This time, owned by DISH, their pockets are deep and NFLX is wounded.

Comments »Monthly Archives: September 2011

STUDY: 30% of Netflix Users Consider Leaving

Today’s Winners and Losers

No. Ticker % Change

1 ATRN 47.11

2 KONA 27.00

3 REVU 21.43

4 CMLS 19.20

5 AUTH 15.04

6 EVC 15.04

7 REXX 13.51

8 CVVT 12.80

9 AMAC 12.09

10 BGMD 11.75

11 PARD 11.46

12 OMEX 10.56

13 MHR 10.07

14 VRML 9.83

15 NAVR 9.71

16 FTWR 9.43

17 CWTR 8.46

18 TNCC 8.34

19 GLNG 8.27

20 NUGT 8.18

21 OREX 7.48

22 NG 7.23

23 IPG 7.19

24 FSM 7.19

25 SCON 7.14

———————————

No. Ticker % Change

1 MCP -18.43

2 HLS -14.63

3 CYDE -12.50

4 NCT -11.68

5 CMM -11.66

6 HEV -11.29

7 ARAY -10.39

8 MITL -9.91

9 MLNX -9.69

10 LOGL.OB -9.25

11 FEED -8.70

12 ZN -8.70

13 NFLX -8.58

14 TSL -8.42

15 DUST -8.03

16 STP -7.98

17 REE -7.76

18 SOL -7.58

19 DATE -7.47

20 CGA -7.12

21 RST -7.02

22 YGE -7.00

23 CXM -6.90

24 SCOK -6.84

25 PRAN -6.74

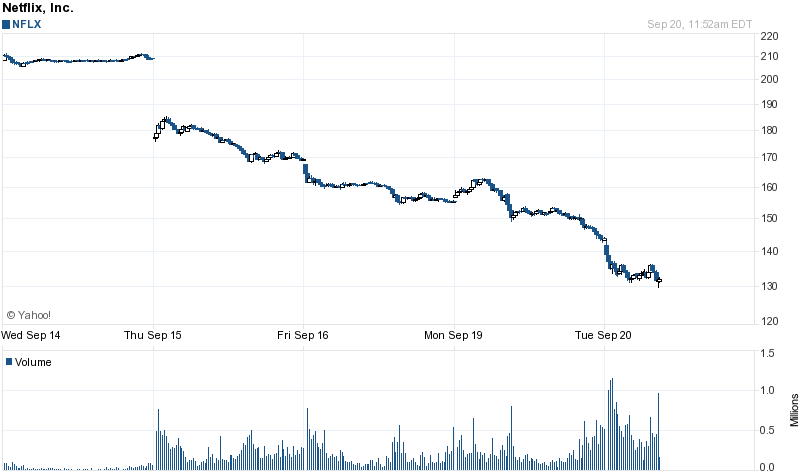

FLASH: SHARES OF NFLX IN VAPOR LOCK MODE

Down another $12 to $131.86

Comments »FLASH: Italian 10 Yr Yields Rise

+2% to 5.7%, clearly in the danger zone.

Comments »IMF Special Report: Averting Another ‘Lehman Moment’

The real question is; are we setting up a Lehman scenario with bailouts ?

Comments »As With FB You Should Be Careful of How You Advetise yourself on LNKD

Time to Face the Music in Greece

No matter what your persepctive is on how Greece arrived at the current crossroads; it is important to consider what is ultimately going to happen and if bailouts should even go forward.

Comments »FLASH: AAPL Hits a New 52 Week High

AAPL was described as a stock to watch to determine the direction of our markets during uncertain debt woe times.

Could AAPL be signaling a recovery and little downside for U.S. markets ? ….stay tuned

Comments »Targeted Taxes vs. Tax the Rich

More of the wealthy actually pay higher tax rates in addition to a large portion of taxes collected.

Obama has engaged in class warfare no ?

Yes and no IMO. There are some people collecting only interest income and paying very low tax rates for that income. Others like Warren make pass through income where tax rates are lower. So some people and corporations need to be brought into the light, but it is improper to make the statement that the rich get away with less tax rates than mom and pop.

Instead of making it all political why not reform the tax code. Fire the IRS and create a flat tax based on consumption. Luxury taxes can stay in force if you must attack a class.

Comments »IMF Cuts Global Growth Outlook; Europe in Deep Mire

Your Tax Dollars at Work: How The Federal Government Pays More For Outsourcing

Demi Moore Tweets Nude Pics of Herself

Founder of Vanguard Jack Bogle: Buy Stocks and Double Your Money in Ten Years

“What I try to point out to people is the stock market moves in cycles. We had this great cycle in the 1980s, this great cycle in the 1990s, this terrible cycle in the first decade of century and on average for the three of them, it was a rather normal level, maybe a little bit above that, of 9 percent,” Bogle says.

Comments »Upgrades and Downgrades This Morning

Upgrades

CARB – Carbonite initiated with a Buy at Canaccord Genuity

TW – Towers Watson ests raised at Stifel Nicolaus

SAP – SAP AG upgraded to Outperform from Market Perform at Wells Fargo

MGM – MGM Resorts upgraded to Overweight from Equal Weight at Morgan Stanley

SBSI – Southside Banc assumed with Market Perform at Keefe Bruyette

PER – SandRidge Permanian Trust initiated with a Mkt Perform at Morgan Keegan

JPM – JPMorgan Chase initiated with an Overweight at Evercore

RL – Polo Ralph Lauren upgraded to Outperform from Neutral at Cowen

TRV – Travelers upgraded to Buy from Sell at Goldman

VMW – VMware initiated with a Buy at Merriman

PHM – PulteGroup upgraded to Buy from Neutral at UBS

CHKM – Chesapeake Midstream Partners initiated with Outperform at Credit Suisse

VC – Visteon initiated with a Buy at BofA/Merrill

AWH – Allied World Assurance resumed with a Neutral at Goldman

Downgrades

CVH – Coventry Health Care downgraded to Underperform at Wedbush

MCP – Molycorp downgraded to Neutral from Overweight at JP Morgan

PRU – Prudential target lowered to $66 at FBR Capital

AIXG – Aixtron downgraded to Neutral from Buy at UBS

LINE – Linn Energy initiated with a Neutral at Credit Suisse

TPX – Tempur-Pedic initiated with a Neutral at Goldman

FDX – FedEx ests and target lowered to $120 at Dahlman Rose

FIO – Fusion-io initiated with an Underperform at Sterne Agee

MRVL – Marvell downgraded to Market Perform from Outperform at JMP Securities

SLRC – Solar Capital initiated with a Hold at Stifel Nicolaus

AIXG – Aixtron downgraded to Underperform at Chevreux

HLS – Healthsouth downgraded to Fair Value from Buy at CRT Capital

QSFT – Quest Software initiated with a Hold at Capstone

Comments »Gapping Up and Down This Morning

Gapping up

CISG +5.3%, KONA +15%, RIO +1.9%, SNY +2%, ABX +1.5%, GOLD +1.5%, BBL +1.4%, KEX +3.7%, AEM +2.6%, HL +1.9%,

NOK +2.2%, RCL +3.4%, APD +0.5%, MGM +4%,

Gapping down

LYG -2.3%, GILD -2%, RAH -1.5%, NCT -9.7%, MLNX -3.5%, NFLX -2.6%, JAZZ -4.6%, UBS -1.1%, SLV -1%,HME -4.6%, WES -4.2%, ARAY -4.1%,

Comments »