[youtube:http://www.youtube.com/watch?v=Igt-jW4e8ts 450 300]

Comments »Monthly Archives: July 2013

Harlem Streets

[youtube://http://www.youtube.com/watch?v=DVL4IAKA9Lc 450 300]

Comments »A Moment of Clarity

Drinking With Bob

[youtube://http://www.youtube.com/watch?v=-ZG4SAUDdVo 450 300]

Comments »A Message From Nigel Farage

[youtube://http://www.youtube.com/watch?v=IB8lJR63Oxw 450 300] Comments »

Venture Capital Investments Double in Q2

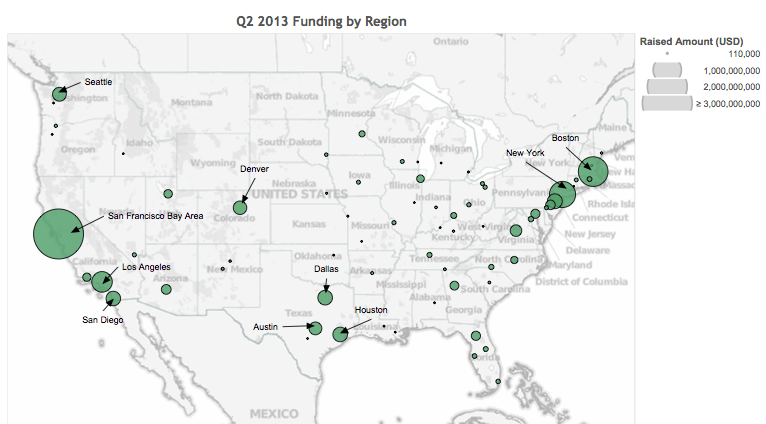

“Total new capital invested in the United States tech industry rose from $1.9 billion in April to $3.8 billion in June, a 100 percent increase in two months, according to quarterly data from CrunchBase. The data, which is specific to the United States, breaks down new venture capital raised by round type, investor, company, geography and more.

In the second quarter of 2013, $9.2 billion was invested in over 1,347 rounds. The rounds break down to 500 angel rounds, 306 Series A, 109 Series B, 102 Series C and later, and 330 unattributed rounds. This data set doesn’t include some investments, such as private equity and post-IPO investments, and thus is lower than the total funding for the quarter.

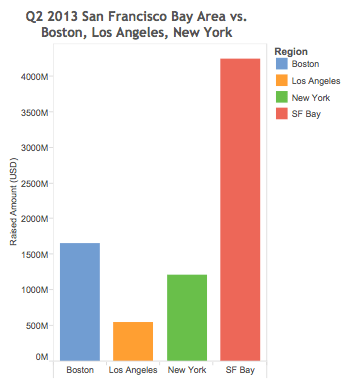

The San Francisco Bay Area still dominates other regions, as companies in the Bay Area raised more capital in Q2 than Boston, New York, and Los Angeles, the next three regions in total capital raised, combined.

Bay Area companies raised $3.2 billion in 316 rounds, while Boston companies raised $1 billion in 84 rounds and New York startups raised $800 million in 142 rounds. Los Angeles companies raised a bit under $500 million in 81 rounds.

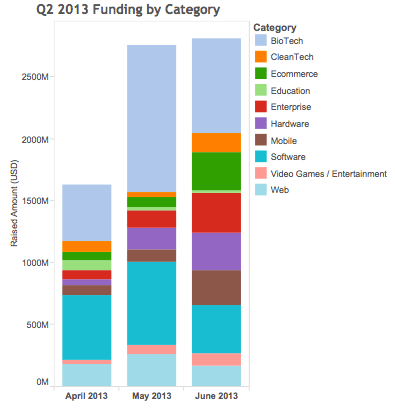

Biotech companies led the way in amount of money raised, followed by software startups. On average, Biotech companies captured 30 percent of total funding per month, followed by software at 19 percent.

The most active investors, in terms of number of rounds they participated in, were….”

Comments »Changing Your DNA

“New studies in cell research are bringing up some alarming new questions concerning GMOs, and one of them in particular makes liver failure or cancer seem like child’s play compared to the garish possibilities that arise when we start to look at how genetically modified foods likely affect our DNA.

Let’s get one thing straight, first. All kinds of things can alter our DNA, for the better or worse. Bruce Lipton, a pioneering biology scientist, proved that emotions can change our DNA; research has shown that even exercise or chemotherapy can alter our DNA; ancient cultures have known that sound can affect our DNA; and the newest research states that we aren’t relegated to a specific destiny because of our genes, but it seems our brains are being rewired via DNA to become ‘new humans.’

Our DNA contains two strands of nucleotides that make up its stair-like structure. Each nucleotide contains one of four bases (adenine, thymine, guanine, cytosine) a phosphate group and a sugar molecule. The bases contain nitrogen, which bond in very specific ways. In one species the way the four bases connect to each other are very different than how they will organize in another.In fact, double stranded RNA (dRNA) GMO created by Monsanto can allegedly turn off certain gene signals and turn on others. Usually, if you put in a Roundup ready gene into a plant, it requires a protein that can make a Roundup ready plant that can resist Roundup and still grow. However, the new dRNA can survive without protein synthesis. This allows the dRNA to alter genes.

In mice who were fed this dRNA, the liver completely changed its cell organization, and the mice grew strangely. The same effects were found when these dRNA were added to human cells. Allegedly, this GMO food can be turning on cancer causing genes, or quiet our immune systems. In other ways, the wheat we are consuming is so different than organic wheat that it is causing us to be addicted to it. Some are calling it bioterrorism for this reason.

GMO food plants make these new dRNA so that the gene structure is silenced or amplified in very specific ways….”Full article

Comments »Tinfoil Hat Diary Entry

Thought this was interesting reading. More research needs to be done, but om the surface it is intriguing indeud….

Comments »Are Bank Reserves Held at the Fed the ‘Largest Scam in History’ ?

“Banks’ excess reserves at FED is one of the biggest scam by the FED and there is a conspiracy of silence as to its actual implications. Economists and financial analysts spewing nonsense to mislead and divert attention to non-issues so that the public is kept in the dark.

The issue of banks’ reserves at the FED and other central banks in the world is a complex subject with much technical jargons that confuses a lot of people. Besides, don’t be surprised that your bank branch manager on Main Street as well as lecturers in finance and economics are also ignorant on this issue. In the case of the latter, this subject is hardly taught in universities. And this is the reason why the scam has not been exposed till today.

But, for those who have a basic idea of bank reserves and how this huge amount of “excess reserves” have been created by the FED, have you asked yourself, “Why have I not spotted this scam earlier?”

Many have been taken in by the propaganda that “excess reserves” is the means to encourage banks to extend credit (give out loans) to desperate borrowers who needed urgent funds to survive and to jump-start their businesses. This propaganda is grounded on the assumption that there is insufficient liquidity in the market.

This assumption is misleading.

What are Excess Reserves

The latest figures obtained from the H.3 release from the Board of Governors of the Federal Reserve System (the FED) shows excess reserves of about $1.794 trillion (data as of April 17, 2013), This level of excess reserves is unprecedented and is the highest since reserves were legislated as a requirement.

Please read the below paragraph carefully, ponder deeply before proceeding further. Don’t rush. It is important that you understand this simple fact as otherwise you would not appreciate the audacity of this financial scam!

Excess reserves are the surplus of reserves against deposits and certain other liabilities that depository institutions (collectively referred to as “banks”) hold above the statutory amounts that the FED requires in accordance with the law. The general requirement is that banks maintain reserves at least equal to ten percent of liabilities payable on demand. There is now data to show that as much as 50% of these “excess reserves” are held for United States banking offices of foreign banks.

Let me elaborate. Banks receives deposits from their customers which are inter-alia placed in current accounts (checking accounts) or time deposits (fixed deposit accounts) and which the customer can at any time withdraw from the bank. But, banking practice shows that at any one time, only a small fraction of customers would withdraw their deposits in full. So, there was no need for banks to keep all the deposits in their vaults to meet such a demand for payment. Laws were enacted to allow banks to keep in reserve a small amount of monies to meet such demands.

That being the case – if only 10% reserves is all that is required according to banking regulations to meet repayment demands, why should there be such a huge amount of reserves, beyond the legal requirement of 10%?

Keep this question at the back of your mind to understand the huge scam by the FED.

A Slight Digression

In a previous article, I had exposed the fact that when a customer deposits monies in a bank, he is in law a “creditor” (he has loaned the monies to the bank) and the bank is a “debtor” (and he can use the money in any way at his absolute discretion, even to speculate).

This is because the ownership of the money has been transferred to the bank. The money is no longer the money of the customer. It now belongs to the bank. And as long as the bank is solvent, and there is a demand for repayment of the deposit, the law of contract stipulates that the bank must repay together with the agreed interest that has accrued.

However, if at the time when demand for repayment is made, the bank is bankrupt (i.e. in a liquidation) then the depositor/customer in law is deemed an “unsecured creditor” and must join the queue of all unsecured creditors to share the proceeds of any remaining assets after all secured creditors have been paid. If there are no remaining assets, the depositors get zilch! Ouch!!!!!!

That is why and as illustrated in the bank confiscation of deposits in Cyprus banks acting in concert with central banks can expropriate all customers’ deposits to pay their secured creditors.

I will elaborate on this issue later.

Let’s return to the issue of excess reserves.

How Did The Excess Reserves Balloon To A Massive US$1.794 Trillion? A Simple Summary

The Fed’s overall balance sheet has expanded from about $909 billion before the crisis (i.e. before 2008) to about $3.3 trillion in 2013. Of the $2.4 trillion increase, approximately $1.8 trillion is excess reserves.

Banks were up to their eyeballs in toxic assets (financial sewage) and they are drowning in this cesspool but for the rescue efforts of the FED and other central banks they would have sunk to the bottom of the cesspool.

First Stage of Excess Reserves Scam

From the diagram below, you will see that the FED created trillions of money out of thin air by a digital entry in its books to purchase the toxic assets (financial sewage) in batches from the banks. The objective of QEs is to save the banks and to save the US Treasury from bankruptcy and not Joe Six-Packs. However, in this article we are focusing on the banks…..”

Comments »On the Matter of Income Inequality

[youtube://http://www.youtube.com/watch?v=ik1y4ZNSjek 450 300] [youtube://http://www.youtube.com/watch?v=Fz0GtKsrwNk 450 300]

Comments »$TSLA to Join NASDAQ 100

“The latest rebalancing of the Nasdaq 100 index NDX will see Tesla Motors TSLA join the index to replace Oracle ORCL , which is moving to the New York Stock Exchange and will no longer be eligible for inclusion.

The move is a testament to Tesla’s rapidly advancing shares, and another feather in the cap of CEO Elon Musk. But it may also signal a slowdown for the stock, judging by what happens when stocks join the Nasdaq 100.

Ryan Detrick of Schaeffer’s Investment Research found that stocks added to the Nasdaq 100 over the years have tended to underperform those that are removed.

“When you are added it means things are going great. Now things can continue to go great, but it does set up a higher bar,” Detrick said in e-mailed comments.

The stocks removed from the Nasdaq 100 going back to 1995 have averaged a return of 22% in the year following their removal, while those added to the index have only averaged a return of 11.6% over the subsequent year.

Detrick said as far as Tesla goes, “this isn’t a sell signal. Still, buying this stock three months ago when it was 40 and very few believed in it was a far better entry. Now it is a popular stock with a very devoted fan base. Just remember the bar is set higher now and any disappointment could lead to a larger than expected sell off.”…”

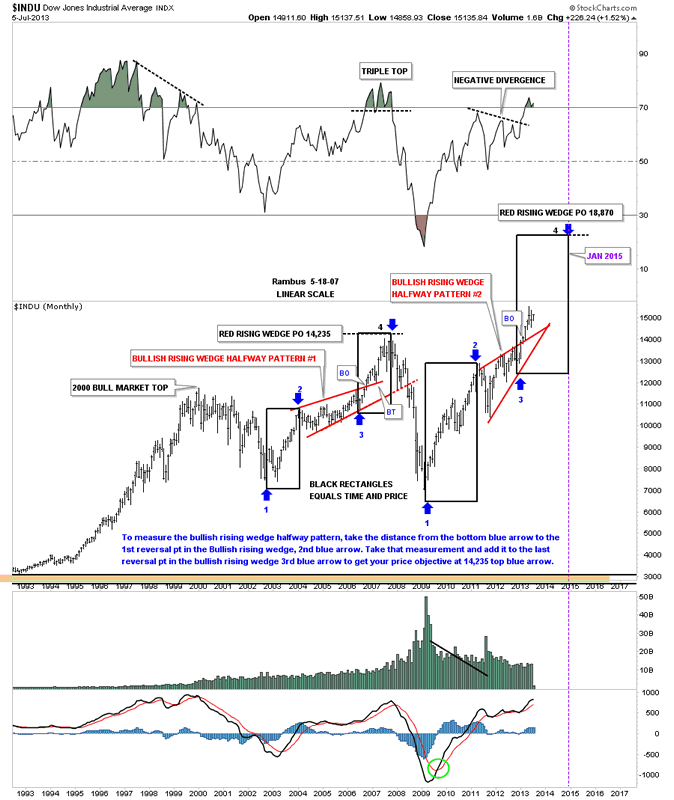

Comments »Chart Chompers Delight

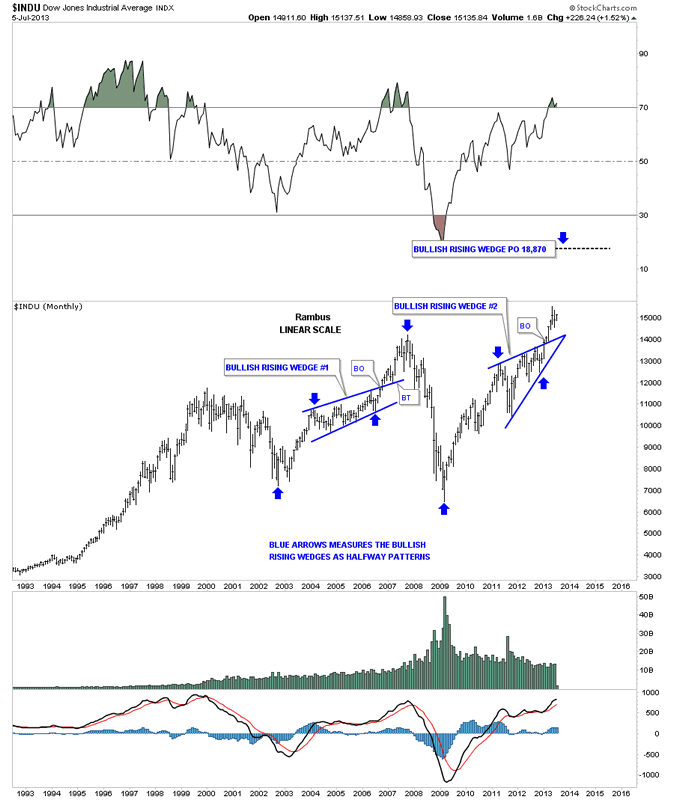

“As most of you know I’ve been bullish on the stock markets for quite sometime now. I know there are a lot of investors that are bearish on the US markets and are looking for them to crash on burn. From my perspective nothing is broken that would tell me at this point in time to expect a major correction. So far the charts have been playing out beautifully and if nothing is broken there is no need to fix it.

The first chart I would like to show you is a very long term monthly look at the INDU that seems to be repeating a pattern that formed back in 2002 to 2007 rally phase. I’ve shown this chart several times in the past that shows the bullish rising wedge that formed as a halfway pattern in the middle of the 2002 to 2007 rally. No one at the time recognized this pattern, the bullish rising wedge, because everyone always considers these patterns as bearish. Nothing could be further from the truth as I have shown many times they act and perform just as any other consolidation if the price action breaks out through the top rail. The chart below shows the bullish rising wedge that formed in 2002 to 2007 as a halfway pattern that measured out perfectly in time and price to the 2007 high just before the crash. You can see our current bullish rising wedge that I’ve been showing since the breakout about 6 months or so ago.

This next chart is the exact same chart as shown above. It may look a little busy but it shows you what I’m look for with our current bullish rising wedge #2. Note the two black rectangles from 2002 to 2007 that measured out the bullish rising wedge #1 as a halfway pattern in time and price. Now look at our current bullish rising wedge #2 that is showing a price objective up to 18,870 as measured by the blue arrows with a time frame in January of 2015 or so. You will only see a chart like this at Rambus Chartology and nowhere else because no one is looking for this pattern. The bears were all over the bullish rising wedge before it broke out to the upside. Its now been about 6 months and nothing is broken.

This next chart is a closeup look at the 2002 to 2007 price action….”

Comments »Crossing the Boundary

Au Nearly On Par With Worst Quarterly Performance Since Bretton Woods Meltdown

“FORTUNE — Gold is down more than 25% from its recent highs, leading some observers to declare it on track for its biggest one-quarter decline since the Bretton Woods system collapsed in 1971.

This is a bit misleading: the average price of gold in 1971 was around $40 an ounce. The following year it was $58. By 1974, the year of the Arab oil embargo, gold averaged $154 an ounce. By taking the dollar off the gold standard in 1971, President Nixon kicked off one of the great risk markets in history, allowing speculators to flee from the occasionally useless (currency) to the utterly useless (gold) whenever the prices of really useful things (oil, food) went up.

The dollar collapsed after Nixon took it off the gold standard. Treasury Secretary John Connally cheered, saying the U.S. “took charge,” precipitating the dismembering of the Bretton Woods exchange rate system. Nixon went on national TV and said closing the gold window would stabilize and strengthen the dollar. The following day — a Monday — the Dow had its biggest one-day gain ever (33 points — those were the days!).

Fast-forward to today as the price of gold fades, even as global turmoil continues. Here are four news items to consider in evaluating gold’s decline…”

Comments »The Fed’s Williams Discusses QE Uncertainties

“Federal Reserve Bank of San Francisco President John Williams, who has never dissented from a Fed decision, said critics of the central bank including Nobel Prize-winning economist Paul Krugman disregard how bond buying by the Fed is an untested tool with an ambiguous impact.

“The claim that the Fed is responding insufficiently to the shocks hitting the economy rests on the assumption that policy is made with complete certainty about the effects of policy on the economy,” Williams said in a paper posted Tuesday on the San Francisco Fed’s website. “Nothing could be further from the truth.”

The 29-page paper by Williams is an academic response to critics such as Krugman who have said high unemployment and low inflation show the Fed hasn’t done enough to fuel economic growth. The central bank is currently considering reducing its $85 billion in monthly bond purchases even with unemployment at 7.6 percent and the Fed’s preferred inflation index showing prices rising 1 percent from a year earlier, below the central bank’s 2 percent goal.

“Policymakers are unsure of the future course of the economy and uncertain about the effects of their policy actions,” Williams said. “Uncertainty about the effects of policies is especially acute in the case of unconventional policy instruments such as using the Fed’s balance sheet to influence financial and economic conditions.”

Williams cited Krugman, a Princeton University economist, by name in his paper. Krugman didn’t immediately respond to a request for comment in a phone message and an e-mail.

Moderation ‘Defense’

Williams, who titled his paper “A Defense of Moderation in Monetary Policy,” told reporters on June 28 that he supported the timetable for winding down purchases that Fed Chairman Ben S. Bernanke outlined in his June 19 press conference. Bernanke said the Fed could start shrinking the pace of purchases later this year and end them around mid-2014 if the economy performs in line with the central bank’s forecast….”

Comments »The EU Positions for Total Control Over Winding Down Banks

“BRUSSELS—The European Commission will propose itself as the single authority for winding down banks in the euro zone, a step that will set the European Union’s executive on a collision course with the bloc’s most powerful member, Germany.

Berlin insists that such an authority—whose actions could force national governments to spend money to help rescue failed banks—would breach EU treaties. That, it says, could lead to legal challenges over bank restructurings and create uncertainty for financial markets at a sensitive time.

Michel Barnier, the EU commissioner responsible for financial-market regulation, was to lay out his final proposal Wednesday for a so-called single resolution mechanism, giving it the authority to restructure or close any of the 6,000 banks in the 17-nation euro zone that hit financial problems.

Bank restructurings currently take place under a patchwork of national rules, which also hinder the winding down of cross-border banks.

The euro-zone’s ambitious banking union project—a cornerstone of efforts to end the three-year-old debt crisis—aims to break the vicious link between struggling euro-zone banks and their governments.

The first pillar is a single supervisor for euro-zone banks, a task the European Central Bank is expected to assume in the fall of 2014. The single resolution mechanism is meant to form the second pillar.

The commission calls for a so-called “single resolution board” to prepare and carry out bank restructurings, backed by a shared fund that would be financed by contributions from banks….”

Comments »The IMF Cuts Global Growth Targets for a Fifth Time This Year

“WASHINGTON: The International Monetary Fund trimmed its global growth forecast on Tuesday for the fifth time since early last year due to a slowdown in emerging economies and the woes in recession-struck Europe.

In its mid-year health check of the world economy, the Washington-based lender also warned global growth could slow further if the pull-back from massive monetary stimulus in the United States triggers reversals in capital flows and crimps growth in developing countries.

The IMF shaved its 2013 forecast for global growth to 3.1%, as fast as the economy expanded last year and below the Fund’s 3.3% projection in April. It also lowered its forecast for 2014 to 3.8% after earlier predicting a 4% expansion….”

Comments »Russell 2k Break Out Have Bulls Considering New Highs All Around

“With the small cap Russell 2000 hitting record levels for a third day Tuesday, traders are watching to see if the S&P 500and Dow will follow it. The Dow is within striking distance of its all-time high, just 109 points from 15,409, the close reached on May 28, and the S&P is just 1 percent away from the high it set on May 21, of 1669.

“I didn’t think it would get there this quickly, but it sure seems like it might make it,” said Randy Frederick, managing director of active trading and derivatives at Charles Schwab.

“The key is 15,340,” said Paul LaRosa, chief market technician at Maxim Group. “If we close above that, the highs are in sight.” The Dow closed up 75 points Tuesday, at 15,300, and the S&P 500 closed at 1652, up 11. The number he is watching in the S&P 500, is 1654, Tuesday’s intraday high, and if it closes above that level, he expects to see new highs.

“It feels like we could get there and a lot of the technology names are looking pretty good, some of the regional banks look good,” said LaRosa. “The consumer companies led it early on and now they’re treading water while technology, banks and special situations have been powering this rally lately…Retailers are one group that’s been strong.”

LaRosa said the two big threats to the rally are interest rates and earnings. Treasurys were mostly higher Tuesday, and the 10-year yield was unchanged at 2.63 percent, off the 2.73 percent level it hit Friday but well above its early May low of 1.62 percent….

10 Year Yield Alert

“I have been very vocal since the beginning of June that now is a great time to be adding bonds to portfolios![]() . (See here and here) There are several fundamental reasons for my belief that the recent rise in interest rates was more related to a short term liquidation cycle rather than a shift in global economic sentiment.

. (See here and here) There are several fundamental reasons for my belief that the recent rise in interest rates was more related to a short term liquidation cycle rather than a shift in global economic sentiment.

1) Domestic economic strength remains very weak (growing at just 1.8% annually since 2000)

2) Four years into the current “recovery” the economy is already past the average length of most growth cycles. Interest rates fall during down cycles.

3) Geopolitical unrest makes U.S. Treasuries an attractive “safe haven” for foreign capital flows.

4) Global economic weakness (China, Euro-zone and Japan) will likely drive buying of U.S. Treasuries.

5) Upcoming “debt ceiling” and budget debate in September likely to drive inflows into the safety of bonds as we saw in 2011.

6) If the Federal Reserve begins to extract liquidity by slowing bond purchases – financial markets are likely to come under selling pressure pushing money flows from equities into bonds.

7) Declining rates of inflation which are representative of economic weakness.

8) Ultra-low interest rate policies by the Fed continue to push investors to seek yield over cash. The recent rise in rates makes bond yields much more attractive.

However, even if you disagree with the fundamental arguments, it is hard to argue against one of the most compelling reasons for buying bonds which has 35 years of history supporting it. I discussed this particular reason during a Fox Business interview recently stating that:

“Interest rates are now 4-standard deviations above their long term moving average.”

As shown in the chart below….”

Comments »Perma Bear Rosenberg Sings a Bulls Song

“….since Friday’s jobs report, Rosenberg’s tone has turned decidedly bullish.

Indeed, he has already published his “Ten Reasons To Love The U.S. Employment Report.”

In his latest Breakfast With Dave note, Rosenberg goes even further:

JOBS DATA A GAME CHANGER

First came the healing in the credit markets in 2009-2010.

Then came the healing in the housing market from 2011 to now.

And now we have the third act in full swing, which is the healing of the labour market….”

Comments »