I’ve alluded to numerous parts of my aversion to TSLA stock, but I’d like to lay it out now in a more complete manner. The basic disposition is not any contempt for the company or what Elon Musk has managed to accomplish. On the contrary, you may be shocked to learn that I actually like Mr. Musk, and secretly root that he displaces the major auto companies for a piece of their market share.

However, I do hold the utmost contempt for anyone buying the stock at these prices, and wish upon them losses ranging higher than 60% of their principle. Such as is only due to them for what is a total disregard for due diligence and common sense.

I personally value the shares much closer to $20 as a growth stock, but feel that even numbers from the most optimistic of forecasts barely justifies a price between $30-60. I wouldn’t buy them for anything more than $10-20.

The reasons are as follows:

Power Series And Excessive Risk Encouragement From Bad Modeling

The steady stream of increasingly fanciful storytelling (you cannot call these projections) are a blemish on the world of finance and anyone daring to call themselves an analyst. They are made to be startling (in this case, in a positive way for the company) for the purpose of garnering attention to the analyst. If the analyst is right and the stock does make their several hundred dollar price target, the will have “earned” a reputation for themselves as a “brilliant” mind with “vision and tenacity”.

When they are wrong (most of the time) they bury the piece and pray no one mentions it.

There is a complete lack of ethics as I see it in this process, and these men and women, who are leading every day investors into compromising positions that may cause them serious harm, are the scourge of the financial industry. Eventually, the Henry Blodgets of the world all get ousted as shams, but not before causing serious injury to those that trust them and always in a victory that is a hollow as it is non-redeeming for the victims.

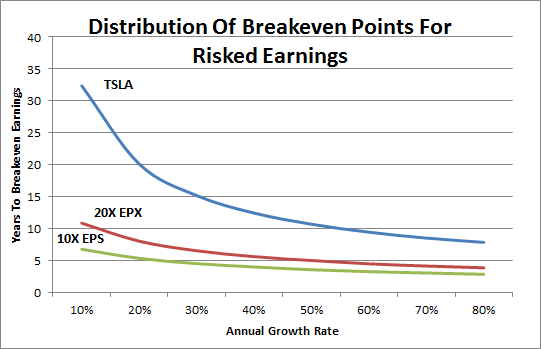

Below is a chart demonstrating the consequences being sewn in the creation of these projections. The three lines show the length of time at various hypothetical growth rates it would take for TSLA, as measured against two theoretical generic 10X and 20X EPS stocks, to attain the earnings level they are being priced at.

This type of distribution, while not perfectly conveying the “real world” fluctuations of a dynamic company, gives a good idea how an average, normal company would make towards paying off capital risked on future earnings, at various growth rates, under three circumstances: a 10X EPS company, like many blue chips; a 20X EPS company, which is usually reserved for growth stocks…

And then, there’s Tesla

Buying TSLA today at the astronomical projected growth rates of 40% or more is already more than double the demands on the investor for taking what are professionally viewed as “larger risks” of buying a 20X EPS tech company.

And what this graph does not convey well is what happens when the average, normal rate of growth is interrupted.

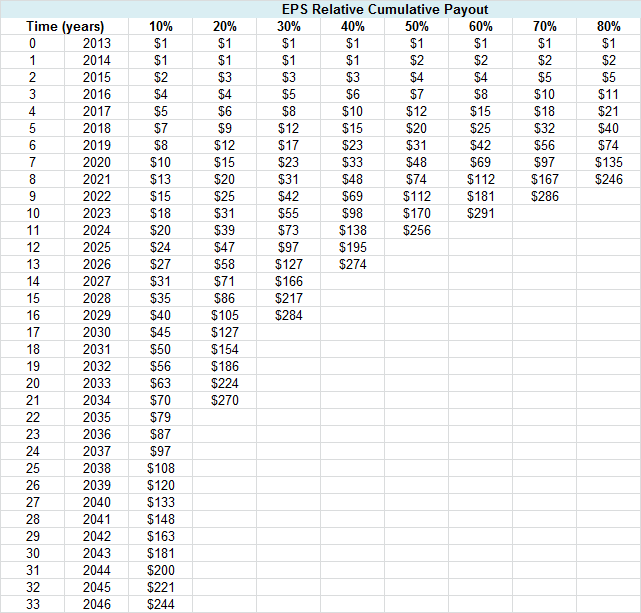

To get a sense of that, look at the accompanying table, which details the consequences of a mid-projection period miss.

Let’s suppose our stock is forecasted to grow earnings a rate of 40% for 10 years, theoretically increasing $1 of hypothetical annual earnings to $98 of earnings per share, per year. This is most fantastic.

But, I regret to inform you of a sensitivity of our projection to unintended consequences. You see, of the $98, $29 of that is earned only in the last year of this growth. This accounts for 30% of all earnings over the 10 year period. Similarly in severity, the last two years of earnings account for $50 of all our earnings (more than half).

Now what would happen if our high flying stock were to slow the earnings growth just slightly before ahead of schedule to a less fabulous 10% rate of growth? As the celebrity analyst that I am, forecasting huge prices for the future, such a small inconvenience should not be a big stumbling point – after all, I was dead on about this company delivering 8 years of exceptional growth!

But, for my slight error, the consequences are most grave. For because I encouraged you to pay a whopping 230X EPS for the shares of this company (which is where Tesla stood last check, measured against just one measly quarter of profits), I can see from the table above that it would take you an additional 16 years of profits at that 10% growth rate to break even.

As an analyst trumpeting forces of a high flying growth stock I do not fully understand, the repercussions have cost you 24 very dear years of your life, just to get back to even. The problem is that all of the gains come at the very end of the line, and so does most of what’s needed to get back to even.

The Competition And The Danger They Pose To Sales And Pollution Credits

It is not a secret that Tesla lost money on basically every element of the automotive business last quarter. To my knowledge, they lost money on every car sold, every human body in their plant, every piece of equipment they own, and every square inch of their facility. But then they made $40 million selling GHG/CAFE and ZEV credits, which put them into black.

What is perhaps a secret is how quickly they could stand to lose proceeds from those.

It is unclear who Tesla is selling these credits to. However, when thinking of automotive companies with poor fuel economy in need of offsetting pollution credits to keep selling cars, companies with large SUV and Truck lines and lacking successful, smaller and more fuel economic models inevitably come to mind. And that greatly limits the field to the Big 3 American autos.

With GM’s electric Cadillac set to launch in November, the real looming danger to Tesla is not that this car may be a big hit and still sales from it (that is also a threat, but not the chief concern). The biggest threat is that GM’s launch, if set with just the right level of production, may substantially reduce the number of pollution credits it needs to buy (or knock it out of the market entirely). GM will now have three electric/hybrid platforms, of varying degrees of success.

If Ford and Chrysler start to match these lineups, Tesla could see any market for its credits start to vanish in as little as 12 months.

With GM now announcing that they intend to study Tesla’s Model S (read strip and reverse engineer), GM or one of the other major auto makers may attempt to push out a comparative model at a loss. The danger here for Tesla is that such a move may be undergone, even if it loses that competitor money, as it will strangle Tesla.

The Problematic Costs Of The Vehicles

(I’m putting a temporary hold on this section. The $38,000 number was picked up from various estimates of others online. However, it’s come to my attention that those numbers were picked off an interview with Musk in 2009. Obviously battery costs have come down substantially since then by estimates ranging to about half. This seems to effect primarily the chart and the implied work to create a <$40,000 vehicle – there is no real work needed to create a cheap vehicle, but there is substantial work to create a cheap battery; whether it effects much else depends on whether or not you believe Tesla can put out that type of vehicle before any of the other automotive companies. I'll leave that to you. I intend to fix the chart later. I'll also point out that I didn't get into the effect that replacement cost of the battery at every 8 years has on the resale value of the vehicle and secondary ownership)

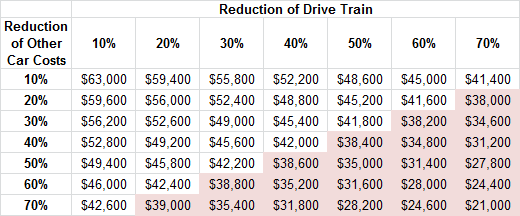

The saving hail Mary for TSLA is supposed to come in the form of an affordable, under $40,000 sedan that can be sold to the masses. What would it take to build such a vehicle?

If we take estimates of the battery at around $38,000, the there are two means by which Tesla can hope to reduce the lower end $70,000 price tag for a Model S. They can reduce the cost of the drivetrain/batter components, or they can try and deeply reduce the cost of the rest of the vehicle development.

This process can be shown here:

What we see is that very steep cuts in any element of vehicle construction are needed to reach the $40,000 sticker price. Do I think this can be accomplished? Of course. Mass production and economies of scale are immensely powerful things.

But, as we discussed in the first section, time is not on Tesla’s side here.

It’s not enough to envision that mass production can be used to steeply cut the cost of battery construction. We’re on a strict time schedule imposed by the very high demands of the stock price, and any delays at this current share price will open up TSLA stock to deep losses.

In addition, the longer it takes TSLA to put out a cheaper electric car, the greater the risk becomes that one of the major auto companies like GM, Ford, or even Tesla frenemy Toyota will beat them to the punch. Any major auto company is in a much better position to take advantage of global supply chains and leverage cheaper costs. If Tesla has become enough of a threat to garner this sort of attention, then it’s a threat that’s about to receive the costs of that attention – patent infringements and all.

I read over an article today that insinuates Tesla has already managed to create a $30,000 vehicle; you just need to stop selling batteries.

The article points out that if you don’t sell the batteries, but instead keep them in a sort of Tesla controlled limbo, that you can offer the vehicles for much cheaper. I like the idea of Tesla not selling their batteries anyway – particularly if you want to make a battery change scheme work, battery ownership needs to be captive under a separate domicile so that you can insure them and separate adverse selection from the equation.

This article goes beyond that to suggest that Tesla can ignore the battery completely, and instead recoup the costs of the batteries by charging about $70 for a swap (you can find the article easily, and I’ll just accept the numbers presented for the moment as it matches Musks statements).

This is a smart and interesting idea certainly, but with one line of flaws that makes it unworkable – the real cost of batteries is there and it’s enormous.

At some point you’re forced to consider one of two viewpoints:

1) Tesla is selling a $40,000 sedan that costs $70 to fill up (compared to $40-50 for all other vehicles)

OR

2) Tesla is giving away free batteries

Remember Tesla has no control over how often someone takes advantage of the battery swap feature. With no supporting data, this sort of speculation, if acted upon by Tesla, is more likely to open Tesla to enormous, long term losses.

Tesla can definitely play games with the costs of its vehicles to increase sales (and destroy my puts in the process). But at the end of the game, what’s in it for TSLA shareholders?

Standards Of Excellence Lacking With Sales Data

Tesla remains a black box on its sales records and that concerns me. So much so that I was willing to wildly speculate that they weren’t selling any vehicles at all, just leasing a bunch. (Sorry, but it’s a tough world – you want to fend off the unwarranted criticism? Show that it’s unwarranted…)

Starting in Q2, Tesla is set to revamp their means of recording vehicle leasing numbers. This has led at least one analyst to opine that the move could “create shareholder value”. Obviously it hasn’t dawned on anyone that needs to revamp reporting methods usually lead to restated earnings numbers, not sudden piles of money appearing out of thin air. Especially in a young start up that just used its flashy new vehicle sales and first ever profitable quarter to raise just under a billion dollars in equity offerings and bond sales.

If they’re doing that, is it technically fiddling with GAARP rules? Of course, but you’d need to show it was blatantly intentional to warrant regulator attention. And it’s not like regulators don’t already have their hands full or are renowned for their quick uptake and willingness to wade into a heated battle with a popular start up; especially one where it will look like they’re defending entrenched legacy companies that received public bailouts as little as four years ago.

Until I see some more solid sales numbers and know that the lease/sale distinction isn’t creating some long term liabilities for the company – especially at 230X EPS – I’m skeptical.

There’s The Wrap

The biggest problem with TSLA isn’t Tesla. It’s people trying to sell you Tesla for too much money. There’s no good justification for paying this much, in the face of so many unknowns. The problem is human emotion. It takes self control to not get involved in something – particularly something you find as exciting as Tesla.

But just because Tesla is a good company led by a visionary who has had a stellar career so far doesn’t mean you should buy it at any price. At current valuations, Tesla is priced to deliver next to nothing to buyers in exchange for a very large transfer of risk directly into their net asset values. Heads you get nothing, tails you lose.

There are lingering questions for Tesla and problems that will take more than a few months to sort out. And every day longer than what is being forecast is running out the clock on the shareholders, who are down big and need to see some major plays to tie it up.

And at these prices, there are plenty of other companies you could be buying that would probably deliver bigger surprises anyway. Interestingly, buying one of Tesla’s competitors or suppliers might be a more cost efficient play .

I know you want to be a part of something special. But the best course of action here is for you to exhibit some self-restraint, and sit this one out.

Comments »