[youtube://http://www.youtube.com/watch?v=aOL1mJjKngw#t=96 450 300]

Comments »Yearly Archives: 2013

China Calls for a “De-Americanized World”

“The looming prospect of a US default on debt prompted China to call for the world to “de-Americanise”, amid warnings of a new global recession.

In China, Xinhua, the official government news agency, said that as American politicians continued to flounder over a deal to break the impasse, “it is perhaps a good time for the befuddled world to start considering building a de-Americanised world”.

The jibe came as Christine Lagarde, the International Monetary Fund chief, raised the spectre of a repeat of the 2008 financial crash as hopes dwindled for a resolution of the crisis over the debt ceiling and partial government shutdown….”

Sup With All the Shit Canning ?

[youtube://http://www.youtube.com/watch?v=zcn7sw-4dpk#t=98 450 300]

Comments »A Word From Peter Schiff

[youtube://http://www.youtube.com/watch?v=-HA_jZGqFok 450 300]

Comments »Twitter Squeezes The Banks for IPO Debut

“Twitter Inc. is parlaying its surging popularity and the intense competition among banks for Internet deals to squeeze unusually favorable terms from the firms that will take it public.

The fees banks are set to collect for selling the shares—at 3.25% of the money raised, said people familiar with the deal—would be the lowest percentage paid on a U.S.-listed IPO in more than a year, according to Ipreo, a capital-markets data and advisory firm.

What’s more, the microblogging service is nearing completion of a $1 billion credit line from its bankers that it can use to help finance its growth, the people said. The credit is arriving even as Twitter is seen by some analysts as a riskier credit bet than some other Internet companies that went public in recent years.

The arrangement shows the power that high-profile Silicon Valley companies can command on Wall Street. In what has become a standard playbook for these companies, Twitter asked for credit from banks seeking to handle its IPO to lend it money, the people said. That setup enables companies to maximize the money they extract out of Wall Street at the time of their IPOs.

For some banks, agreeing to lend can be a way to establish a relationship with companies going public. When banks work on hot IPOs, they get bragging rights, and position themselves for plum roles in any future transactions the company does.

But the arrangement also means the banks must weigh the costs of providing credit for often-unproven companies against what can be meager IPO fees.

Facebook Inc. FB +0.12% paid an underwriting fee of 1.1% of the money it raised in its IPO last year while Pandora Media Inc. P +0.81% and LinkedIn Corp. LNKD -0.41% each paid 7% in 2011, according to Ipreo. Facebook still paid far more in total dollars because of the size of its IPO—$16 billion—compared with Twitter, which is seeking to raise $1 billion. The average spread for IPOs that have raised between $1 billion and $2 billion in the U.S. since 2001 was 4.6%, according to Ipreo.

Twitter initially tapped Goldman Sachs Group Inc. GS +1.26% to spearhead its IPO, and later added Morgan Stanley MS +1.12% and J.P. Morgan Chase JPM -0.02% & Co. to the circle of banks leading the deal. Bank of America BAC -0.28% Merrill Lynch and Deutsche Bank AG DBK.XE +1.33% also secured roles in the IPO. All of the banks also are providing credit to the company, people familiar with the discussions said….”

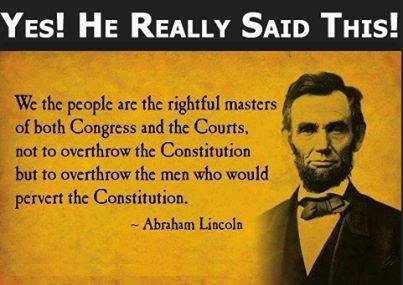

Comments »An Open Message to Congress

A Word From Edward Snowden and Julian Assange

[youtube://http://www.youtube.com/watch?v=lesFHt0Cs-U 450 300]

Comments »Will China Force An End to QE?

“Nothing lasts forever… (especially in light of China’s earlier comments)

Submitted by Patrick Barron via The Ludwig von Mises Institute,

We use the term “reserve currency” when referring to the common use of the dollar by other countries when settling their international trade accounts. For example, if Canada buys goods from China, it may pay China in US dollars rather than Canadian dollars, and vice versa. However, the foundation from which the term originated no longer exists, and today the dollar is called a “reserve currency” simply because foreign countries hold it in great quantity to facilitate trade.

The first reserve currency was the British pound sterling. Because the pound was “good as gold,” many countries found it more convenient to hold pounds rather than gold itself during the age of the gold standard. The world’s great trading nations settled their trade in gold, but they might hold pounds rather than gold, with the confidence that the Bank of England would hand over the gold at a fixed exchange rate upon presentment. Toward the end of World War II the US dollar was given this status by international treaty following the Bretton Woods Agreement. The International Monetary Fund (IMF) was formed with the express purpose of monitoring the Federal Reserve’s commitment to Bretton Woods by ensuring that the Fed did not inflate the dollar and stood ready to exchange dollars for gold at $35 per ounce. Thusly, countries had confidence that their dollars held for trading purposes were as “good as gold,” as had been the Pound Sterling at one time.

However, the Fed did not maintain its commitment to the Bretton Woods Agreement and the IMF did not attempt to force it to hold enough gold to honor all its outstanding currency in gold at $35 per ounce. The Fed was called to account in the late 1960s, first by France and then by others, until its gold reserves were so low that it had no choice but to revalue the dollar at some higher exchange rate or abrogate its responsibilities to honor dollars for gold entirely. To it everlasting shame, the US chose the latter and “went off the gold standard” in September 1971.

Nevertheless, the dollar was still held by the great trading nations, because it still performed the useful function of settling international trading accounts. There was no other currency that could match the dollar, despite the fact that it was “delinked” from gold.

There are two characteristics of a currency that make it useful in international trade: one, it is issued by a large trading nation itself, and, two, the currency holds its value vis-à-vis other commodities over time. These two factors create a demand for holding a currency in reserve. Although the dollar was being inflated by the Fed, thusly losing its value vis-à-vis other commodities over time, there was no real competition. The German Deutsche mark held its value better, but German trade was a fraction of US trade, meaning that holders of marks would find less to buy in Germany than holders of dollars would find in the US. So demand for the mark was lower than demand for the dollar. Of course, psychological factors entered the demand for dollars, too, since the US was seen as the military protector of all the Western nations against the communist countries for much of the post-war period.

Today we are seeing the beginnings of a change. The Fed has been inflating the dollar massively, reducing its purchasing power in relation to other commodities, causing …”

Comments »Documentary: The Destruction of America’s Middle Class

[youtube://http://www.youtube.com/watch?v=hTbvoiTJKIs 450 300] [youtube://http://www.youtube.com/watch?v=Bb3gB-qY2bQ 450 300]

Comments »Dollar and Stock Correlation May Spell a Bull Market Top

“The stock market is finally starting to show signs that the bull market may be coming to an end. Before I go into the stock market though, I want to discuss the dollar because I think currencies are going to be integrally tied to the topping process.

For the better part of the past five years a lower dollar has generally been positive for the stock market. However, we are now five years into QE and I think we are at the point where it’s important that the dollar hold its value. At this point I think the stock market is deathly afraid that the dollar is going to crack under five years of continual debasement. As many of you have probably noticed over the last several weeks stocks have been dropping along with the dollar.

We have some interesting currents at play in the currency markets at the moment. It’s been my opinion for some time that the dollar would adjust its yearly cycle low from the spring to later in the fall (this will set up next year’s yearly and three year cycle low to occur late in the year. This is also the most likely time frame generally for the currency crisis to occur). I think that process is now in play.

For this to come to fruition the dollar needs to move below the February low sometime in the next two or three weeks. Keep in mind that other than a three year cycle low the yearly cycle low is the most intense sell off of the year and generally does not terminate until it looks like the world is coming to an end (we definitely haven’t reached that point yet).

I suspect the government shutdown and debt ceiling debacle are going to intensify the dollar’s yearly cycle low this year. This suggests that we are going to see a very aggressive and scary decline in the dollar index over the next 2-3 weeks.

I’m expecting the yearly cycle to bottom either on the debt ceiling resolution, or one day either side of it as the market starts to sniff out a deal. At that point I think we’re probably going to see a significant intermediate degree rally as the currency markets breathe a sigh of relief.

However, within 1-2 months I also expect the currency markets to come to their senses and realize that nothing has changed and the dollar is going to continue to be debased, maybe even at a faster rate than before. At that point I think the dollar will roll over again and get busy moving down into next year’s three year cycle low which should manifest as a moderately severe currency crisis around this same time next fall.

Now let’s look at some of the warning signs in the stock market. To begin with, this is the first time in five years that the advance decline line has failed to follow the market to new highs.

In the next chart I have marked each intermediate cycle low with a blue arrow. You can see that the previous intermediate cycle ran quite long as it was stretched by QE 4 to 33 weeks. This is a full 11 weeks longer than a normal intermediate cycle duration. Often a long cycle like this is followed by a short cycle. Note that the last intermediate cycle had 4 complete daily cycles nested within it. I think there is a very good chance that the current intermediate cycle will only have two.

Considering that the current daily cycle is already on day 25 …”

Comments »Out With the Old and In With the New Constitution Proposed by the Obama Administration

Grain of salt needed here, but interesting none the less…..

Source: Charles Hugh Smith http://www.oftwominds.com/blog.html

“October 10, 2013

The U.S. Constitution leaves too many areas open to interpretation; a New Constituion of 2,300 pages (+ 200 redacted secret pages) is the solution.

The Obama Administration has proposed replacing the current U.S. Constitution (4,543 words, including the signatures) with a 2,300-page “new Constitution” that in the words of an administration spokesperson, “clears up the gray areas in the current Constitution.”

The proposal was launched after the success of two recent 1,000+ page pieces of legislation, the Affordable Care Act and the Dodd-Frank financial reform act.

An additional 200+ pages of the “new Constitution” are redacted due to the sensitive nature of the National Security-related amendments.

Lobbyists from key industries were invited to contribute amendments to the new Constitution;” constitutional legal experts were also invited to submit improvements to the current law of the land.

Some critics who have reviewed the 2,300 pages of the proposed “new Constitution” have stated that the document is impenetrable even to those with law degrees. Average citizens “will be unable to understand the laws that govern their lives.”

Other observers note that the complexity and length of legislation such as the Affordable Care Act and the Dodd-Frank financial reform act are already beyond the comprehension of all but a handful of experts.

An administration spokesperson defended the proposed re-write on the grounds that “the new Constitution will provide the clarity that people want in their Constitution.” ”

[youtube://http://www.youtube.com/watch?v=11OhmY1obS4 450 300] Comments »New Litmus Test for Military: Will You Fire Upon American Citizens?

[youtube://http://www.youtube.com/watch?v=rLXOtR9Gr3E 450 300]

Comments »Yellen + GOP Grace = Full Retard Rally

After smellin’ Yellen all week for fed chair and surmising she will be dovish; the markets rejoiced full retard mode when news came out earlier today that the GOP will offer a raising of the debt limit. If the president agrees to the proposal it will only stave off any potential short term default and will not reopen government until serious talks resume in the current standoff.

DOW UP SILLY

NASDAQ UP EXTRA SILLY

S&P UP MODESTLY SILLY

[youtube://http://www.youtube.com/watch?v=l5oWzB4Xgzw 450 300] Comments »

The Story of the Viral Navy Yard Shooting Photo

On the Matter of the Capitol Hill Lynching

If this testimony is true, then we have a modern day lynching passed off as a proud event full of honor and valor.

One could and should have shot out the engine, tires, and or tried to subdue the driver once they secured the child. What need was there to open fire on a unarmed woman?

[youtube://http://www.youtube.com/watch?v=cGHzE9ie-M8 450 300] Comments »The Blunt Truth About the Government Shutdown

An Amazing Number of Predictions Come True From Robert Welch

Anyone for Ping Pong?

[youtube://http://www.youtube.com/watch?v=KVloaB5_J1k 450 300] [youtube://http://www.youtube.com/watch?v=MB2f6-U72Zk 450 300]

Comments »Twitter Gets an Upgrade, Buy Rating, and a $50 Price Target Despite Not Having Traded a Share

“It has been only four days since Twitter first took the wraps off its initial public offering prospectus. But that hasn’t stopped Robert Peck from setting a high $50-a-share price target on the still-private social network.

Mr. Peck, of SunTrust Robinson Humphrey, was the first research analyst to set a public target on Twitter’s not-yet-public stock. But by the time the regulatory filing came out, he had already conducted what he described as several months’ worth of work: talking to industry contacts, marketers and others.

Still, going first wasn’t the aim, he said in an interview.

“It wasn’t the main reason we did it, but it was a nice sort of benefit,” Mr. Peck told DealBook.

Instead, he wanted to use what even he would concede was limited information to decide whether Twitter was a worthwhile investment. What he concluded was unambiguous: His note set a $50 price target for Twitter, more than double the $20.62 at which the company itself valued its stock in August. That would value the company at around $31 billion on a diluted basis, up from nearly $13 billion now.

For Mr. Peck, the decision was based on the sense that Twitter had room to grow. Despite recording a net loss for the 12 months through the end of June, the company has been spending significantly on new tools like Vine, a short-video platform, and MoPub, a big advertising exchange.

“It reminds me of Facebook when they had just rolled out a bunch of new products that hadn’t shown up in the financials yet,” he said in the interview. “I like to see those investments in the platform.”

In his note, Mr. Peck argues that Twitter is a unique platform that isn’t quite like Facebook. Instead, it lets users broadcast their interests, 140 characters at a time, while also conversing with others. And it supplements other media like TV, as users comment on TV shows like “Breaking Bad” in real time.

The research note concedes that Twitter’s future is hard to determine…..”

Comments »

Keep On Drinking the Kool Aid

[youtube://http://www.youtube.com/watch?v=kg9m1F8B2_c 450 300]

Comments »