Click here to discover the simple key to progress

Comments »Yearly Archives: 2014

A Quick History Lesson on Banking

[youtube://http://www.youtube.com/watch?v=VQ0-3fQIB2g#t=118 450 300]

Comments »A Homage to CNBC

“We get experts on everything that sound like they’re scientific experts … They’ll sit at a typewriter and make up all this stuff as if it’s science and then become an expert … Now, I might be quite wrong, maybe they do know all these things. But I don’t think I’m wrong. You see I have the advantage of having found out how hard it is to get to really know something … how easy it is to make mistakes and fool yourself. I know what it means to know something. And therefore, I see how they get their information and I can’t believe that they know it. They haven’t done the work necessary. They haven’t done the checks necessary. They haven’t done the care necessary … and they’re intimidating people. -Richard Feynman, Nobel Prize-winning physicist.

The excerpt is from a 1981 BBC documentary about Richard Feynman that was linked in a Zero Hedge post several years ago. Unfortunately, Feynman passed away in 1988 and never had the chance to watch the “experts” on financial television. We would have particularly liked to hear the great physicist’s thoughts on economics punditry.

To understand economics experts in Feynman’s absence, the best analogy that we can think of is to the methods of a magician. Magicians operate by showing their audience a small window on reality, and then tricking people into mentally filling in the rest incorrectly. Because the economy has so many moving parts, a similar approach also works in economics. Pundits can draw our attention to a couple of indicators, ignore everything else, and make claims that sound realistic even though they make little sense in the bigger picture. One difference between economists and magicians, though, is that economists are often unaware of their trickery because they fool themselves before fooling others.

To be clear, we don’t claim to be immune to such deceptions, but we do try to root them out as best we can and will do that here.

We’ll look at capital expenditures (capex), in particular. You can’t take in much media commentary today before finding someone arguing that capex is lower than it should be. Crystal ball gazers predict a capex resurgence that lifts the economy into a robust recovery, while pundits with an activist bentimplore businesses (and public officials) to ramp up their investments.

There’s usually some combination of four pieces to what we’ll call the “CNBC” story:

- Corporate cash is high

- Net investment is low

- Bond yields are low

- Corporate profits are high

These four observations are said to demonstrate that businesses are behaving irrationally or improperly by not pushing capex higher. And the story may sound reasonable on the surface, but is it really that simple?

To dig deeper, we’ll critique the proposition linked to each observation, while testing them with over 60 years of data. Our results show that the CNBC story is yet another careless economic illusion.

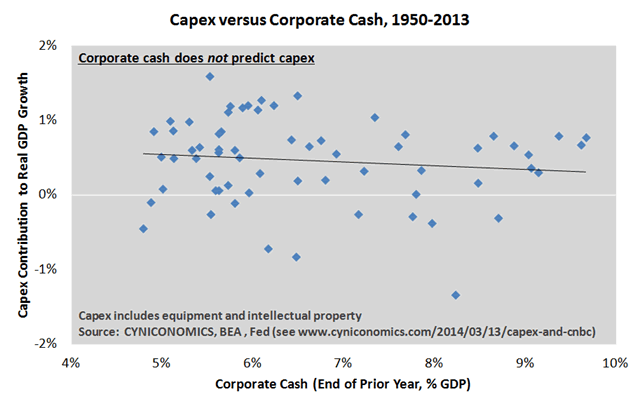

Proposition 1: Corporate cash is high, and therefore, businesses should put that cash to work through capex.

Comments: This is the most obviously deceptive of the four propositions, hence Mark Spitznagel’s incredulous response when asked to address cash balances by Maria Bartiromo last week. As Spitznagel explained, it makes little sense to isolate the cash that sits on corporate balance sheets without netting the credit portions of both assets and liabilities. We last updated corporations’ net credit position here, showing that gradual increases in cash balances are dwarfed by rising debt.

A longer history further disproves the proposition; it shows that there’s no correlation between capex and corporate cash:

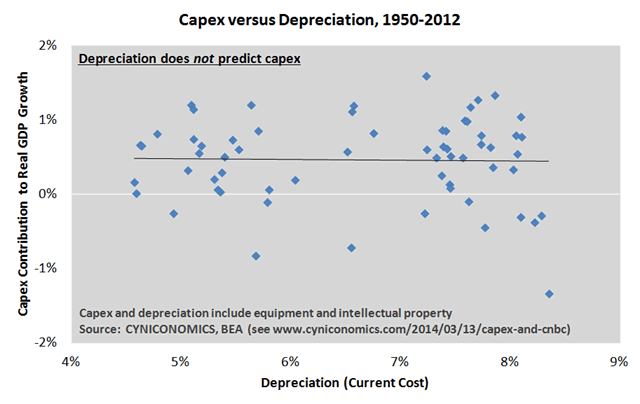

Proposition 2: Net investment (capex less depreciation) is unusually low and should be much higher at this point in the business cycle.

Comments: This argument implies that businesses should invest more when depreciation is higher, as that’s the only way to drive the net amount of investment towards “normal” levels. Our criticism is that it combines current capex with an accounting measure of depreciation on past capex. This is extremely misleading after periods of malinvestment, in particular, when the capital stock is too high for the level of demand. Unusually high depreciation after such periods is a sign that capex should be managed carefully to keep the capital stock from further outpacing fundamentals, not increased blindly to maintain an assumed margin over depreciation. Therefore, net investment fails to tell us anything about the “right” amount of capex.

Turning again to the last six decades, data confirms that the second proposition is just as faulty as the first:

Proposition 3: Low interest rates should encourage more capex.

Comments: This is a trickier proposition than the first two, since low rates should certainly spur higher spending when other factors are held constant. The problem is that other factors are never constant. On the contrary, low rates are typically associated with a challenging economy, and this is especially true in today’s highly manipulated markets. The Fed seems to be discouraging long-term investment in some respects by holding rates well below where they would otherwise be. As perceived by us and many others (including Spitznagel per the interview linked above), the Fed’s approach raises long-term risks while drawing capital into short-term financial strategies.

Needless to say, this isn’t the ideal environment for capex. It’s not that companies aren’t taking advantage of low rates; they’ve increased borrowing substantially as noted above. It’s just that the proceeds of that borrowing aren’t flowing into capex as much as they would in less manipulated markets.

Moreover, history once again refutes the proposition. Adjusting corporate bond yields for inflation, the chart below shows that capex has tended to be slightly lower than average when real yields are low….”

Comments »Record Bid Hitting Taking Place in U.S. Paper, Russia Suspected

“A drop in U.S. government securities held in custody at the Federal Reserve by the most on record is fueling speculation that Russia may have shifted its holdings out of the U.S. as Western nations threaten sanctions.

Treasurys held in custody at the Fed by foreign central banks dropped by $104 billion to $2.86 trillion in the week ending March 12, according to Fed data, as the turmoil in Ukraine intensified. As of December, Russia held $138.6 billion of Treasurys, making it the ninth largest country holder. Russia’s holdings are about 1 percent of the $12.3 trillion in marketable Treasurys outstanding, according to data compiled by Bloomberg.

“The timing of the drop in custody holdings makes Russia a more likely suspect,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman in a telephone interview. “If Russia did it, then they may have transferred the holdings to another bank outside of the U.S.”…..”

Comments »The Top Ten Most Wanted Corrupt Politicians From Judicial Watch

“(Washington, DC) – Judicial Watch today released its 2013 list of Washington’s “Ten Most Wanted Corrupt Politicians.” The list, in alphabetical order, includes:

- Speaker of the House John Boehner (R-OH)

- CIA Director John Brennan

- Senator Saxby Chambliss

- Former Secretary of State Hillary Clinton

- Attorney General Eric Holder

- Former IRS Commissioner Steven T. Miller / Former IRS Official Lois Lerner

- Former DHS Secretary Janet Napolitano

- President Barack Obama

- Senator Harry Reid (D-NV)

- Health Secretary Kathleen Sebelius

Dishonorable Mentions for 2013 include:

- Former New York Mayor Michael Bloomberg

- Outgoing Virginia Gov. Bob McDonnell (R) / Incoming Virginia Gov. Terry McAuliffe (D)

- Former Rep. Rick Renzi (R-AZ)

- National Security Adviser Susan Rice

Speaker of the House John Boehner (R-OH):

House Speaker John Boehner has apparently become a master at what Government Accountability Institute President Peter Schweizer calls the “Tollbooth Strategy.” As Schweizer explains in his new book, Extortion: How Politicians Extract Your Money, Buy Votes, and Line Their Own Pockets: “You pay money at a tollbooth in order to use a road or bridge. The methodology in Washington is similar: if someone wants a bill passed, charge them money to allow the bill to move down the legislative highway.” According to Schweizer, Boehner apparently used the Tollbooth Strategy to collect more than $200,000 in political donations from executives just days before holding votes on bills critically important to their industries.

The first bill was the Wireless Tax Fairness Act. Strongly supported by big phone companies like AT&T and Verizon, it sailed through the House Judiciary Committee, and was expected to immediately come to the floor for a full House vote. Instead of scheduling the bill for a vote, however, Boehner allowed it to languish on the calendar for the next three months. What finally prompted Boehner to bring the bill to a vote? As Schweizer explains it: “The day before the vote, Boehner’s campaign collected the toll: thirty-three checks from wireless industry executives, totaling almost $40,000.”

According to Schweizer, two more bills on which Boehner employed the Tollbooth Strategy were the Access to Capital for Job Creators Act and the Small Company Capital Formation Act. Brokers and venture capitalists and investment firms strongly supported the proposed law. Explains Schweizer in Extortion: “The Speaker of the House took in $91,000 in the forty-eight hours of October 30 and 31 from investment banks and private equity firms, two days before the vote. During the same time period, he took in $46,500 from self-described ‘investors’ and another $32,450 from bank holding companies. With the tolls paid, the votes took place on the full House floor. Both passed easily.”

CIA Director John Brennan:

In mid-December 2013, Judicial Watch obtained and released the full transcript of a May 7, 2012, teleconference between then-White House top counterterror adviser (now CIA Director) John Brennan and various TV terrorism consultants in which Brennen revealed that the U.S. and its allies had “inside control over any plot” in its efforts to thwart a May 2012 terrorism bomb plot, thus blowing the cover on undercover agents within al Qaeda.

The Brennan revelation of “inside control” – an intelligence community euphemism for spies within an enemy operation – reportedly helped lead to the disclosure of a previously well-kept secret at the heart of a joint U.S.-British-Saudi undercover terrorism operation inside Yemen-based al Qaeda in the Arabian Peninsula (AQAP). According to a Reuters May 18, 2012, report:

The next day’s headlines were filled with news of a U.S. spy planted inside Yemen-based Al Qaeda in the Arabian Peninsula (AQAP), who had acquired the latest, non-metallic model of the underwear bomb and handed it over to U.S. authorities.

At stake was an operation that could not have been more sensitive — the successful penetration by Western spies of AQAP, al Qaeda’s most creative and lethal affiliate. As a result of leaks, the undercover operation had to be shut down.

In the transcript obtained by Judicial Watch, Brennan led the teleconference where he addressed the top terror consultants for ABC, NBC, CNN, and CBS including Caitlin Hayden, Frances Townsend, Richard Clarke, Roger Cressey, and Juan Zarate. In an apparent attempt to soft-peddle the thwarted terrorist attack, Brennan twice exposed the covert operation; first at the outset of the call, then as the conference drew to a close: ….”

Comments »Crimea Votes Overwhelmingly to Join Russia, Moscow Will Annex Quickly

“Crimea greeted the overwhelming decision to join Russia with a festive atmosphere. Anton Troianovski reports the morning after the referendum on the difficult decisions that lie ahead for the Crimean, U.S., European and Russian governments. Photo: Getty Images

Russia gave its clearest signal yet Monday that it plans to move fast to annex Crimea, defying U.S. and European threats of sanctions a day after a referendum in the breakaway Ukrainian region to secede passed handily.

The Moscow-backed leadership of Crimea wasted no time in formally asking to join Russia following the hastily called referendum in which 97% of voters supported becoming part of Russia.

“We will take care of our part quickly, quickly and responsibly,” Sergei Naryshkin, speaker of the lower house of Russia’s parliament, told reporters in response to the Crimean parliamentary vote, according to local news agencies.

Mr. Naryshkin’s comments came shortly after officials announced that Russian PresidentVladimir Putin will address a joint session of parliament Tuesday on the issue.

The Kremlin didn’t immediately specify what Mr. Putin’s message would be, but the official ITAR-Tass news agency said the address would cover “accepting Crimea into the Russian Federation.”

European diplomats gathered in Brussels to finalize sanctions aimed at deterring Moscow from annexing Crimea, a move the U.S. and Europe argue is illegal and illegitimate. Diplomats said those sanctions are likely to be limited to a small number of Russian and Crimean officials, however….”

Comments »Are Chinese Defaults Just Starting to Wind Up ?

“A few days ago, copper prices and the Chinese stock market were roiled by speculation that another – the second in a row – Chinese bond default may be imminent, in the shape of Baoding Tianwei Baobian Electric (TBE) a maker of electrical equipment and solar panels, whose bonds and stock were suspended from trading a week ago after reporting massive losses. A few days later, TBE “promised” not to defaultwhen its next interest payment is due in July (although how the insolvent company can see that far into the future is just a little confusing). And yet the market shrugged and contrary to its recent idiotic euphoria to surge on even the tiniest of non-horrible news, barely saw a rise. Today we may know the reason: overnight Bloomberg reports that second Chinese corporate bond default may be imminent after the collapse and arrest of the largest shareholder of closely held Chinese real estate developer Zhejiang Xingrun Real Estate Co, which just happens to be saddled with 3.5 billion yuan ($566.6 million) of debt.

Debt which absent a bailout, which at this point is very improbable, will not be repaid.

From Bloomberg:

Zhejiang Xingrun Real Estate Co. doesn’t have enough cash to repay creditors that include more than 15 banks, with China Construction Bank Corp. (939) holding more than 1 billion yuan of its debt, according to the officials, who asked not to be named because they weren’t authorized to discuss the matter. The company’s majority shareholder and his son, its legal representative, have been detained and face charges of illegal fundraising, the officials said.

What is curious about this particular potential default is that it touches not only on the massive leverage in the Chinese system, but on the one real bubble in China (since nobody there seems to care about the Shanghai Composite): housing.

The collapse of the company, in the eastern town of Fenghua, adds to concern of strains in China’s real estate sector. The property market in smaller Chinese cities faces “true risks of a sharp correction” due to oversupply and investors may have underestimated the risk, Nomura Holdings Inc. economists said in a March 14 report.

Two calls to the chairman’s office and financial department at Zhejiang Xingrun weren’t answered today…..”

Comments »Empire Manufacturing Strikes Out Again, Outlook Dims

“Since July of last year, the Empire Fed manufacturing index has only beaten expectations once as March data once again fell below consensus (5.61 vs 6.5 est.) – hardly confirming the weakness is weather-driven. The underlying sub-indices were ugly with the most worrisome being the outlook – despite some optimism for capex, the general business conditions 6-months ahead fell by the most since Oct 2011 to its lowest since July 2013 – which once again suggest this weakness is anything but weather-driven…”

Comments »The Curiosity Rover Has a Pic For Your Consideration

[youtube://http://www.youtube.com/watch?v=xH5nprNjfFY#t=14 450 300]

Comments »The Boogey Man Obamao is Gonna Get You

Executive Order — Blocking Property of Certain Persons Contributing to the Situation in Ukraine

EXECUTIVE ORDER

– – – – – – –

BLOCKING PROPERTY OF CERTAIN PERSONS CONTRIBUTING TO THE SITUATION IN UKRAINE

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq.) (IEEPA), the National Emergencies Act (50 U.S.C. 1601 et seq.) (NEA), section 212(f) of the Immigration and Nationality Act of 1952 (8 U.S.C. 1182(f)), and section 301 of title 3, United States Code,

I, BARACK OBAMA, President of the United States of America, find that the actions and policies of persons — including persons who have asserted governmental authority in the Crimean region without the authorization of the Government of Ukraine — that undermine democratic processes and institutions in Ukraine; threaten its peace, security, stability, sovereignty, and territorial integrity; and contribute to the misappropriation of its assets, constitute an unusual and extraordinary threat to the national security and foreign policy of the United States, and I hereby declare a national emergency to deal with that threat. I hereby order:

Section 1. (a) All property and interests in property that are in the United States, that hereafter come within the United States, or that are or hereafter come within the possession or control of any United States person (including any foreign branch) of the following persons are blocked and may not be transferred, paid, exported, withdrawn, or otherwise dealt in: any person determined by the Secretary of the Treasury, in consultation with the Secretary of State:

(i) to be responsible for or complicit in, or to have engaged in, directly or indirectly, any of the following:

(A) actions or policies that undermine democratic processes or institutions in Ukraine;

(B) actions or policies that threaten the peace, security, stability, sovereignty, or territorial integrity of Ukraine; or …”

Comments »Documentary: The Superior Human

“Two things are infinite: the universe and human stupidity; and I’m not sure about the universe.”

~~~Albert Einstein

“Never underestimate the power of stupid people in large groups.”

~~~George Carlin

“Sometimes a man wants to be stupid if it lets him do a thing his cleverness forbids.”

~~~John Steinbeck

Cheers on your weekend!

[youtube://http://www.youtube.com/watch/?v=mqT82oGeax0 450 300] [youtube://http://www.youtube.com/watch?v=Lj3bCXViNNM 450 300]Comments »

Piano Man

Turning Gospel Into Myth

“An incredible discovery that was recently made in Russia threatens to shatter conventional theories about the history of the planet. On Mount Shoria in southern Siberia, researchers have found an absolutely massive wall of granite stones. Some of these gigantic granite stones are estimated to weigh more than 3,000 tons, and as you will see below, many of them were cut “with flat surfaces, right angles, and sharp corners”. Nothing of this magnitude has ever been discovered before. The largest stone found at the megalithic ruins at Baalbek, Lebanon is less than 1,500 tons. So how in the world did someone cut 3,000 ton granite stones with extreme precision, transport them up the side of a mountain and stack them 40 meters high? According to the commonly accepted version of history, it would be impossible for ancient humans with very limited technology to accomplish such a thing. Could it be possible that there is much more to the history of this planet than we are being taught?

For years, historians and archaeologists have absolutely marveled at the incredibly huge stones found at Baalbek. But some of these stones in Russia are reportedly more than twice the size. Needless to say, a lot of people are getting very excited about this discovery. The following comes from a Mysterious Universe article…

Alternate history buffs are about to be whipped into a frenzy! OK, maybe not, but they will find this interesting.

An ancient “super-megalithic” site has been found in the Siberian Mountains. Found recently in Gornaya Shoria (Mount Shoria) in southern Siberia, this site consists of huge blocks of stone, which appear to be granite, with flat surfaces, right angles, and sharp corners. The blocks appear to be stacked, almost in the manner of cyclopean masonry, and well…they’re enormous!

Russia is no stranger to ancient megalithic sites, like Arkaimor Russia’s Stonehenge, and the Manpupuner formation, just to name two, but the site at Shoria is unique in that, if it’s man-made, the blocks used are undoubtedly the largest ever worked by human hands.

When I say that this is a new discovery, I am not kidding. In fact, the very first expedition to study these stones happened just a few months ago. Prior to this expedition, there were no known photographs of these megalithic stones. Archaeologist John Jensen is mystified by these ancient ruins, and the following is an excerpt from a post on his personal blog…”

Comments »Evidence Shows Jackals in the Ukraine Were Hired by the Neo Nazis and The West Knew

State of the Union: Trapped Between a Rock and No Place To Go

“For years, many Americans followed a simple career path: Land an entry-level job. Accept a modest wage. Gain skills. Leave eventually for a better-paying job.

The workers benefited, and so did lower-wage retailers such as Wal-Mart: When its staffers left for better-paying jobs, they could spend more at its stores. And the U.S. economy gained, too, because more consumer spending fueled growth.

Not so much anymore. Since the Great Recession began in late 2007, that path has narrowed because many of the next-tier jobs no longer exist. That means more lower-wage workers have to stay put. The resulting bottleneck is helping widen a gap between the richest Americans and everyone else.

Editor’s Note: Get These 4 Stocks Before 399% Stock Market Rally!

“Some people took those jobs because they were the only ones available and haven’t been able to figure out how to move out of that,” Bill Simon, CEO of Wal-Mart U.S., acknowledged in an interview with The Associated Press.

If Wal-Mart employees “can go to another company and another job and make more money and develop, they’ll be better,” Simon explained. “It’ll be better for the economy. It’ll be better for us as a business, to be quite honest, because they’ll continue to advance in their economic life.”

Yet for now, the lower-wage jobs once seen as stepping stones are increasingly being held for longer periods by older, better-educated, more experienced workers.

The trend extends well beyond Wal-Mart, the nation’s largest employer, and is reverberating across the U.S. economy. It’s partly why average inflation-adjusted income has declined 9 percent for the bottom 40 percent of households since 2007, even as incomes for the top 5 percent now slightly exceed where they were when the recession began late that year, according to the Census Bureau.

Research shows that occupations that once helped elevate people from the minimum wage into the middle class have disappeared during the past three recessions dating to 1991.

One such category includes bookkeepers and executive secretaries, with average wages of $16.54 an hour, according to the Labor Department. Since the mid-1980s, the economy has shed these middle-income jobs — a trend that’s become more pronounced with the recoveries that have followed each subsequent recession, according to research by Henry Siu, an economist at the University of British Columbia, and Duke University economist Nir Jaimovich.

That leaves many workers remaining in jobs as cashiers earning an average of $9.79 an hour, or in retail sales at roughly $10.50 — jobs that used to be entry points to higher-paying work. Hourly pay at Wal-Mart averages $8.90, according to the site Glassdoor.com. (Wal-Mart disputes that figure; it says its pay for hourly workers averages $11.83.)

Since the Great Recession began, the share of U.S workers employed by the retail and restaurant sector has risen from 16.5 percent to 17.1 percent.

“It really has contributed to this widening of inequality,” Siu said…..”

Comments »Data Shows China’s Economy Is Slowing Rapidly

“BEIJING (Reuters) – China’s economy slowed markedly in the first two months of the year, with growth in investment, retail sales and factory output all falling to multi-year lows, a surprisingly weak performance that raises the specter of a sharper cooldown.

The weaker-than-expected data is bound to amplify global investors’ worries about slackening growth in the world’s second-largest economy, and will almost certainly feed speculation that Beijing may loosen policies soon to bolster growth.

China’s industrial output rose 8.6 percent in the first two months of 2014 from a year earlier, the National Bureau of Statistics said on Thursday, missing market expectations for a 9.5 percent rise.

That marked the worst performance for China’s factory output growth since April 2009.

“Policy easing should be imminent,” said Hao Zhou, an economist at ANZ Bank in Shanghai, adding that Thursday’s data implied that China’s economy may grow 7 percent in the first quarter.

Sources told Reuters earlier this week that China’s central bank is prepared to take its strongest action since 2012 to loosen monetary policy if economic growth slows further, by cutting the amount of cash that banks must keep as reserves.

A cut would be triggered if growth slips below 7.5 percent and towards 7.0 percent, and would be expected only in the second quarter, according to the sources who are involved in internal policy discussions.

Other sectors of the economy also appeared to have lost steam…..”

Marc Faber says 4% growth is ok for China

Comments »#10

What If Everything You Were Ever Taught Was A Lie?

“There is a war going on right now and it doesn’t involve guns or the military industrial complex.

It’s a war on consciousness and most people are clueless that it even exists.

EDUCATION OR INDOCTRINATION?

Ultimately, the education system can be blamed for feeding us propaganda and forcing us to regurgitate it so we can “fit in” with the rest of society. Our public school systems are set up to get the students primed foreconomic slavery without ever offering courses that allow to students to think creatively or freely.

If you trace the company’s who print our children’s textbooks, you’ll find a Zionist agenda behind them all. For example, George W. Bush’s grandfather, Prescott Bush, was arrested for funding both sides of World War II, yet we never learned this in school. Why? Because had we learned this, NEITHER Bush would have been elected president for having a traitor in their lineage.

And surely, Christopher Columbus didn’t “discover” America.

Granted some things that we learn in school are the truth, such as math, music and some science but our TRUE history has been kept from us for reasons of subservience, control and conformity.

In all forms of education, there are still perpetual references to “fossil fuels” including at the college level. How ridiculous is this? Oil is abiotic, which means it replenishes itself, yet we are draining the planet of a lubricant that serves no other interests other than economic.

For example, in the late 1980′s, Stanley Meyer invented a car that could go from coast to coast in the United States on 21 gallons of water. He was offered $1 billion from the automobile industry for his invention but turned it down because he wanted this idea to go to the people. Shortly afterwards, he was poisoned to death and the invention has been hidden from us ever since, yet our children are not learning about inventors such as Meyer in school, nor are they being encouraged to develop alternate fuel sources.

[youtube://http://www.youtube.com/watch?v=GFIlXaABU54 450 300]Our children are inevitably asked, “What do you want to be when you grow up?” Their answers becomeconditioned responses in various forms of economic subservience instead of what they truly would like to do.

A better question to ask them, once they understand the concept of money is, “If there was no such thing as money, then what would you like to do with your life?”

Surely, the fry cook with a high school education would not still be making french fries at a fast food “restaurant”…..”

Surely, the fry cook with a high school education would not still be making french fries at a fast food “restaurant”…..”

U.S. Will Violate its Own Law if We Supply Aid to the Ukraine

“Washington’s decision to provide financial aid to the coup-appointed government of Ukraine goes against the US laws, Russia’s Foreign Ministry said, urging American politicians to think about the consequences of supporting the radicals in Kiev.

Ukraine’s ousted president, Viktor Yanukovich, said on Tuesday that the US plans to loan $1 billion to the country’s new authorities are illegal.

“Indeed, in accordance with the amendments introduced to the 1961 law (Foreign Assistance Act) a few years ago the provision of foreign assistance is prohibited to ‘the government of any country whose duly elected head of government is deposed by military coup or decree.’ The relevant provision is contained in22 US Code § 8422,” the Russian Foreign Ministry said in a statement.

“Thus, by all criteria the provision of funds to the illegitimate [Kiev] regime, which seized power by force, is unlawful and goes beyond the boundaries of the US legal system,” the statement added.

However, the ministry said it realizes that the American side “would hardly recognize this obvious fact” due to the stance it has already taken in the Ukrainian crisis.

“The US administration will most probably continue to close its eyes on the dominance of the ultranationalist forces in Kiev, which have launched a hunt for dissidents across the country, increasing pressure on the Russian-speaking population and our compatriots, threatening the people in the Crimea with punishment for their desire for self-determination,” the ministry stressed……”

Comments »Secret Documents Reveal How the NSA Plans to Infect Millions of Computers With Malware

“Top-secret documents reveal that the National Security Agency is dramatically expanding its ability to covertly hack into computers on a mass scale by using automated systems that reduce the level of human oversight in the process.

The classified files – provided previously by NSA whistleblower Edward Snowden – contain new details about groundbreaking surveillance technology the agency has developed to infect potentially millions of computers worldwide with malware “implants.” The clandestine initiative enables the NSA to break into targeted computers and to siphon out data from foreign Internet and phone networks.

The covert infrastructure that supports the hacking efforts operates from the agency’s headquarters in Fort Meade, Maryland, and from eavesdropping bases in the United Kingdom and Japan. GCHQ, the British intelligence agency, appears to have played an integral role in helping to develop the implants tactic.

In some cases the NSA has masqueraded as a fake Facebook server, using the social media site as a launching pad to infect a target’s computer and exfiltrate files from a hard drive. In others, it has sent out spam emails laced with the malware, which can be tailored to covertly record audio from a computer’s microphone and take snapshots with its webcam. The hacking systems have also enabled the NSA to launch cyberattacks by corrupting and disrupting file downloads or denying access to websites.

The implants being deployed were once reserved for a few hundred hard-to-reach targets, whose communications could not be monitored through traditional wiretaps. But the documents analyzed by The Intercept show how the NSA has aggressively accelerated its hacking initiatives in the past decade by computerizing some processes previously handled by humans. The automated system – codenamed TURBINE – is designed to “allow the current implant network to scale to large size (millions of implants) by creating a system that does automated control implants by groups instead of individually.”

In a top-secret presentation, dated August 2009, the NSA describes a pre-programmed part of the covert infrastructure called the “Expert System,” which is designed to operate “like the brain.” The system manages the applications and functions of the implants and “decides” what tools they need to best extract data from infected machines…..”

Comments »