Monthly Archives: May 2012

Europe Tanks Into the Closing Bell

European markets will close on the lows with Vienna Austria down 3.96%. Luckily U.S. equities are paring losses as we speak.

Comments »EXPE: Technical Alert

SURPRISE: Guess Which European Stock Market is Crashing the Hardest Today?

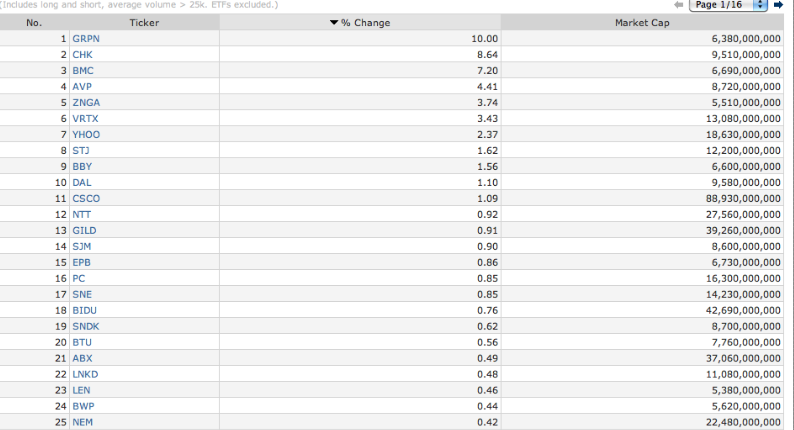

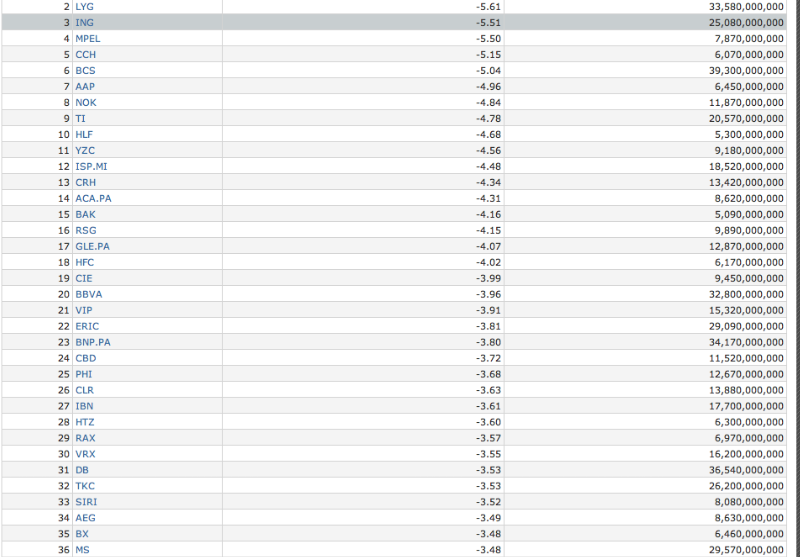

Today’s Large Cap Winners and Losers

52 Week Highs and Lows

NYSE

New Highs 16 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ BlackRock Build Am Bd Tr BBN 22.75 8,161 BlkRk MuniHldgs II MUH 16.77 2,826 DWS Strategic Muni Inco KSM 14.59 1,290 Invesco VnKmCAInc VCV 14.43 11,183 M/I Homes MHO 15.09 42,612 NVR Inc NVR 824.00 4,758 Nationstar Mortgage Hldgs NSM 15.35 58,161 Nuveen CA Muni Value NCA 10.33 4,087 Nuveen Ins CA NXC 15.44 883 Nuveen Sel Tax Free NXP 15.22 2,874 Standard Pacific SPF 5.67 289,525 Strat Htls & Resorts B BEEpB 30.81 500 Toll Brothers TOL 27.74 348,693 US Airways Grp LCC 11.55 677,749 Wstrn Asset Muni Ptnrs Fd MNP 16.64 1,783 Wisconsin Energy WEC 37.45 174,543 New Lows 65 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ AAR Corp AIR 14.22 12,205 Alumina ADS AWC 3.75 471,603 Ares Commercial Real Est ACRE 16.02 53,900 Artio Global Invs Inc ART 3.15 10,288 Best Buy BBY 19.02 340,806 BraskemSA BAK 12.11 72,787 Buckeye Partners BPL 50.06 39,417 CACI Intl CACI 46.18 31,038 Cellcom Israel CEL 10.48 157,956 Centrais Eletricas Brasil EBR 8.04 47,153 Cent Ele Brasil pfd. ADS EBR/B 10.83 9,708 China Unicom HK CHU 16.18 68,534 Coeur D'Alene CDE 17.61 220,458 Crawford & Co B CRD/B 3.70 4,875 Credit Suisse Group AG CS 20.36 1,298,431 DeVry DV 29.56 36,861 EldoradoGold EGO 10.97 564,939 Enerplus ERF 15.43 414,713 Excel Tr 8.125% Pfd B EXLpB 24.90 38,604 FTI Consulting FCN 31.10 46,670 GFI Group GFIG 2.86 7,708 G O L Linhas Aereas GOL 5.03 152,905 Genco Shipping Trading GNK 3.89 32,546 Green Dot Cl A GDOT 22.50 33,368 IamGold IAG 10.31 449,215 Intrepid Potash IPI 20.38 46,694 Investment Tech Grp ITG 8.92 28,854 Banco Itau Hldg ITUB 14.21 930,957 Ivanhoe Mines IVN 9.03 159,665 Kemet KEM 5.66 159,929 Legg Mason BW Glbl Incm BWG 19.45 44,499 Lone Pine Resources LPR 5.02 10,100 Memc Elec Materials WFR 2.21 699,004 McEwen Mining MUX 2.85 307,780 Mechel OAO MTL 6.87 253,009 NTT DOCOMO Inc DCM 16.14 16,420 Navistar Intl NAV 29.54 101,893 Newfield Exploration NFX 31.60 67,360 Nokia NOK 3.03 7,752,382 No Amer Engy Ptnrs NOA 3.23 11,550 Nuveen Glbl Val Opp Fd JGV 14.75 7,100 Oi SA ADS Ord OIBR/C 5.40 6,759 Oi S.A.ADS OIBR 13.83 190,528 PNC Finl Svs Dep. Pfd. P PNCpP 24.96 20,258 Pacific Coast Oil Trust ROYT 18.27 48,716 Patriot Coal PCX 4.83 398,000 Petoleo Brasil PBR 19.95 2,112,251 Petoleo Brasil A PBR/A 19.02 762,135 Pitney Bowes PBI 14.57 367,259 Resolute Energy wt REN/WS 0.55 700 Resolute Energy Cp REN 9.08 26,314 SAIC Inc SAI 11.03 84,986 Seabridge Gold SA 13.82 67,696 Silver Wheaton SLW 25.00 1,208,503 Silvercorp Metals SVM 5.64 161,461 Sinopec Shanghai Petro SHI 31.82 9,810 Standard Register SR 0.63 18,468 STMicroelec STM 4.99 210,218 Talisman Energy TLM 10.55 471,859 Telefonica TEF 13.95 512,231 Vale Cap II 6.75% CJS 53.44 478 Vale Cap II VALE.P CJT 60.15 300 Vale ADS Cl A pfd. VALE/P 18.70 827,932 Vale S.A. VALE 19.27 2,567,775 Vonage Holdings VG 1.73 32,185

NASDAQ

New Highs 12 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Audience Inc. ADNC 20.50 25,758 BioDelivery Sciences BDSI 4.20 35,561 Bona Film Group ADS BONA 6.37 61,851 Citizens South Banking CSBC 6.44 11,002 Golfsmith Intl Hldgs GOLF 6.05 65,912 Heritage Oaks Bancorp HEOP 5.62 1,188 Homeowner Choice 7% Ser A HCIIP 19.83 900 Mantex Intl MNTX 10.45 38,813 Medivation MDVN 84.94 106,900 MutualFirst Fincl MFSF 11.49 100 Ultimate Software Group ULTI 83.02 80,126 Vertex Pharm VRTX 65.37 922,109 New Lows 58 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ APCO Oil and Gas APAGF 26.43 4,851 Acme Packet APKT 24.03 133,398 Alaska Comm Sys Grp ALSK 2.20 41,398 Amtech Sys ASYS 5.13 32,403 Arkansas Best ABFS 13.21 9,634 Biostar Pharmaceuticals BSPM 1.24 10,734 Brightpoint CELL 5.58 28,504 BSQUARE BSQR 2.65 6,444 Cambium Learning Gr ABCD 1.81 200 Ceres CERE 10.27 200 China Jo-Jo Drugstores CJJD 0.95 500 China TechFaith Wireless CNTF 1.21 2,250 China Valves Technology CVVT 1.55 10,711 Clearwire A CLWR 1.19 1,401,550 Codexis CDXS 3.20 16,104 Commun Sys JCS 11.50 3,923 Cumulus Media CMLS 2.08 283,081 Daktronics DAKT 7.45 773 Digital Generation DGIT 7.51 30,574 Echelon ELON 3.62 31,083 Education Management EDMC 9.35 12,768 First Solar FSLR 15.68 350,191 First Tr ISE Glbl Platinm PLTM 16.48 2,440 Flir Systems FLIR 20.91 48,366 Global Power Equipmnt Grp GLPW 19.26 3,332 Grupo Galicia GGAL 5.08 8,036 Infosys ADS INFY 43.17 67,804 iSh MSCI Emg Mkts Growth EGRW 50.65 100 iShs S&P Glbl Cln Enrgy ICLN 7.85 861 j2 Global JCOM 24.58 16,144 Knightsbridge Tankers VLCCF 10.78 44,583 Layne Christensen Co LAYN 19.27 1,802 Lincoln Educational Svcs LINC 6.10 16,333 MGP Ingredients MGPI 3.90 1,700 ManTech Intl (Cl A) MANT 23.23 12,598 Multiband Corporation MBND 2.30 3,500 Multi-Color LABL 19.29 2,126 Nash Finch Co NAFC 22.35 2,140 NxStage Medical NXTM 15.09 10,400 Oclaro Inc OCLR 2.23 97,147 Pan American Silver PAAS 16.17 144,200 Partner Comm Co PTNR 6.52 13,054 PwrShrs Glbl Wind Energy PWND 5.71 400 QuinStreet QNST 7.82 3,755 Research in Motion RIMM 11.55 1,287,594 Riverbed Tech RVBD 16.30 368,239 Scientific Learning SCIL 1.21 6,679 Sify Techs (ADS) SIFY 2.42 10,587 Silicon Graphics Intl SGI 5.83 71,395 Silver Standard Resources SSRI 11.39 109,004 Sky-mobi Ltd ADS MOBI 2.29 78,776 Sohu com SOHU 44.28 83,919 Swisher Hygiene SWSH 1.74 106,796 Sycamore Networks SCMR 14.82 6,409 Symantec SYMC 14.74 1,205,109 Transcat TRNS 8.31 1,900 Vicor VICR 6.37 12,617 Wacoal Hldgs Corp WACLY 53.96 576Comments »

Most Active Options Trades

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE COP1 6/16/12 72.5000 2688 0.4300 dn 0.2700 C 5/19/12 30.0000 2119 0.2700 dn 0.1100 DHR 6/16/12 57.5000 1934 0.1500 dn 0.0500 TTWO 6/16/12 13.0000 1888 0.6400 dn 0.0100 BAC 6/16/12 8.0000 1751 0.2200 dn 0.0300 EUO 5/19/12 20.0000 1672 0.4500 up 0.2000 YHOO 7/21/12 17.0000 1556 0.3700 up 0.0400 BAC 1/19/13 10.0000 1543 0.3500 dn 0.0100 ARNA 5/19/12 7.0000 1405 0.2100 up 0.0000 TLB 8/18/12 3.0000 1340 0.1200 dn 0.0600 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE NRG 1/18/14 10.0000 6271 1.2000 dn 0.1000 SFI 1/18/14 5.0000 5435 1.1000 dn 0.1000 SFI 1/19/13 5.0000 4567 0.6500 up 0.0000 DF 1/19/13 5.0000 4259 0.1500 up 0.0000 MHR 5/19/12 5.0000 3521 0.5000 up 0.0000 CIT 1/18/14 20.0000 3512 1.4800 up 0.0900 UAL 1/19/13 10.0000 3120 0.3800 up 0.0100 UAL 1/19/13 8.0000 1975 0.2700 dn 0.0400 PHH 1/18/14 12.5000 1875 2.0500 dn 0.2000 MGM 1/18/14 8.0000 1864 1.4600 dn 0.0300 -VOLUME- CALLS PUTS TOTAL 344099 458732 802831

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE JPM 5/19/12 37.0000 290 0.4100 dn 0.3300 AAPL 5/19/12 570.0000 182 5.2000 dn 0.4500 JPM 5/19/12 36.0000 169 0.8200 dn 0.5900 AAPL 5/19/12 585.0000 138 1.2000 dn 0.1600 AAPL 5/19/12 580.0000 127 1.9600 dn 0.0400 JPM 7/21/12 38.0000 119 1.2500 dn 0.3300 JPM 5/19/12 38.0000 114 0.1700 dn 0.1600 GLD 5/19/12 153.0000 113 0.7200 dn 1.8800 GE 5/19/12 20.0000 111 0.0100 dn 0.0300 DAL 5/19/12 12.0000 101 0.1200 up 0.0600 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE CHK 5/19/12 16.0000 850 1.0700 dn 0.8900 MS 5/19/12 14.0000 406 0.2800 up 0.1600 MS 5/19/12 12.0000 203 0.0400 up 0.0200 MS 5/19/12 16.0000 203 1.6400 up 0.5500 CHK 6/16/12 15.0000 130 1.5700 dn 0.4800 AAPL 5/19/12 520.0000 104 0.3500 up 0.0800 JCP 5/19/12 36.0000 100 2.9000 up 0.1600 GLD 5/19/12 146.0000 95 0.1800 up 0.1000 SBUX 1/19/13 40.0000 94 1.2500 up 0.3000 SBUX 6/16/12 50.0000 94 0.5300 up 0.1000 -VOLUME- CALLS PUTS TOTAL 22880 21634 44514Comments »

3D Heat Map and A/D Lines

Twilight Zone: International Law Allows, Perhaps Forces, Courts to Bend to Corporations When Government Sue

Best Buy Chairman And Founder Fired For Aiding Fired CEO; $BBY

“Former CEO of Best Buy (NYSE: BBY) Brian Dunn has an inappropriate relationship with a female employee and lost his job. The market expected that. The bomb shell about the incident surrounding Dunn was that Chairman and founder Richard Schulze knew about the relationship and did not tell the board audit committee. ”

Comments »Shares of $GRPN Gap Higher by 15%

Avon Products, $AVP, Considers Latest Buyout Offer

Avon should consider this offer as it will likely not go any higher than the current $10.7 billion…

Comments »$JPM May Invoke the Return of Glass Steagal

“We at The Small Business Authority believe in free markets. We also believe in less government regulation to more government regulation and we believe that financial institutions should be able to transact on an arm’s length basis and do so in many different markets. The primary caveat to this is when the financial institution uses a government guarantee or a government subsidy, it must therefore be very limited to the amount of risk and financial leverage that it can utilize to earn money.”

Comments »FLASH: EUROPEAN STOCKS ARE IN PLUNGE MODE, SANS PROTECTION

The Fed Gets Behind $JPM With Former LTCM Trader Appointment

Matt Zames Named as new CIO of $JPM. He has experience as a trader from LTCM and is Chairman of the Treasury Borrowing Advisory Board.

Comments »FLASH: Matt Zames Replaces Ina Drew at $JPM

Ina, once regarded as best in the business, has been ousted post CIO blow up.

Zames has long been discussed as possible heir to Dimon.

Here is an open letter, written by Zames, to Geithner in 2011–regarding the debt ceiling.

Comments »Notes From This Morning’s $CHK Conference Call

Chesapeake Energy on conference call says it market reaction to 10-Q issue was ‘so extreme’ so they wanted to get loan done on Friday afternoon and host conference call this morning

Chesapeake Energy on conference call says it does not know exactly how much it has drawn on its $4 bln revolver before it received the $3 bln loan, but says it was probably ‘north of $3 bln’

Chesapeake Energy on conference call says it ‘would not be surprised’ if Carl Icahn would become a large shareholder

Chesapeake Energy on conference call says it will cut 80% of third party land brokers

Chesapeake Energy on conference call says Eagle Ford Production deal will be delayed or cancelled; Was going to generate $1 bln

Chesapeake Energy on conference call says it still expects to sell assets in 2013 and be cash flow positive in 2014; says remaining assets will worth between $50-60 bln; says asset values will be ‘significantly higher when gas prices improve’

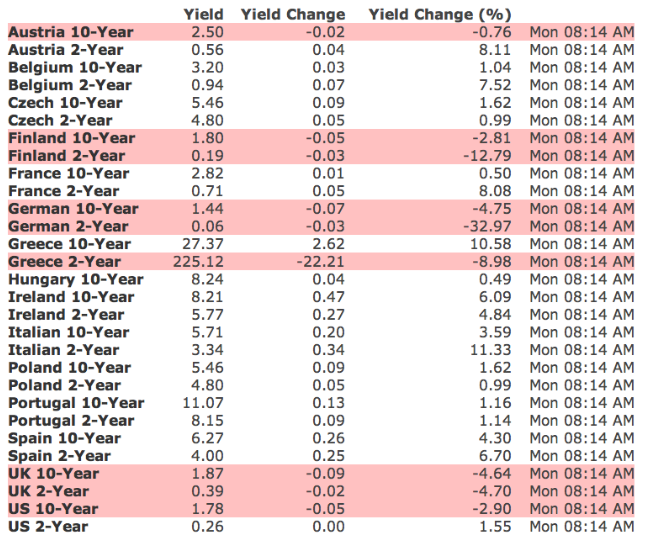

Comments »A Full Summary of European Sovereign Bond Yields

Elizabeth Warren Calls for Dimon to Resign From New York Fed

“May 13 (Bloomberg) — Elizabeth Warren, a Massachusetts candidate for U.S. Senate, called for JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon to resign his position as a director at the Federal Reserve Bank of New York.”

Comments »Chattel Slavery on the Rise

“The U.S. economy may be improving but Americans are still bogged down by massive debt burdens with little or no savings, a study finds.

One out of five families owes more on credit cards, medical bills, student loans and other unsecured debt than they have in savings, according to a new University of Michigan study, USA Today reports.

At the end of 2011, the number of families with no savings rose to 23.4 percent from 18.5 percent in 2009, the study finds….”

Comments »