achieved over the course of the last two years in expanding our customer base, introducing new products and focusing on our target growth markets.”

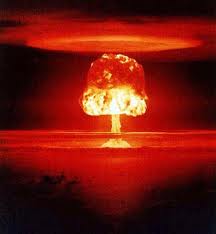

Comments »FLASH: SHARES OF NFLX BURN IN HELL IN AFTER HOURS TRADE

The Death of a brand.

The stock is trading at $85, down from a close of $118.84.

Reports Q3 (Sep) earnings of $1.16 per share, $0.22 better than the Capital IQ Consensus Estimate of $0.94; revenues rose 48.6% year/year to $822 mln vs the $812.9 mln consensus. NFLX reports Q3 net subscribers of 23.79 mln vs approx 24 mln guidance. Total U.S. Subscribers is 23.79 mln up 42% y/y. Net Sub additions falls -0.81 mln down 145% y/y. Co issues downside guidance for Q4, sees EPS of $0.36-0.70 vs. $1.09 Capital IQ Consensus Estimate; sees Q4 revs of $841-875 mln vs. $923.19 mln Capital IQ Consensus Estimate.

Says DVD subs in Q4 will decline sharply which is reflected in guidance due to price change. Weekly rate of DVD cancellations is shrinking; expect future cancellation rates to shrink more modestly. Says that streaming net additions will be negative in october due to the cancellation wave. Expect levels to be flat in November. Overall expect slightly negative streaming net sub additions in Q4. Expects to double spending on content in 2012 from 2011.

Comments »