Japan should be on board, but China may be the harder sell. Geithner will try to garner more international support against Iran.

Comments »Monthly Archives: January 2012

Automakers Forecast Weaker 2012 Sales in the U.S.

Weak economic growth will be the reason lower sales may be posted this year.

Comments »Hungary cancels bond swap amidst currency turmoil

Comments »BUDAPEST, Hungary (AP) — Hungary’s woes deepened Wednesday as the government’s controversial economic policies and uncertainty over whether it can agree on a deal with the IMF drove its currency to a new low against the euro.

Hungary’s borrowing costs also rose to levels not seen since 2009, forcing the government to cancel a planned bond swap auction Wednesday.

Hungary’s economy has been staggering since 2008, when the global credit crunch prompted the Central European nation of 10 million to accept an International Monetary Fund bailout of euro20 billion ($26 billion). Over the past months, investors have shied away from buying Hungarian debt, and the country’s credit rating was cut to junk status by two U.S. ratings agencies late last year. Unemployment is 10.8 percent and the country could be heading toward a recession.

Hungary is seeking a financial “safety net” from the IMF and the European Union, but preliminary talks ended early in December after the government pushed ahead with new laws seen as infringing on the independence of the National Bank of Hungary. Talks with the IMF are due to restart next week in Washington.

On Wednesday, the euro rose to a record 321.40 forints, surpassing a peak above 317 reached only two months ago, while interest rates for Hungary’s 10-year bonds was 10.6 percent, compared with 8.4 percent in early December.

“With problems likely to deepen in the eurozone and no sign that Hungary’s policy credibility is improving, Hungarian assets look set to be in for a bumpy ride,” said William Jackson, an emerging markets economist at Capital Economics in London.

Cheap natural gas to bolster U.S. chemical companies

Comments »NEW YORK (AP) — U.S. chemical companies that use natural gas as a feedstock have an advantage over European rivals that rely on more expensive crude, a Citi analyst said Wednesday.

Analyst P.J. Juvekar noted that with natural gas prices expected to average around $3.85 per 1,000 cubic feet this year, it will still be a cheaper feedstock than crude oil.

Juvekar also upgraded chemical maker Cytec Industries Inc. and nitrogen producer CF Industries Holdings Inc. to “Buy” from “Neutral” for individual reasons. Juvekar also downgraded phosphates and potash producer Mosaic Co. to “Neutral” from “Buy.”

Cytec was upgraded because of its ability to make carbon fiber, which is becoming a bigger component of new aircraft models like the Boeing 787. Juvekar also favored CF Industries over Mosaic, noting that makers of nitrogen-based fertilizers will fare better than others as fertilizer demand falls after the North American harvest. Juvekar noted that farmers must apply nitrogen-based fertilizers every year, while they can skip applying other fertilizers made from phosphates or potash.

In morning trading, CF Industries shares rose by $3.20, or 2 percent, to $157.01 while Cytec Industries shares added $1.07, or 2.4 percent, to $47.02. Mosaic shares fell by $1.19, or 2.3 percent, to $51.40.

Boeing to close Wichita plant

Comments »WICHITA, Kan. (AP) — The Boeing Co. has told its employees that it plans to close its massive defense plant in Wichita by the end of 2013 in a bid to cut costs in a tight market for defense spending.

Wednesday’s announcement means the loss of 2,100 well-paying jobs at its Kansas facility, which was once considered the centerpiece of Wichita’s claim as the air capital of the world.

It also dashes hopes for an additional 7,500 direct and indirect jobs that the company once promised to bring to Wichita with the Air Force air refueling tanker contract.

The work will move to Boeing facilities in Texas, Oklahoma and Washington.

MF Global unloading assets heavily to GS in bankruptcy runup

Comments »(Reuters) – MF Global unloaded hundreds of millions of dollars’ worth of securities to Goldman Sachs in the days leading up to its collapse, according to two former MF Global employees with direct knowledge of the transactions. But it did not immediately receive payment from its clearing firm and lender, JPMorgan Chase & Co (NYSE:JPM – News), one of the sources said.

The sale of securities to Goldman occurred on October 27, just days before MF Global Holdings Ltd (Other OTC:MFGLQ.PK – News) filed for bankruptcy on October 31, the ex-employees said. One of the employees said the transaction was cleared with JPMorgan Chase.

At the same time MF Global, which was run by former Goldman Sachs head Jon Corzine, was selling securities to Goldman to raise badly needed cash, the futures firm was also drawing down a $1.2 billion revolving line of credit it had with JPMorgan, according to one of the former MF Global employees.

JPMorgan spokeswoman Mary Sedarat said the bank did not withold money because of the line of credit. She declined further comment on details of the transactions.

Questions about OWS influence arise after Iowa

Comments »DES MOINES, Iowa (AP) — With several attention-grabbing protests before Iowa’s caucuses, Occupy Wall Street activists proved their movement did not end when its encampments in big cities dispersed. But they also showed the group hasn’t matured into a political force, and it’s not clear whether it will become a liberal counterweight to the tea party this election year.

Following Tuesday’s vote in Iowa, on which the movement had little impact, Occupy organizers are pledging to stage more protests in New Hampshire and South Carolina as the presidential nomination process moves east. But the smaller-than-expected crowds, a muddled message that was mostly ignored by candidates, and tactics that seem to limit their appeal raised questions about its long-term viability.

“This is a sign that the way they have been trying to do it probably isn’t going to work,” said Dave Petersen, director of the Harkin Institute of Public Policy at Iowa State University, who said Occupy’s only discernible impact was tighter-than-usual security at Republican events. He said the group needed to develop leaders and a more coherent message if it wanted to make the transition from a grassroots movement to an electoral powerhouse.

Occupy protesters credited their Iowa counterparts with keeping the movement going even as they questioned tactics such as heckling candidates and blocking campaign offices.

Bill Gross speaks about the markets and his “new new normal”

Comments »Bill Gross is backing away from Pacific Investment Management Co.’s outlook for a “new normal” after lagging behind the majority of his peers during the biggest bond-market rally in nine years.

The period of muted growth in developed economies, high unemployment and “relatively orderly delevering” that Mohamed El-Erian, who shares the title of chief investment officer with Gross, coined in the aftermath of the 2008 financial crisis appears to be morphing into a world of credit and zero-bound interest-rate risk, said Gross, the founder of Pimco and manager of the world’s biggest bond fund.

“It’s as if the earth now has two moons instead of one and both are growing in size like a cancerous tumor that may threaten the financial tides, oceans and economic life as we have known it for the past half century,” Gross wrote in a monthly investment outlook posted on the Newport Beach, California-based company’s website today. “Welcome to 2012.”

Most developed economies have not, in fact, de-levered since 2008 and credit remains resilient because of the multitude of monetary stimulus packages being made available through central banks in the U.S. and Europe, Gross wrote. This risks leading to unraveling of financial markets if policy makers are unable to foster growth and inflation accelerates, he said.

Early Lunch Break: Paper Only Firms Scam Medicare

2012 Risk Report (video)

This Morning’s Money Flows, Heat Map, and S&P A/D Line

Money Flows

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

iShrs Russell 2000 IWM ARCA 74.60 +45.5 1.86

Apple AAPL NASD 410.67 +34.4 1.23

Microsoft MSFT NASD 27.05 +33.5 2.32

Google GOOG NASD 662.00 +31.4 1.28

iShrs Russell 2000 Value IWN ARCA 66.49 +21.8 12.54

Intel INTC NASD 24.69 +15.0 2.14

General Electric GE NYSE 18.36 +13.6 2.37

ExxonMobil XOM NYSE 85.93 +11.9 1.52

Citigroup C NYSE 28.01 +11.7 1.45

Johnson & Johnson JNJ NYSE 65.45 +11.3 2.08

Liberty Property Tr LRY NYSE 31.04 +10.2 18.11

Bank Of America BAC NYSE 5.68 +9.4 1.34

Baidu BIDU NASD 123.34 +9.1 1.32

PepsiCo PEP NYSE 66.56 +8.3 2.43

Wells Fargo WFC NYSE 28.19 +7.4 1.91

PwrShrs QQQ Tr Series 1 QQQ NASD 56.78 +6.8 1.39

Schlumberger SLB NYSE 70.28 +6.1 1.71

Caterpillar CAT NYSE 94.63 +6.0 1.41

pricelinecom PCLN NASD 484.41 +5.7 1.51

Amazoncom AMZN NASD 178.68 +5.7 1.15

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Ventas VTR NYSE 53.94 -22.5 0.31

AT&T T NYSE 30.60 -20.7 0.49

Chevron CVX NYSE 110.20 -19.9 0.49

Verizon Communications VZ NYSE 39.97 -15.3 0.33

Procter & Gamble PG NYSE 66.73 -15.3 0.36

Sel Sec SPDR-Hlth Cr XLV ARCA 35.02 -13.8 0.18

IBM IBM NYSE 186.21 -13.0 0.65

McDonald's MCD NYSE 99.50 -12.9 0.62

Pfizer PFE NYSE 21.90 -12.6 0.39

Yahoo! YHOO NASD 15.98 -11.5 0.48

Wal-Mart Stores WMT NYSE 59.90 -11.5 0.45

SPDR Gold Tr GLD ARCA 156.96 -11.0 0.87

DuPont DD NYSE 46.39 -10.8 0.30

Merck MRK NYSE 38.10 -10.4 0.29

Duke Realty DRE NYSE 12.10 -10.4 0.04

PPL Corp PPL NYSE 28.86 -9.8 0.14

Thermo Fisher Sci TMO NYSE 46.77 -9.7 0.28

JPMorgan Chase JPM NYSE 34.50 -9.7 0.62

Cisco Systems CSCO NASD 18.45 -8.6 0.52

Teva Pharmaceutical (ADS) TEVA NASD 43.37 -8.4 0.51

Comments »

52 Week Highs and Lows Made This Morning

NYSE

New Highs 26 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Ala Pwr 5.83% O pfd. ALPpO 27.10 200 Ameriprise Finl 7.75% Nts AMPpA 28.47 1,312 Atlas Pipeline Partners APL 38.87 84,886 BlkRk Cr All Tr III BPP 11.16 144,941 BlkRk MuniYld CA Fd MYC 15.25 8,721 BlkRk MuniYld Inv MYF 14.84 5,384 Brookfield Infrastructure BIP 28.25 95,880 6.7% CorTS Cl A for SunAm KNO 25.08 500 Delphi Automotive DLPH 23.23 31,290 Entergy Inc6.0 Bd2051 EMZ 28.33 1,698 Flotek Ind FTK 11.20 796,204 Gabelli Utility Tr GUT 7.89 2,697 Invesco IMInc IIM 16.31 45,191 Invesco Qlty Mun Inco IQI 13.58 8,256 InvescoVK OHQlty VOQ 15.95 162 Kodiak Oil & Gas KOG 10.10 1,031,973 Nike Inc NKE 98.47 443,368 Nuveen Build Am Bd Opp Fd NBD 21.89 4,721 Nuveen CA Investment NQC 14.79 2,587 Nuveen California Select NVC 15.15 4,109 Nuveen Div Fnd NAD 14.64 10,658 Nuveen NY Muni Value Fund NNY 10.10 5,841 Oiltanking Partners LP OILT 29.68 2,664 Philippine Long Distance PHI 60.00 21,998 Provident Energy PVX 9.91 165,307 Vornado Rlty Tr 6.75% H VNOpH 25.16 1,644 New Lows 3 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ CPI Corp CPY 1.59 111,737 Cash Store Financial Svc CSFS 5.74 2,750 Team TISI 29.37 57,518

NASDAQ

New Highs 11 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Acorn Energy ACFN 6.62 6,795 Citizens & Northern CZNC 19.17 671 Citizens Republic Bancorp CRBC 11.82 25,761 Evolving Systems EVOL 6.24 46,282 1st Source SRCE 26.16 5,653 Google GOOG 669.25 580,048 Intuitive Surgical ISRG 474.50 45,402 Mid-Con Engy Ptrs L.P. Un MCEP 18.88 8,600 Smith & Wesson Hldg SWHC 4.62 384,211 US Home Systems USHS 6.87 3,063 Unvsl Bus Pay Sol Acqn UBPS 9.15 300 New Lows 10 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ Acme Packet APKT 25.34 5,467,954 BancTr Fincl Grp BTFG 1.14 400 BioMimetic Therapeutics BMTI 2.55 199,093 Informatica INFA 35.13 396,952 Millennium India Acqu SMCG 0.58 1,250 New Century Bancorp NCBC 1.82 6,390 Pointer Telocation PNTR 3.00 102 Sears Hldgs SHLD 31.17 194,007 Texas Instruments TXN 29.24 469,900 Trident Microsystems TRID 0.06 7,719,211Comments »

U.S. Auto Sales Up 1.8% for 12/11

GM is out with a 4.7% gain in auto sales. Kia and Chrysler were the big winners. Overall sales were up 1.8%.

Comments »Chrysler Sales Rise 37%

Most Active Options Trades This Morning

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE MMR 1/21/12 17.5000 2561 0.2900 dn 0.1000 IAG 2/18/12 17.0000 2311 1.2000 up 0.4000 F 1/21/12 12.5000 2093 0.0600 up 0.0200 MSFT 1/19/13 25.0000 1890 3.6000 up 0.1000 HL 1/21/12 6.0000 1265 0.3500 up 0.0600 MSFT 1/21/12 27.5000 960 0.3800 up 0.1000 BAC 3/17/12 6.0000 955 0.3600 dn 0.0500 F 1/21/12 11.0000 883 0.5700 up 0.1700 AAPL 1/6/12 415.0000 859 1.1500 dn 0.3000 CXO 1/21/12 100.0000 750 2.8500 up 1.1000 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BIDU 1/21/12 110.0000 1614 1.0000 up 0.0900 BIDU 1/21/12 115.0000 1571 1.8600 up 0.1500 T 2/18/12 30.0000 1209 0.6200 dn 0.0800 DAL 3/17/12 5.0000 1000 0.0700 dn 0.0200 DAL 3/17/12 6.0000 1000 0.1700 up 0.0000 MGM 1/21/12 12.5000 780 1.5600 up 0.0700 SYNO 4/21/12 25.0000 750 0.0500 dn 0.0500 APKT 1/21/12 22.5000 731 0.4000 up 0.3000 POT 2/18/12 42.5000 634 2.1100 up 0.1100 JPM 1/6/12 34.0000 542 0.2200 dn 0.0200 -VOLUME- CALLS PUTS TOTAL 178105 150331 328436

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE F 1/21/12 12.5000 2170 0.0600 up 0.0200 BAC 1/6/12 6.0000 510 0.0300 dn 0.0300 MSFT 1/21/12 27.5000 163 0.3900 up 0.1100 JNPR 2/18/12 19.0000 150 2.3700 dn 0.4900 GLD 1/21/12 163.0000 150 0.6500 up 0.1000 YHOO 2/18/12 16.0000 108 1.0000 dn 0.2300 BAC 3/17/12 6.0000 100 0.3500 dn 0.0700 MON 1/21/12 75.0000 100 0.7700 up 0.0500 AAPL 1/6/12 415.0000 86 1.0000 dn 0.4500 CIEN 1/21/12 12.5000 82 0.4000 dn 0.1200 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE GE 1/6/12 18.0000 277 0.0400 dn 0.0200 AMZN 2/18/12 165.0000 144 5.6000 dn 0.2000 AMZN 2/18/12 140.0000 132 1.3600 dn 0.0800 BMY 3/17/12 35.0000 100 1.4100 up 0.0700 GLD 1/21/12 154.0000 85 1.8000 dn 0.0300 GLD 1/21/12 153.0000 85 1.4600 dn 0.0700 GLD 1/21/12 156.0000 76 2.7200 dn 0.0500 GLD 1/21/12 152.0000 75 1.1800 dn 0.0900 SLW 1/21/12 27.0000 57 0.2400 dn 0.0200 AGO 1/21/12 14.0000 56 0.6600 dn 0.4000 -VOLUME- CALLS PUTS TOTAL 12193 8997 21190Comments »

Factory Orders: Prior -0.4%, Market Expects +2.1%, Actual +1.8%

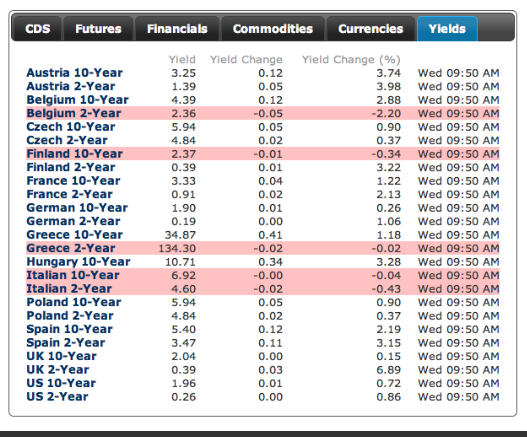

Update on Pan European Sovereign Yields

Ohio Orders the Temporary Closing of Fracking Operations After Earthquake

Other states have reported similar types of earthquakes after hydraulic fracturing has taken place.

Comments »Kyle Bass Says a Sr. Obama Official States “Were Going to Kill the Dollar” (video)

[youtube://http://www.youtube.com/watch?v=OeIFcuVTS3U 450 300]

Comments »French Oat-Bund Spreads Blowout to Recent Highs

This is the widest spread since November….when everyone was freaking out about yields.

Comments »