Yearly Archives: 2011

The New York Times is Selling Regional Papers for $143 Million

Derivatives are the Design of the Devil

Hedge Funds Miss Out on Recent Commodity Performance; Will They Chase Risk?

The Yen is Still Rising on Safe Haven Bets

Analyst Feel Deflation Has Returned to Japan as Factory Production Falls

Equity Outflows Prompt Goldman to Say Growth Has Peaked in Asia

Italian and Spanish Bond Yields Fall As Three Year Loans From the ECB are Believed to Boost Demand

Asia Trades Down While Europe and U.S. Futures Grab Meager Gains

Oh, the GOP Drama! Newt Rips Ron Paul; Romney Rips Newt

State of the Union: From Hero to Zero

USA Today Reports Banks Increase Lending

The credit crunch is getting better after a bleak period of lending that started in 2008 and the second quarter of this year.

Comments »LCD Makers Pay $533 Million For Price Fixing Scheme

Chinese Blogger Gets 10 Years in Prison for “Subversion”

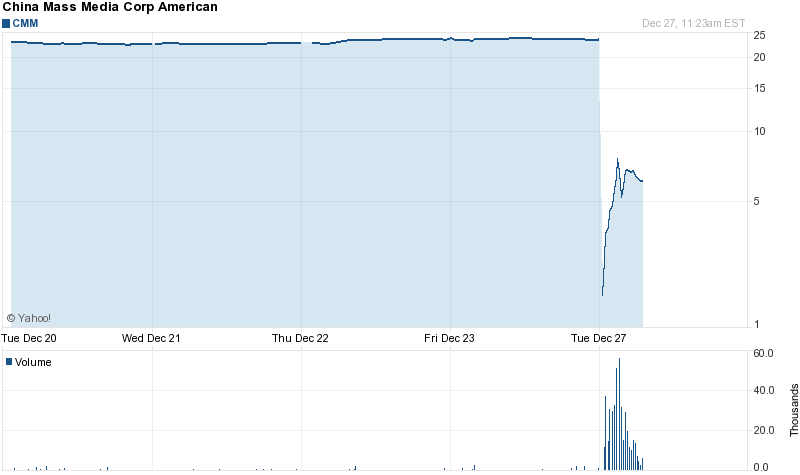

China Mass Media Corp (CMM) is Fully Idiotic

The company paid almost $23 in a special dividend to shareholders today. But then people started to sell and panic out, not knowing about the divvy. Then the insane momo buyers emerged, taking the stock up several hundred percent in minutes. The result is this chart.

Comments »Overnight Deposits Hit New Highs at the ECB

GE Moves Into Online Banking With a Purchase of MetLife’s Retail Division

“General Electric Co.’s finance arm moved quickly on its plan to get into online banking, announcing plans to buy insurer MetLife Inc.’s U.S. retail deposit business.

The acquisition, announced Tuesday, will bring GE Capital $7.5 billion in deposits and MetLife’s online banking platform, which could speed GE’s efforts to attract more individual savers. Terms of the deal, which will boost GE Capital’s existing U.S. deposit base of $23 billion by about a third, weren’t disclosed.

GE Capital said earlier this month that it will launch an online banking platform to attract more retail deposits. GE’s lending business is bigger than all but seven U.S. banks, but its so-called wholesale-funding model means it has to regularly go to the markets to raise the money it uses to make loans. That model was shaken when markets froze during the financial crisis, prompting GE to put the business on firmer footing.”

Comments »This Morning’s Money Flows, Heat Map, and A/D Line

Money flows

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

SPDR S&P 500 SPY ARCA 126.65 +43.2 1.30

Apple AAPL NASD 408.16 +24.8 1.08

Coca-Cola KO NYSE 70.06 +9.1 2.35

Graco Inc GGG NYSE 40.39 +8.7 35.88

Chevron CVX NYSE 108.31 +8.3 1.79

AT&T T NYSE 29.92 +7.8 2.43

McDonald's MCD NYSE 100.59 +7.7 2.07

IBM IBM NYSE 184.65 +7.3 1.44

Pfizer PFE NYSE 21.85 +7.0 2.63

Johnson & Johnson JNJ NYSE 66.10 +6.7 1.74

Annaly Capital Mgmnt NLY NYSE 16.30 +6.4 1.74

PwrShrs QQQ Tr Series 1 QQQ NASD 56.28 +5.8 1.45

ConocoPhillips COP NYSE 72.81 +5.2 2.02

Cisco Systems CSCO NASD 18.55 +4.8 2.11

Freeport McMoran FCX NYSE 38.11 +4.6 1.60

Vale S.A. VALE NYSE 21.96 +4.2 2.03

Nike Inc NKE NYSE 97.24 +4.0 2.42

Teva Pharmaceutical (ADS) TEVA NASD 41.87 +3.6 2.71

Union Pacific UNP NYSE 106.06 +3.3 1.97

MetLife Inc. Un MLU NYSE 62.17 +3.3 2.06

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Procter & Gamble PG NYSE 66.70 -15.2 0.38

Wal-Mart Stores WMT NYSE 59.89 -13.0 0.30

iShrs Tr MSCI EAFE EFA ARCA 49.32 -11.9 0.37

Salesforcecom CRM NYSE 100.64 -11.9 0.68

Microsoft MSFT NASD 26.08 -9.5 0.45

Vanguard Total Bond Mkt BND ARCA 83.19 -7.8 0.15

General Electric GE NYSE 18.15 -7.3 0.66

Mead Johnson Nutrition MJN NYSE 68.97 -6.5 0.86

iShs Brclys Aggregate Bd AGG ARCA 109.82 -6.3 0.24

Weight Watchers WTW NYSE 57.30 -5.9 0.12

Merck MRK NYSE 37.88 -5.8 0.33

Hewlett-Packard HPQ NYSE 25.96 -5.5 0.34

Verizon Communications VZ NYSE 39.95 -5.4 0.43

JPMorgan Chase JPM NYSE 33.58 -5.2 0.66

MetLife MET NYSE 31.56 -5.1 0.59

Amazoncom AMZN NASD 178.10 -5.0 0.84

Best Buy BBY NYSE 23.34 -4.8 0.43

Intel INTC NASD 24.48 -4.6 0.68

Ford Motor F NYSE 10.93 -4.5 0.54

Abbott Labs ABT NYSE 56.20 -4.4 0.44

Comments »

52 Week Highs and Lows Made This Morning

NYSE

New Highs 109 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Abbott Labs ABT 56.25 411,373 Alaska Air Grp ALK 77.14 33,869 Amer Campus Communities ACC 41.99 39,417 Amer Fincl Grp AFG 37.48 17,980 Amer Tower AMT 60.47 96,497 American Water Works Co AWK 32.34 58,152 Assd Banc-Corp.8.00%Pfd ABWpB 25.15 858 BlackRockMuni 2020 BKK 15.77 404 BlkRk Munienhanced MEN 11.68 10,602 BlkRk MuniHldgs II MUH 15.56 4,253 Blkrck MunHl NJ Qlty MUJ 15.71 9,472 BlkRk MuniVest II MVT 15.64 1,875 BlkRd MuniYld Michigan II MYM 14.42 8,003 BlkRk MuniYld MI Qlty MIY 15.40 8,239 BlkRk MuniYld NJ Fd MYJ 15.47 1,297 BlRk Muyld NJ Qlty MJI 15.83 5,627 BlkRk MuniYld Qlty II MQT 13.68 11,707 BlRkMunyldQltyIII MYI 13.97 23,095 BlackRock NJ Municipal Tr BNJ 15.55 2,626 Brown Forman A BF/A 80.50 5,286 Brown Forman B BF/B 81.58 17,909 CMS Energy Corp CMS 22.12 130,284 Cervecerias Compania CCU 62.63 4,818 China Mass Media ads CMM 4.50 100,462 Chubb Corp CB 70.22 64,341 Cleco Corp CNL 38.01 22,970 ConAgra Foods CAG 26.68 213,464 Consolidated Edison ED 62.29 138,922 Consumers Engy $4.50 pfd. CMSpB 92.99 210 Cross Timbers Royalty Tr CRT 51.00 4,554 DCP Midstream Ptnrs DPM 45.92 1,959 DWS Muni Inco KTF 13.70 13,611 Delphi Automotive DLPH 22.89 126,333 Dominion Resources D 53.28 116,821 Dreyfus Strategic Munis LEO 8.89 13,533 Duff & Phelps Utl & Cp Bd DUC 12.20 5,565 Duke Energy DUK 21.94 568,793 Education Realty Trust EDR 10.11 52,616 El Paso Corp EP 26.32 306,818 EnbridgeEnergy EEQ 34.24 4,407 Enbridge Inc ENB 37.31 33,175 Gallagher AJG 33.88 22,224 Gazit-Globe GZT 9.77 54,669 General Mills GIS 40.80 443,955 Great Plains Energy Inc GXP 21.91 33,105 HCP HCP 41.44 125,504 HnckJohn TxAdv HTD 17.38 16,514 Hershey HSY 61.41 77,948 Home Depot HD 42.29 555,232 Idacorp IDA 42.40 25,834 Inergy Midstream LP NRGM 18.87 40,680 Integrys Engy Gp TEG 54.05 31,376 Invesco CA Qty Tr IQC 13.93 4,384 Invesco Quality Mun Secs IQM 14.64 5,433 Invesco Van Kampen Bd Fd VBF 21.85 2,780 Invesco VK PAValMun VPV 14.38 10,096 Inv Vn Km NJ VTJ 17.34 2,190 Kayne Anderson Engy Dev KED 21.46 3,771 Kimberly-Clark KMB 73.92 144,989 Kinder Morgan Mgmt KMR 77.40 17,187 Kodiak Oil & Gas KOG 9.67 692,050 Kraft Foods KFT 37.93 442,708 McDonald's MCD 100.66 343,222 NV Engy NVE 16.30 69,053 NJ Resources NJR 49.34 6,568 NextEra Energy NEE 60.66 124,547 Nuveen Build Am Bd Opp Fd NBD 21.86 637 Nuveen CA Investment NQC 14.67 7,442 Nuveen CA Muni Value NCA 9.49 2,852 Nuveen CA Performance NCP 14.88 5,981 Nuveen CA Quality Income NUC 15.94 6,025 Nuveen Insured CA Muni 2 NCL 15.48 7,295 Nuveen Invest Qual Muni NQM 15.55 14,988 Nuveen NJ Premium Income NNJ 15.39 7,155 Nuveen NY Quality Income NUN 15.41 10,716 Nuveen Premier Insd Muni NIF 15.72 6,278 OGE Energy OGE 56.39 16,542 Oneok Inc OKE 87.18 21,771 Omnicare Inc OCR 35.24 60,504 Oxford Indus OXM 44.90 2,176 Pfizer PFE 21.90 1,902,639 Philip Morris Intl PM 79.42 383,589 Pimco Calif Fund PCQ 13.45 4,277 Pionr Muni HI Tr MHI 14.95 2,769 Progress Energy PGN 55.73 74,998 Public Storage PSA 135.41 41,000 Putnam Muni Opportunities PMO 12.11 13,910 Questar Corp STR 19.95 44,708 SandRidge Permian Trust PER 21.94 25,489 Scana 7.70%Sers A SCU 29.40 1,086 Southern SO 46.17 307,636 Southwest Gas SWX 42.89 19,156 Standard Motor SMP 20.76 14,297 TJX Cos TJX 65.50 157,460 Triumph Group TGI 60.90 18,534 Tyson Foods TSN 21.00 142,996 UIL Hldgs UIL 35.41 17,094 Vectren Corp VVC 30.24 25,172 Verizon Communications VZ 39.99 711,430 VISA (Cl A) V 103.10 392,644 WGL Holdings WGL 44.30 33,600 Westar Energy WR 28.66 34,439 Western Asset Income Fd PAI 14.49 7,189 Western Asset Invt IGI 22.88 15,200 Western Asset Mun Tr Fund MTT 22.18 1,615 Wstrn Asset Muni Ptnrs Fd MNP 15.26 3,111 Wisconsin Energy WEC 34.95 49,336 Wyndham Worldwide WYN 37.78 171,632 YUM! Brands YUM 59.40 235,763 New Lows 6 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ China Education Alliance CEU 0.65 22,797 China Green Agric CGA 2.71 52,758 HSBC USA pfd. Ser D HBApD 18.76 4,229 MS China a Shr Fd CAF 19.23 22,144 Panasonic Cp PC 8.17 61,762 Verso Paper VRS 0.91 10,250

NASDAQ

New Highs 23 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ AMAG Pharmaceuticals AMAG 19.62 2,149 AmerElecTech AETI 4.59 2,950 American Software (Cl A) AMSWA 9.44 13,327 Amgen AMGN 63.97 324,577 C&F Fincl CFFI 26.48 1,560 Cardtronics Inc CATM 28.74 49,432 Copart CPRT 48.00 13,261 CryptoLogic CRYP 2.53 187,706 Curis CRIS 4.58 231,200 Fastenal Co FAST 43.95 115,149 Golar LNG Partners LP GMLP 30.70 15,221 Huron Consulting Group HURN 39.95 20,033 Intuitive Surgical ISRG 462.80 37,641 Jack Henry & Associates JKHY 34.25 17,754 Jive Software JIVE 16.86 50,433 Multimedia Games Holding MGAM 8.13 43,187 Parlux Fragrances PARL 6.60 406,230 PETsMART PETM 52.24 68,302 Ross Stores ROST 48.68 101,250 Silicon Motion Tech (ADS) SIMO 21.19 40,917 Starbucks SBUX 45.83 429,874 Video Display VIDE 6.10 2,801 World Acceptance WRLD 73.26 21,658 New Lows 16 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ API Technologies ATNY 2.97 185,885 Alaska Comm Sys Grp ALSK 3.18 336,546 BioDelivery Sciences BDSI 0.82 19,866 Central VA Bankshares CVBK 0.50 4,100 China Yida Hldg Co CNYD 2.00 5,300 HomeAway AWAY 19.77 198,473 Ku6 Media ADS KUTV 0.91 986 Optical Cable OCC 2.74 1,969 ProShs UlShrt Nsdq Biot BIS 33.37 100 SORL Auto Parts SORL 2.52 12,325 Sears Hldgs SHLD 36.51 1,751,867 TBS Intl Cl A TBSI 0.20 18,585 Thermogenesis KOOL 0.77 7,818 Vertro Inc VTRO 1.07 8,670 Westinghouse Solar WEST 0.28 63,628 Yucheng Techs YTEC 2.05 6,590Comments »

Winning and Losing Sectors Update

----- Percent Change ------

Sector Index Daily 1 Wk. 1 Mo. 3 Mo. 1 Yr.

===============================================================================

Computer Hardware 8557.01 56.75 1.70 9.27 3.17 6.36

Gambling 6158.53 51.18 3.07 5.43 -1.57 -6.00

Distillers & Vintners 5050.55 39.23 1.58 9.57 14.17 -0.74

Restaurants & Bars 9651.59 26.96 1.63 10.04 11.14 27.09

Tobacco 4892.61 21.84 1.31 9.74 17.57 30.47

Food Prod 2961.21 18.52 1.03 6.54 2.08 12.21

Integrated Oil & Gas 5684.90 17.32 1.37 15.06 16.03 15.19

Exploration & Production 7062.75 16.83 0.43 6.95 11.16 -1.92

Footwear 7328.70 15.14 2.42 6.23 1.54 11.25

Iron & Steel 2456.54 14.35 0.96 14.65 17.14 -19.36

Personal Prod 4679.68 14.32 1.55 7.60 3.55 12.00

Life Insurance 3021.73 13.91 1.43 13.06 13.83 -20.99

Pipelines 7033.32 9.60 1.34 8.35 30.67 48.05

Internet 2195.93 9.19 1.06 12.79 17.02 2.63

Health Care Providers 4886.27 9.12 0.77 10.17 8.97 12.29

Water 5030.16 8.53 0.94 6.70 4.75 9.83

Hotels 2714.35 6.41 2.08 11.96 15.29 -15.60

Biotechnology 3738.06 6.32 0.68 9.14 2.75 2.94

Consumer Finance 5639.08 6.23 1.42 10.15 7.29 25.34

Insurance Brokers 2851.75 6.00 0.82 9.05 15.16 9.03

Apparel Retailers 3805.90 5.92 1.33 9.17 6.89 10.80

Specialty Chemicals 5649.83 5.74 1.17 8.81 5.05 -2.85

Home Improv Retailers 7082.49 5.62 0.12 14.15 24.45 11.85

Pharmaceuticals 2472.27 5.39 1.03 12.55 12.15 15.14

Transportation Serv 2465.36 4.83 0.15 10.83 17.18 -3.12

Soft Drinks 3990.71 4.72 1.03 7.79 3.14 6.16

Software 7160.64 4.51 0.95 2.17 -2.05 -8.69

Nondurable Household Prod 5775.26 4.04 0.74 9.03 4.91 3.54

Commodity Chemicals 2386.24 3.61 1.53 12.06 11.42 -3.44

Electricity 1892.16 3.22 0.82 8.16 5.50 12.39

Waste & Disposal Serv 1288.76 3.14 1.10 7.20 1.32 -1.38

Prop & Casualty Insurance 3773.79 2.97 0.68 10.32 14.75 3.35

Food Retailers & Wholesalers1882.09 2.92 1.00 10.60 9.98 8.08

Aluminum 1171.84 2.87 -0.22 1.25 -13.98 -40.22

Mobile Telecom 1259.81 2.82 -0.12 8.86 0.41 -12.06

Medical Equip 5440.62 1.85 0.67 8.27 0.04 -1.96

Multiutilities 1466.01 1.57 1.08 9.04 8.99 17.30

Financial Admin 4325.20 1.26 0.80 12.03 12.28 7.86

Gas Distribution 2090.19 1.06 0.96 8.63 13.99 17.95

Asset Managers 5289.64 0.83 0.91 13.30 10.05 -19.56

Marine Transportation 1351.51 0.68 -0.24 9.16 3.15 -16.77

Consumer Electronics 7394.53 0.66 0.21 1.58 1.21 -24.70

Mortgage Finance 177.23 0.59 1.30 12.45 10.04 -20.06

Trucking 3461.80 0.40 0.53 11.17 10.51 -6.88

Airlines 586.25 0.36 -0.12 17.96 0.54 -28.87

Fixed Line Telecom 1131.48 0.24 1.04 9.37 4.43 0.88

Forestry & Paper 1594.04 0.15 0.64 13.38 10.60 3.19

Industrial Suppliers 4178.52 0.12 1.21 13.43 20.84 25.60

Specialized Consumer Serv 3610.25 -0.18 0.98 10.90 2.15 4.12

Paper 1252.46 -0.23 0.66 13.36 10.49 2.98

Travel & Tourism 2372.96 -0.33 0.96 5.58 -2.84 8.90

Full Line Insurance 324.00 -0.36 0.40 14.16 3.68 -32.43

Nonferrous Metals 6099.72 -0.41 0.05 12.54 7.91 -34.73

Recreational Serv 2325.33 -0.61 1.52 9.78 7.80 -20.61

Delivery Serv 7814.26 -0.74 0.61 9.81 13.83 -6.57

Brewers 4765.62 -1.29 0.91 15.50 11.42 -10.59

Medical Supplies 6648.67 -1.40 0.48 7.26 -2.99 -4.21

Farming & Fishing 5341.44 -1.71 0.47 5.10 7.86 6.26

Specialty Retailers 2929.11 -1.96 0.70 4.19 2.90 -0.51

Tires 421.92 -2.30 0.70 14.95 30.72 -1.62

Business Support Serv 957.10 -2.32 -0.10 5.24 4.50 1.45

Clothing & Accessories 2793.62 -2.81 2.29 4.33 -0.41 13.21

Gold Mining 2162.60 -2.97 1.10 -3.00 -2.65 4.27

Defense 4578.68 -3.09 0.51 9.03 10.68 0.38

Toys 3430.90 -3.18 1.46 0.28 -1.00 -1.10

Media Agencies 3793.68 -3.46 0.73 10.48 11.41 -12.56

Automobiles 1753.42 -3.63 -0.03 9.11 5.64 -31.53

Home Construction 2394.52 -3.87 -1.17 12.11 27.57 -10.45

Electronic Office Equip 894.68 -5.11 0.61 8.34 4.85 -27.37

Electr Components & Equip 2247.50 -5.26 0.77 8.97 8.31 -13.43

Real Estate Invest Trusts 2051.00 -5.62 0.14 11.10 8.53 2.46

Oil Equip & Serv 5730.71 -5.64 0.70 6.50 9.49 -8.80

Coal 3257.18 -5.92 -1.27 6.56 -5.92 -42.56

Diversified Industrials 2726.73 -5.93 0.87 17.12 14.53 -0.92

Real Estate Invest & Serv 2053.22 -5.96 -0.33 7.37 6.49 -20.16

Electronic Equip 3288.38 -6.26 1.16 5.24 7.84 -9.16

Build Materials & Fixtures 2557.53 -6.39 0.20 14.81 21.83 -0.38

Computer Serv 6902.35 -7.17 1.18 4.52 3.15 17.67

Heavy Construction 4181.37 -7.84 0.35 9.11 9.08 -16.14

Broadline Retailers 3902.76 -7.92 0.45 2.80 0.50 5.37

Banks -SS 2038.40 -8.17 0.25 15.00 7.62 -24.94

Drug Retailers 6360.14 -8.67 1.02 7.88 7.81 7.88

Containers & Packaging 2549.64 -9.04 0.15 7.62 6.67 -1.80

Telecom Equip 5569.31 -9.22 0.98 4.85 8.65 -8.28

Publishing 2315.29 -9.32 0.82 10.59 9.42 -1.69

Industrial Machinery 4677.41 -10.30 0.75 9.56 14.05 -6.63

Furnishings 2668.40 -13.13 -0.24 15.62 11.58 1.81

Broadcasting & Entertainmen 3849.11 -13.21 1.04 9.06 7.70 7.04

Invest Serv 2970.32 -13.93 -0.46 8.70 -0.62 -33.73

Commercial Vehicl & Trucks 10495.32 -16.16 0.64 6.68 13.21 -12.22

Durable Household Prod 1638.12 -16.21 -0.18 10.21 14.46 -10.41

Auto Parts 2283.73 -17.85 1.04 9.50 8.28 -14.93

Specialty Finance 3787.83 -19.67 0.20 12.01 9.86 -5.16

Reinsurance 6115.05 -20.66 0.86 6.08 8.38 -3.66

General Mining 2384.67 -22.21 -0.71 3.20 -9.74 -28.29

Business Training & Emp 3880.71 -33.12 -0.51 15.48 13.41 -28.24

Comments »