This is a great law !

Comments »Monthly Archives: June 2012

Shelia Bair: We Need a Watchdog for all the New Watchdogs

“Two years after passage of the Dodd- Frank financial reform law, how are we doing putting in place crucial provisions, including a way to control systemic risk?

Not well, according to Sheila Bair, chairman of the Federal Deposit Insurance Corp. during the 2008-2009 economic disaster and author of some of the reforms in the act.

Bair is still at it. On June 6 she established a private- sector systemic-risk council, an initiative funded by the Pew Charitable Trusts and the Chartered Financial AnalystsInstitute. (I’m a member of the council, but I am writing here in my personal capacity; we have agreed that only Bair will speak for the council.)”

Comments »Krugman on the Spanish Bailout: ‘The Whole Story Is Starting To Feel Like A Comedy Routine’

“Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody. In fact, the whole story is starting to feel like a comedy routine: yet again the economy slides, unemployment soars, banks get into trouble, governments rush to the rescue — but somehow it’s only the banks that get rescued, not the unemployed.

Just to be clear, Spanish banks did indeed need a bailout. Spain was clearly on the edge of a “doom loop” — a well-understood process in which concern about banks’ solvency forces the banks to sell assets, which drives down the prices of those assets, which makes people even more worried about solvency. Governments can stop such doom loops with an infusion of cash; in this case, however, the Spanish government’s own solvency is in question, so the cash had to come from a broader European fund.”

Comments »How the Oklahoma City Thunder Became the Hottest Ticket in NBA

BY DARREN ROVELL

When the Seattle Supersonics moved to Oklahoma City and became the Thunder, there likely wasn’t a single person who would have predicted that the team would become the hottest ticket in the NBA.

But that’s exactly what has happened.

Tickets on the secondary market have soared for the Thunder all season and the NBA Finals is no exception.

StubHub reports that tickets to Game 1 and Game 2 on Tuesday and Thursday in Oklahoma City are selling for an average of $708 and $827 a ticket, respectively. Compare that to Miami, whose Game 3 and 4 on Saturday and Tuesday are selling for an average of $617 and $472 a ticket.

READ THE REST HERE AT CNBC.COM

Comments »Rumors of Nokia Being Bought Out by Samsung are Played Down

“Shares of Nokia Corp. (NYSE: NOK) rose more than 12% last week, about half that on Friday as rumors swirled that the company might be acquired. Nokia, now partners with Microsoft Corp. (NASDAQ: MSFT) in the smartphone sector, has just been hammered since the introduction of the iPhone from Apple Inc. (NASDAQ: AAPL) and the Android operating system from Google Inc. (NASDAQ: GOOG). Shares have fallen from a high of around $40 in late 2008 to just around $3.”

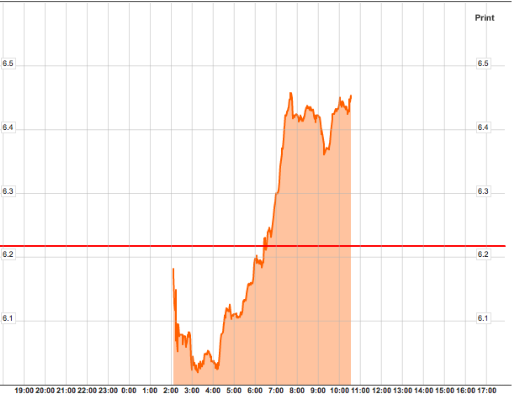

Comments »Markets Ignore Spanish Bailout

The U.S. markets have already faded the Spanish bailout in the first hour of trade. Spanish banks tell the real story.

Comments »FLASH: SPANISH AND ITALIAN YIELDS CLIMB, POST #SPAILOUT

FLASH: The Euro is Now Flat, Giving Up a 1% Rally

United Health To Keep Some Parts of Obamacare

“Insurer UnitedHealth Group sees some parts of the health care overhaul as sound medicine and plans to keep them regardless of whether the law survives an upcoming Supreme Court ruling.”

Comments »Stiglitz: Spain Bank Deal May Not Work, Bolder Euro Reforms Needed

“Europe’s plan to lend money to Spain to heal some of its banks may not work because the government and the country’s lenders will in effect be propping each other up, Nobel Prize-winning economist Joseph Stiglitz said.

“The system … is the Spanish government bails out Spanish banks, and Spanish banks bail out the Spanish government,” Stiglitz said in an interview.

The plan to lend Spain up to 100 billion euros ($125 billion), agreed on Saturday by eurozone finance ministers, was bigger than most estimates of the needs of Spanish banks that have been hit by the bursting of a real estate bubble, recession and mass unemployment.”

Comments »Working Out the Kinks in Mobile Payment

“Is that a Windows phone? Uh, sorry about that…. we only accept payments from Apple devices.”

The absurdity of the above statement is crystal clear. Basic transfer of money from one party to another in exchange for goods and services shouldn’t be this exclusive. Yet, this is where we find ourselves today.

Did we just unveil the new “we don’t accept American Express” of our generation?”

Comments »Italy is the next Big Worry, But Cyprus is on Deck Too

Under Armour Sets 2-For-1 Stock Split, Stays Strong With Mighty Valuation

“Under Armour’s board has approved a two-for-one stock split. The company expects the split will be distributed near July 9 with a record date of June 25.

Shares of Under Armour rose 1.2% to $104.50.”

Comments »Pension Funds Enter the Fast and Furious Stage

What will happen to pension funds and their beneficiaries as money managers increase the octane on a conservative investment model ?

Comments »GE is Considering Curtailing its Lending Unit

“General Electric is considering breaking off large parts of its lending business amid investor concerns that the conglomerate has become one of the largest banks in the U.S., The Wall Street Journal reported.

|

Although GE [GE 19.324 ![]() 0.124 (+0.65%)

0.124 (+0.65%) ![]() ] has made strides to cut down its GE Capital division by selling assets and allowing its loan portfolio to shrink, top executives are now looking at going further, the Journal said.”

] has made strides to cut down its GE Capital division by selling assets and allowing its loan portfolio to shrink, top executives are now looking at going further, the Journal said.”

Italy Well-Placed to Face Financial Turmoil: Minister

So you thought the crisis was over or at least quelled for the moment. Guess it may be time to get short Italian bonds.

Comments »Looking In the Mirror

When one looks in the mirror everyday, it has been said that it is hard to notice change. I have been removed from NYC, where i was born and raised, for many years now. I have played poker with friends nearly every weekend for years in the city which has kep me looking into the mirror.

My regular game has been postponed many times as the host has had family issues to deal with, and is also hunting for a house as a country weekend retreat. As a result yesterday, was the first visit to the city in nearly 6 months.

After not being in the city and visitng usual haunts and favorite places to grab a bite to eat i have noticed an extremely high amount of commercial vacancies.

The city is always changing, people failing, moving on, or moving up. But i have never seen such a dramatic change as i did yesterday.

Call it anecdotal evidence, but it appears that the health of the economy is really for shit. If you can not make it in the busiest spendthrift city, how will you make it anywhere else ?

I’m not sure if this spells a commercial real estate bust, but it certainly can not bode well. Many warned of a another debacle from commercial real estate, which thankfully never quite materialized. It appears it is closer now than ever. Knowing that liquidity is tight, corporations need to refinance some $4 trillion in debt over the next couple of years. What effect will this have for commercial real estate ?

In addition to seeing so many vacancies, my mother was offered a six figure sum to move out of her flat. My mom is one of those lucky seniors renting a two bed & two bath for $478 on the upper west side. I ask myself why is she and many other seniors being asked to move out ? The landlord is the third generation of European descendants, and the family is worth well over $150 million dollars. The landlord has already sold 85% of the building and plays with corporate jets as a hobby.

The family owns at least a dozen other apartment buildings which all went condo over the last 10-15 years. I do not know him well, but i wonder why the rush to push out all the seniors and sell ? It seems like a small bit of money to make in comparison to his net worth. Plus it would behoove his wallet to sit on the apartments as the elderly expire in their own time.

At any rate, i couple these observations with all the stories of 20k applying for 877 jobs at Hyundai last week to surmise the horizon. Mr. Obama the private sector is not well.

GLT

[youtube://http://www.youtube.com/watch?v=3t8MeE8Ik4Y 450 300]Comments »

Gapping Up and Down This Morning

Gapping up

INMD +19.9%, ING +5.4%, BBVA +4.6%, PCX +3.6%, STD +3.3%, RIO +3%,

DB +2.8%, TEF +2.8%, BAC +2.6%, BCS +2.4%, BBL +2.3%, BP +2.1%, ABB +1.8%,

BHP +1.8%, SAP +1.6%, HBC +1.1%, TRIP +3.2% , THC +2.8%, EMC +1.6% , NVDA+2.3%

Gapping down

TTM -1.9%, NOK -1.3%, AKS -1.7%, AKS -1.7%, AMZN -0.2%,

SFLY -1.3%, MOH -2%, CNC -23.9%, ES -6.7%, FRX -5.3%,

Comments »Upgrades and Downgrades This Morning

AKS, ATO, BRCM, BRCD, DUK, EMC, HA, HNT, IRM, MCD, NTAP, NVDA, SKX, SO, TPX, TWX, VAL, WPI, WY,

Comments »