[youtube://http://www.youtube.com/watch?v=o3Wa3ImxjZo 450 300]

Comments »Monthly Archives: March 2014

The Rule of Law and the Mafia

[youtube://http://www.youtube.com/watch?v=hqjYEFIwUT8#t=50 450 300]

Comments »Comedy Files: Support a Reintroduction of Obamao’s Gun Control Bill

[youtube://http://www.youtube.com/http://www.activistpost.com/ 450 300]

Comments »Is the Collapse of Small Lenders Collateral Damage or a Mathematical Equation ?

“Under the Federal Reserve Act, panics are scientifically created. The present panic is the first scientific one, worked out as we figure a mathematical equation.” ~ Charles Lindbergh

___________________________________________________________________________________________________________________________

“Georgia homebuilder Blankenship Homes lost its source of loans for new construction after four local community banks failed since 2009.

“The economy just shut down,” said owner Johnny Blankenship, 54, a builder for more than 30 years in Douglasville, 20 miles west of Atlanta. “We are just starting back to do a few homes. The economy is still very, very slow.”

While the Federal Reserve and U.S. Treasury rescued major banks amid the 2008 financial crisis to avert a meltdown of the nation’s financial system, the bailouts didn’t prevent the collapse of about 500 small lenders. Their disappearance, part of a syndrome of economic weakness, still weighs on growth and employment in dozens of counties across the U.S.

“It will be difficult to fill the void left by failing small banks,” said Mark Zandi, chief economist at Moody’s Analytics Inc. in West Chester, Pennsylvania. “Small bank failures matter a lot to the communities in which they operate, especially in non-urban areas. Small banks are key to small businesses.”

Alert: Stocks to Drop 90%? These 5 Charts Reveal Why…

Counties that experienced bank failures from 2008 to 2010 saw income growth reduced as much as 1.43 percent, job growth cut as much as 0.5 percentage point and poverty rise as much as 1.4 percent in the following year, Fed economist John Kandrac reported in research presented last October at a community banking conference at the Federal Reserve Bank of St. Louis.

He concluded bank failures had “measurable effects” on economic performance. On average, that meant a drop of as much as $700 in per capita income and a loss of close to 600 jobs in the first year after a failure, Kandrac’s research found.

Small Businesses

The demise of local lenders has inflicted a disproportionate blow on small enterprises, said Mark Gertler, an economist at New York University and co-author of research with former Fed Chairman Ben S. Bernanke on how bank failures contributed to the severity of the Great Depression. Community banks provide almost half of small loans, those under $1 million, to farms and businesses, according to a 2012 Federal Deposit Insurance Corp. report.

Bank failures have been more common in four states that experienced real estate booms and busts or had large concentrations of community lenders. Georgia has had the most failures with 88 since September 2007, followed by Florida’s 70, Illinois’s 56 and California’s 39, according to Trepp LLC, a real estate and financial data provider in New York….”

Comments »El-Erian on Yellen Fed Speak

“On the surface, you would have thought that the stock market would have liked the outcome of the Federal Reserve meeting; and you would have expected that front-end interest rates would have been relatively well anchored. Instead, equities sold off while the yield curve flattened as a result of a selloff in shorter maturities.

Why?

In attempting to answer this question, let us start with a quick summary of what the Federal Open Market Committee decided at the end of its two-day meeting:

* As expected, our central bankers continued to taper their experimental purchases of securities, reducing the pace of monthly purchases by another $10 billion. They remain on track to exit quantitative easing fully by the end of the year.

(Read more: Fed tapers, backs away from unemployment target)

* To compensate, they strengthened their forward policy guidance in two ways: by replacing the increasingly outmoded and partial 6.5-percent unemployment threshold with a more holistic approach to the labor market; and by making explicit an inflation indicator that is above the current rate.

* They reiterated their intention to keep policy rates floored for quite a while, even after inflation and unemployment are near their “mandated levels.” During her press conference, Janet Yellen stated that the FOMC could keep interest rates lower than “normal values” and that the glide path would be shallower.

(Read more: What’s new in the latest Fed statement)

By any measure, this is quite a dovish outcome — overall and relative to expectations. Unambiguously it signals a Fed that remains dedicated to support the economy, and to do so by continuing to use the asset market channel.

So why didn’t markets like it? I would suggest three inter-related possibilities:

Higher uncertainty premiums: The Fed is in the midst of not one but two policy transitions. It is pivoting from reliance on a direct instrument (QE purchases of securities in the marketplace) to an indirect one (forward policy guidance to convince others to devote their balance sheets) — thereby raising effectiveness questions. It is also moving from a readily-observable unemployment threshold to a set of indicators that include qualitative judgments — thereby raising less predictable interpretation questions….”

The Gradual Erosion of Civil Liberties, Legal Rights and Government Ethics are Connected

“Rather than deal forthrightly with the reality that unrealistic promises made to their employees cannot be honored, local government has pursued a strategy of legalizing looting.

The gradual erosion of civil liberties, legal rights and government ethics are connected: our rights don’t just vanish into thin air, they are expropriated by government: Federal, state and local. Though much is written about the loss of civil liberties at the Federal level, many of the most blatantly illegal power grabs are occurring in local government.

This expropriation is under the radar of the average citizen because the process slowly chips away the fundamentals of legality and justice: bit by bit, due process and the rights of the individual have been eroded by state and local governments until the fundamental Constitutional protections simply cease to exist.

When local government looting is legalized, the entire system is illegal. Here are three recent examples of blatantly illegal looting by local governments.

First up: privatizing the collection of traffic fines and probation to create a modernized debtor’s prison. We turn to The Nation for the story:

The Town That Turned Poverty Into a Prison Sentence Most states shut down their debtors’ prisons more than 100 years ago; in 2005, Harpersville, Alabama, opened one back up.

What happened to Ford in the small town of Harpersville was tangled and unconstitutional– but hardly unique. Similar tales have been playing out in more than 1,000 courts across the country, from Georgia to Idaho. In the face of strained budgets and cuts to public services, state and local governments have been stepping up their efforts to ensure that the criminal justice system pays for itself. They have increased fines and court costs, intensified law enforcement efforts, and passed so-called “pay-to-stay” laws that charge offenders daily jail fees. They have also begun contracting with “offender-funded” probation companies like JCS, which offer a particularly attractive solution—collection, at no cost to the court.Harpersville’s experiment with private probation began nearly ten years ago. In Alabama, people know Harpersville best as a speed trap, the stretch of country highway where the speed limit changes six times in roughly as many miles. Indeed, traffic is by far the biggest business in the town of 1,600, where there is little more than Big Man’s BBQ, the Sudden Impact Collision Center and a dollar store.

In 2005, the court’s revenue was nearly three times the amount that the town received from a sales tax, Harpersville’s second-largest source of income. Fines had become key to Harpersville’s development, but it proved difficult to chase down those who did not pay. So, that year, Harpersville decided to follow in the footsteps of other Alabama cities and hire JCS to help collect.

It was a system of extraction and coercion so flagrant that Alabama Circuit Court Judge Hub Harrington likened it to a modern-day “debtors’ prison.”

Her fines for the three charges added up to $2,922, court papers show. Ward sentenced her–and others who said they couldn’t pay their full fines that day– to probation. Once a means of allowing convicted offenders to stay out of jail on the condition of good behavior, probation had now become a court-sanctioned tool for debt collection.

Burdette reported to the JCS office in nearby Childersburg, where she paid her probation officer $100. Of that, $45 went toward her fine, $10 toward a one-time “start-up fee,” and the last $45 went to JCS as a monthly fee for service.

Next up: illegal search and seizure under the pretext of traffic violations. As if “driving while black” isn’t bad enough, now “driving with cash” is pretext enough to be stripped of your rights and your property stolen by local government:

Lawsuits over cash seizures settled in Nevada

Tan Nguyen of Newport, Calif., and Michael Lee of Denver said in lawsuits filed in U.S. District Court in Reno they were stopped last year on U.S. Interstate 80 near Winnemucca about 165 miles east of Reno under the pretext of speeding. They said they were subjected to illegal searches and told they wouldn’t be released with their vehicles unless they forfeited their cash.The lawsuits claimed the cash seizures were part of a pattern of stopping drivers for speeding as a pretext for drug busts in violation of the Constitution.

Nguyen was given a written warning for speeding but wasn’t cited. As a condition of release, he signed a “property for safekeeping receipt,” which indicated the money was abandoned or seized and not returnable. But the lawsuit says he did so only because Dove threatened to seize his vehicle unless he “got in his car and drove off and forgot this ever happened.”

“He wasn’t charged with anything. He had no drugs in his car. The pretext for stopping him was he was doing 78 in a 75,” John Ohlson told KRNV-TV. “It’s like Jesse James or Black Bart,” he told AP in an interview last week.

The district attorney’s statement said both men were stopped legally and that “every asset that was seized pursuant to those stops was lawfully seized.”

Exhibit # 3: guilty until proven innocent: State of California seizes cash from “suspected” tax evaders with no evidence, no court action, no recourse. I have documented in detail how the jackboot of the State of California has pressed on the necks of thousands of law-abiding citizens whose only crime was moving out of California.

The State of California presumes anyone moving out of the state who still has a source of income in California–for example, a few dollars of interest earned on a bank account–owes California income tax on all their presumed income, even if they have filed income tax returns in another state.

If this isn’t the acme of illegal seizure and denial of basic rights, i.e. presumed innocent until proven guilty, then what is?…..”

Comments »Markets Do Not Trust Yellen as Rates Rise

“Janet Yellen said the Federal Reservewasn’t altering policy when it overhauled the way it signals changes in borrowing costs. Investors didn’t buy it.

In her first press conference as Fed chair, Yellen emphasized that dropping a 6.5 percent unemployment threshold for considering an interest-rate increase “does not indicate any change in the committee’s policy intentions.”

Rather than paying heed to Yellen’s assertion, investors seized on an increase in Fed officials’ own interest-rate forecasts and Yellen’s comment that that borrowing costs could start rising “around six months” after it stops buying bonds. Yields on two-year Treasury notes climbed as much as 10 basis points, the most since June 2011.

The market reaction highlights the perils faced by central bankers when they retreat to language investors consider vague after setting precise numerical markers for changes in policy. Lacking specific guidance in the Fed’s policy statement, investors swung toward the next best thing: Fed officials’ own forecasts for the benchmark federal funds rate.

“With the shift to qualitative guidance, the only quantitative metric we have is the fed funds projections from the Fed,” said Dean Maki, chief U.S. economist for Barclays Plc in New York and formerly an economist at the central bank. “So while the statement and Chair Yellen in the press conference said little had changed, the Fed’s projections suggested that there was a notable change in the Fed’s outlook.”

Broad Range

The Federal Open Market Committee said it will no longer link borrowing costs to a specific unemployment rate, saying it would instead consider a broad range of indicators on the labor market, inflation and financial markets.

“We know we’re not close to full employment, not close to an employment level consistent with our mandate, and unless inflation were a significant concern, we wouldn’t dream of raising the federal funds rate-target,” Yellen said at the press conference in Washington…..”

Comments »A Word From John Whitehead on A Government of Wolves

[youtube://http://www.youtube.com/watch?v=bMaH6ecDxsQ 450 300]

Comments »Fiscal Times: US War on Mortgage Fraud Is a Sham

“The Justice Department’s much ballyhooed battle against mortgage fraud in the years following the 2008 housing meltdown was mostly a sham, with gross exaggerations about its success from top government officials including Attorney General Eric Holder, according to The Fiscal Times.

The department’s own Office of the Inspector General (OIG), an internal agency watchdog, studied the results of the government’s mortgage industry investigations in the wake of the economic disaster that still haunts many Americans.

What the OIG found was that the Justice Department did not assign the high priority to mortgage fraud that was commonly believed, the Times said. To the contrary, the Justice Department’s FBI “ranked mortgage fraud as the lowest ranked criminal threat in its lowest crime category,” according to the OIG.

Editor’s Note: 250% Gains Bagged Using Secret Calendar (See Video)

In fact, through the FBI received $196 million to battle mortgage fraud from 2009 through 2011, the agency actually reduced the number of agents assigned to the matter and the number of pending investigations.

The Fiscal Times reported that “perhaps the most damning finding to emerge” from an OIG audit came at a 2012 news conference in which Holder maintained that 530 people had been charged with mortgage fraud the previous year, including 172 executives, and that 110 civil cases had been launched – a major undertaking involving $1 billion in losses and 73,000 “homeowner victims.

But after months of prodding from the OIG, the Justice Department admitted that only 107 people had been charged with mortgage fraud, and the losses added up to just $95 million…..”

Comments »Putin Announces Procedures to Annex Crimea

“(Reuters) – Russian President Vladimir Putin, defying Ukrainian protests and Western sanctions, told parliament on Tuesday that Russia will move forward with procedures to annex Ukraine’s Crimean region.

Putin signed an order “to approve the draft treaty between the Russian Federation and the Republic of Crimea on adopting the Republic of Crimea into the Russian Federation”. The order indicated the president would sign the treaty with Crimea’s Russian-installed leader, who is in Moscow to request incorporation into Russia, but it gave no date.

The move followed a disputed referendum in Crimea on Sunday, staged under Russian military occupation, in which a Soviet-style 97 percent of voters were declared to have voted to return to Russian rule, after 60 years as part of Ukraine.

By pressing ahead with steps to dismember Ukraine against its will, Putin raised the stakes in the most serious East-West crisis since the end of the Cold War.

But Ukraine’s interim prime minister, Arseniy Yatseniuk, sought to reassure Moscow on two key areas of concern, saying in a televised address delivered in Russian that Kiev was not seeking to join NATO, the U.S.-led military alliance, and would act to disarm Ukrainian nationalist militias.

On Monday, the United States and the European Union imposed personal sanctions on a handful of officials from Russia and Ukraine accused of involvement in Moscow’s military seizure of the Black Sea peninsula, most of whose 2 million residents are ethnic Russians.

Russian politicians dismissed the sanctions as insignificant and a badge of honor. The State Duma, or lower house, adopted a statement urging Washington and Brussels to extend the visa ban and asset freeze to all its members.

Leonid Slutsky, one of the lawmakers on the sanctions list, hailed Crimea’s decision as historic. “Today we see justice and truth reborn,” he said.

Japan joined the mild Western sanctions on Tuesday, announcing the suspension of talks with Russia on investment promotion and visa liberalization.

Putin was to address a special joint session of the Russian parliament on the Crimea issue on Tuesday…..”

Comments »The Key to Progress

A Quick History Lesson on Banking

[youtube://http://www.youtube.com/watch?v=VQ0-3fQIB2g#t=118 450 300]

Comments »A Homage to CNBC

“We get experts on everything that sound like they’re scientific experts … They’ll sit at a typewriter and make up all this stuff as if it’s science and then become an expert … Now, I might be quite wrong, maybe they do know all these things. But I don’t think I’m wrong. You see I have the advantage of having found out how hard it is to get to really know something … how easy it is to make mistakes and fool yourself. I know what it means to know something. And therefore, I see how they get their information and I can’t believe that they know it. They haven’t done the work necessary. They haven’t done the checks necessary. They haven’t done the care necessary … and they’re intimidating people. -Richard Feynman, Nobel Prize-winning physicist.

The excerpt is from a 1981 BBC documentary about Richard Feynman that was linked in a Zero Hedge post several years ago. Unfortunately, Feynman passed away in 1988 and never had the chance to watch the “experts” on financial television. We would have particularly liked to hear the great physicist’s thoughts on economics punditry.

To understand economics experts in Feynman’s absence, the best analogy that we can think of is to the methods of a magician. Magicians operate by showing their audience a small window on reality, and then tricking people into mentally filling in the rest incorrectly. Because the economy has so many moving parts, a similar approach also works in economics. Pundits can draw our attention to a couple of indicators, ignore everything else, and make claims that sound realistic even though they make little sense in the bigger picture. One difference between economists and magicians, though, is that economists are often unaware of their trickery because they fool themselves before fooling others.

To be clear, we don’t claim to be immune to such deceptions, but we do try to root them out as best we can and will do that here.

We’ll look at capital expenditures (capex), in particular. You can’t take in much media commentary today before finding someone arguing that capex is lower than it should be. Crystal ball gazers predict a capex resurgence that lifts the economy into a robust recovery, while pundits with an activist bentimplore businesses (and public officials) to ramp up their investments.

There’s usually some combination of four pieces to what we’ll call the “CNBC” story:

- Corporate cash is high

- Net investment is low

- Bond yields are low

- Corporate profits are high

These four observations are said to demonstrate that businesses are behaving irrationally or improperly by not pushing capex higher. And the story may sound reasonable on the surface, but is it really that simple?

To dig deeper, we’ll critique the proposition linked to each observation, while testing them with over 60 years of data. Our results show that the CNBC story is yet another careless economic illusion.

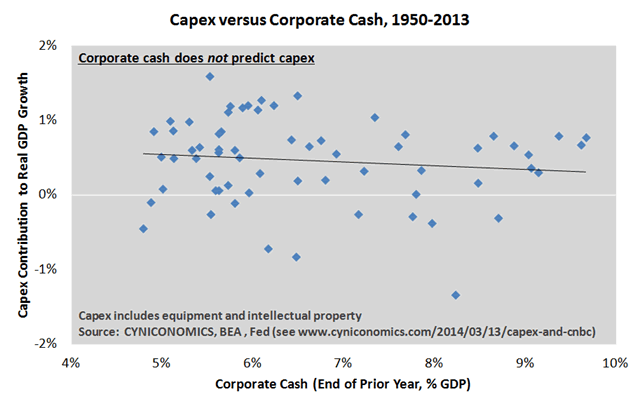

Proposition 1: Corporate cash is high, and therefore, businesses should put that cash to work through capex.

Comments: This is the most obviously deceptive of the four propositions, hence Mark Spitznagel’s incredulous response when asked to address cash balances by Maria Bartiromo last week. As Spitznagel explained, it makes little sense to isolate the cash that sits on corporate balance sheets without netting the credit portions of both assets and liabilities. We last updated corporations’ net credit position here, showing that gradual increases in cash balances are dwarfed by rising debt.

A longer history further disproves the proposition; it shows that there’s no correlation between capex and corporate cash:

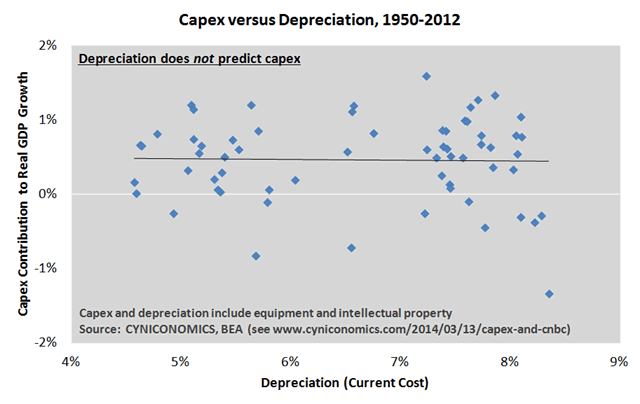

Proposition 2: Net investment (capex less depreciation) is unusually low and should be much higher at this point in the business cycle.

Comments: This argument implies that businesses should invest more when depreciation is higher, as that’s the only way to drive the net amount of investment towards “normal” levels. Our criticism is that it combines current capex with an accounting measure of depreciation on past capex. This is extremely misleading after periods of malinvestment, in particular, when the capital stock is too high for the level of demand. Unusually high depreciation after such periods is a sign that capex should be managed carefully to keep the capital stock from further outpacing fundamentals, not increased blindly to maintain an assumed margin over depreciation. Therefore, net investment fails to tell us anything about the “right” amount of capex.

Turning again to the last six decades, data confirms that the second proposition is just as faulty as the first:

Proposition 3: Low interest rates should encourage more capex.

Comments: This is a trickier proposition than the first two, since low rates should certainly spur higher spending when other factors are held constant. The problem is that other factors are never constant. On the contrary, low rates are typically associated with a challenging economy, and this is especially true in today’s highly manipulated markets. The Fed seems to be discouraging long-term investment in some respects by holding rates well below where they would otherwise be. As perceived by us and many others (including Spitznagel per the interview linked above), the Fed’s approach raises long-term risks while drawing capital into short-term financial strategies.

Needless to say, this isn’t the ideal environment for capex. It’s not that companies aren’t taking advantage of low rates; they’ve increased borrowing substantially as noted above. It’s just that the proceeds of that borrowing aren’t flowing into capex as much as they would in less manipulated markets.

Moreover, history once again refutes the proposition. Adjusting corporate bond yields for inflation, the chart below shows that capex has tended to be slightly lower than average when real yields are low….”

Comments »Record Bid Hitting Taking Place in U.S. Paper, Russia Suspected

“A drop in U.S. government securities held in custody at the Federal Reserve by the most on record is fueling speculation that Russia may have shifted its holdings out of the U.S. as Western nations threaten sanctions.

Treasurys held in custody at the Fed by foreign central banks dropped by $104 billion to $2.86 trillion in the week ending March 12, according to Fed data, as the turmoil in Ukraine intensified. As of December, Russia held $138.6 billion of Treasurys, making it the ninth largest country holder. Russia’s holdings are about 1 percent of the $12.3 trillion in marketable Treasurys outstanding, according to data compiled by Bloomberg.

“The timing of the drop in custody holdings makes Russia a more likely suspect,” said Marc Chandler, global head of currency strategy at Brown Brothers Harriman in a telephone interview. “If Russia did it, then they may have transferred the holdings to another bank outside of the U.S.”…..”

Comments »The Top Ten Most Wanted Corrupt Politicians From Judicial Watch

“(Washington, DC) – Judicial Watch today released its 2013 list of Washington’s “Ten Most Wanted Corrupt Politicians.” The list, in alphabetical order, includes:

- Speaker of the House John Boehner (R-OH)

- CIA Director John Brennan

- Senator Saxby Chambliss

- Former Secretary of State Hillary Clinton

- Attorney General Eric Holder

- Former IRS Commissioner Steven T. Miller / Former IRS Official Lois Lerner

- Former DHS Secretary Janet Napolitano

- President Barack Obama

- Senator Harry Reid (D-NV)

- Health Secretary Kathleen Sebelius

Dishonorable Mentions for 2013 include:

- Former New York Mayor Michael Bloomberg

- Outgoing Virginia Gov. Bob McDonnell (R) / Incoming Virginia Gov. Terry McAuliffe (D)

- Former Rep. Rick Renzi (R-AZ)

- National Security Adviser Susan Rice

Speaker of the House John Boehner (R-OH):

House Speaker John Boehner has apparently become a master at what Government Accountability Institute President Peter Schweizer calls the “Tollbooth Strategy.” As Schweizer explains in his new book, Extortion: How Politicians Extract Your Money, Buy Votes, and Line Their Own Pockets: “You pay money at a tollbooth in order to use a road or bridge. The methodology in Washington is similar: if someone wants a bill passed, charge them money to allow the bill to move down the legislative highway.” According to Schweizer, Boehner apparently used the Tollbooth Strategy to collect more than $200,000 in political donations from executives just days before holding votes on bills critically important to their industries.

The first bill was the Wireless Tax Fairness Act. Strongly supported by big phone companies like AT&T and Verizon, it sailed through the House Judiciary Committee, and was expected to immediately come to the floor for a full House vote. Instead of scheduling the bill for a vote, however, Boehner allowed it to languish on the calendar for the next three months. What finally prompted Boehner to bring the bill to a vote? As Schweizer explains it: “The day before the vote, Boehner’s campaign collected the toll: thirty-three checks from wireless industry executives, totaling almost $40,000.”

According to Schweizer, two more bills on which Boehner employed the Tollbooth Strategy were the Access to Capital for Job Creators Act and the Small Company Capital Formation Act. Brokers and venture capitalists and investment firms strongly supported the proposed law. Explains Schweizer in Extortion: “The Speaker of the House took in $91,000 in the forty-eight hours of October 30 and 31 from investment banks and private equity firms, two days before the vote. During the same time period, he took in $46,500 from self-described ‘investors’ and another $32,450 from bank holding companies. With the tolls paid, the votes took place on the full House floor. Both passed easily.”

CIA Director John Brennan:

In mid-December 2013, Judicial Watch obtained and released the full transcript of a May 7, 2012, teleconference between then-White House top counterterror adviser (now CIA Director) John Brennan and various TV terrorism consultants in which Brennen revealed that the U.S. and its allies had “inside control over any plot” in its efforts to thwart a May 2012 terrorism bomb plot, thus blowing the cover on undercover agents within al Qaeda.

The Brennan revelation of “inside control” – an intelligence community euphemism for spies within an enemy operation – reportedly helped lead to the disclosure of a previously well-kept secret at the heart of a joint U.S.-British-Saudi undercover terrorism operation inside Yemen-based al Qaeda in the Arabian Peninsula (AQAP). According to a Reuters May 18, 2012, report:

The next day’s headlines were filled with news of a U.S. spy planted inside Yemen-based Al Qaeda in the Arabian Peninsula (AQAP), who had acquired the latest, non-metallic model of the underwear bomb and handed it over to U.S. authorities.

At stake was an operation that could not have been more sensitive — the successful penetration by Western spies of AQAP, al Qaeda’s most creative and lethal affiliate. As a result of leaks, the undercover operation had to be shut down.

In the transcript obtained by Judicial Watch, Brennan led the teleconference where he addressed the top terror consultants for ABC, NBC, CNN, and CBS including Caitlin Hayden, Frances Townsend, Richard Clarke, Roger Cressey, and Juan Zarate. In an apparent attempt to soft-peddle the thwarted terrorist attack, Brennan twice exposed the covert operation; first at the outset of the call, then as the conference drew to a close: ….”

Comments »Crimea Votes Overwhelmingly to Join Russia, Moscow Will Annex Quickly

“Crimea greeted the overwhelming decision to join Russia with a festive atmosphere. Anton Troianovski reports the morning after the referendum on the difficult decisions that lie ahead for the Crimean, U.S., European and Russian governments. Photo: Getty Images

Russia gave its clearest signal yet Monday that it plans to move fast to annex Crimea, defying U.S. and European threats of sanctions a day after a referendum in the breakaway Ukrainian region to secede passed handily.

The Moscow-backed leadership of Crimea wasted no time in formally asking to join Russia following the hastily called referendum in which 97% of voters supported becoming part of Russia.

“We will take care of our part quickly, quickly and responsibly,” Sergei Naryshkin, speaker of the lower house of Russia’s parliament, told reporters in response to the Crimean parliamentary vote, according to local news agencies.

Mr. Naryshkin’s comments came shortly after officials announced that Russian PresidentVladimir Putin will address a joint session of parliament Tuesday on the issue.

The Kremlin didn’t immediately specify what Mr. Putin’s message would be, but the official ITAR-Tass news agency said the address would cover “accepting Crimea into the Russian Federation.”

European diplomats gathered in Brussels to finalize sanctions aimed at deterring Moscow from annexing Crimea, a move the U.S. and Europe argue is illegal and illegitimate. Diplomats said those sanctions are likely to be limited to a small number of Russian and Crimean officials, however….”

Comments »Are Chinese Defaults Just Starting to Wind Up ?

“A few days ago, copper prices and the Chinese stock market were roiled by speculation that another – the second in a row – Chinese bond default may be imminent, in the shape of Baoding Tianwei Baobian Electric (TBE) a maker of electrical equipment and solar panels, whose bonds and stock were suspended from trading a week ago after reporting massive losses. A few days later, TBE “promised” not to defaultwhen its next interest payment is due in July (although how the insolvent company can see that far into the future is just a little confusing). And yet the market shrugged and contrary to its recent idiotic euphoria to surge on even the tiniest of non-horrible news, barely saw a rise. Today we may know the reason: overnight Bloomberg reports that second Chinese corporate bond default may be imminent after the collapse and arrest of the largest shareholder of closely held Chinese real estate developer Zhejiang Xingrun Real Estate Co, which just happens to be saddled with 3.5 billion yuan ($566.6 million) of debt.

Debt which absent a bailout, which at this point is very improbable, will not be repaid.

From Bloomberg:

Zhejiang Xingrun Real Estate Co. doesn’t have enough cash to repay creditors that include more than 15 banks, with China Construction Bank Corp. (939) holding more than 1 billion yuan of its debt, according to the officials, who asked not to be named because they weren’t authorized to discuss the matter. The company’s majority shareholder and his son, its legal representative, have been detained and face charges of illegal fundraising, the officials said.

What is curious about this particular potential default is that it touches not only on the massive leverage in the Chinese system, but on the one real bubble in China (since nobody there seems to care about the Shanghai Composite): housing.

The collapse of the company, in the eastern town of Fenghua, adds to concern of strains in China’s real estate sector. The property market in smaller Chinese cities faces “true risks of a sharp correction” due to oversupply and investors may have underestimated the risk, Nomura Holdings Inc. economists said in a March 14 report.

Two calls to the chairman’s office and financial department at Zhejiang Xingrun weren’t answered today…..”

Comments »Empire Manufacturing Strikes Out Again, Outlook Dims

“Since July of last year, the Empire Fed manufacturing index has only beaten expectations once as March data once again fell below consensus (5.61 vs 6.5 est.) – hardly confirming the weakness is weather-driven. The underlying sub-indices were ugly with the most worrisome being the outlook – despite some optimism for capex, the general business conditions 6-months ahead fell by the most since Oct 2011 to its lowest since July 2013 – which once again suggest this weakness is anything but weather-driven…”

Comments »The Curiosity Rover Has a Pic For Your Consideration

[youtube://http://www.youtube.com/watch?v=xH5nprNjfFY#t=14 450 300]

Comments »The Boogey Man Obamao is Gonna Get You

Executive Order — Blocking Property of Certain Persons Contributing to the Situation in Ukraine

EXECUTIVE ORDER

– – – – – – –

BLOCKING PROPERTY OF CERTAIN PERSONS CONTRIBUTING TO THE SITUATION IN UKRAINE

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq.) (IEEPA), the National Emergencies Act (50 U.S.C. 1601 et seq.) (NEA), section 212(f) of the Immigration and Nationality Act of 1952 (8 U.S.C. 1182(f)), and section 301 of title 3, United States Code,

I, BARACK OBAMA, President of the United States of America, find that the actions and policies of persons — including persons who have asserted governmental authority in the Crimean region without the authorization of the Government of Ukraine — that undermine democratic processes and institutions in Ukraine; threaten its peace, security, stability, sovereignty, and territorial integrity; and contribute to the misappropriation of its assets, constitute an unusual and extraordinary threat to the national security and foreign policy of the United States, and I hereby declare a national emergency to deal with that threat. I hereby order:

Section 1. (a) All property and interests in property that are in the United States, that hereafter come within the United States, or that are or hereafter come within the possession or control of any United States person (including any foreign branch) of the following persons are blocked and may not be transferred, paid, exported, withdrawn, or otherwise dealt in: any person determined by the Secretary of the Treasury, in consultation with the Secretary of State:

(i) to be responsible for or complicit in, or to have engaged in, directly or indirectly, any of the following:

(A) actions or policies that undermine democratic processes or institutions in Ukraine;

(B) actions or policies that threaten the peace, security, stability, sovereignty, or territorial integrity of Ukraine; or …”

Comments »