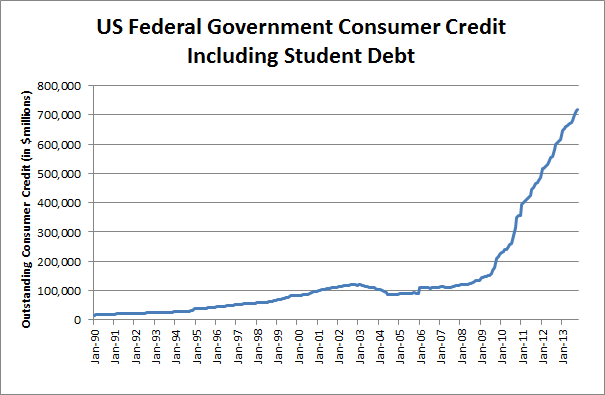

Want to see something distressing? Let me show you the outstanding consumer credit of the US federal government according to the Federal Reserve.

These numbers include student loans originated under the Federal Family Education Loan Program and the Direct Loan Program, Perkins loans, and private student loans without government guarantees. These numbers also include loan balances that are not included in the non-revolving credit balances reported by the Federal Reserve.

The US government has crossed over $700 Billion in outstanding consumer credit (by its definition, non-investment credit for the purpose of consumption of goods and services by the borrower). These numbers were around $100 Billion just five years ago.

To put this into perspective, JPMorgan Chase’s entire loan portfolio was about $729 Billion last quarter.

To further put this into perspective, the market caps of Visa, MasterCard, Discover, Citi, JPM Chase, Capital One, and American Express combined are just under roughly $800 Billion. The US consumer credit program is equal in size to the publicly traded shares of all of these companies put together.

If something should happen to this loan program – if, for instance, these loans should have happen to been made under shaky, high risk terms to people that cannot repay them – the resulting blow would be similar in scope to a company the size of the largest banks going under or, if you prefer this imagery, the shares of all the aforementioned companies trading to $0.00.

Have a nice day.

If you enjoy the content at iBankCoin, please follow us on Twitter

Print Baby Print

cheers

been reading too much zerohedge as of late?

No, the other day I was looking through Federal Reserve data and those numbers were screaming out

Ahh, the power and temptation of having the magic checkbook.

Relax, they are just hedging to balance risk.

If they are the greatest debtor, why not be the greatest creditor? Brilliant ! So simple even a member of Congress could think of it.

that’s why my longer term view is still bearish. the student loan bubble WILL pop. It’s the reasoning why our government enacted rules outlawing the ability to discharge student loans in bankruptcy…to shore up protection. But mathmatics don’t lie and when people’s income can’t pay their bills, the student loan will go into default. Then it’s either bubble pop, or the return of debtor’s prisons to scare them into paying.

This is one of your silly posts.

Are there any realistic circumstances in which 0% of the student loans are paid back?

And comparing a 100% wipeout of $800 billion in company share value to a loan writeoff by the government – very silly.

Imagine an economic situation where the share prices of the companies you mentioned (several of which aren’t in the lending business) all drop to zero. Pretty hellish. End times for the economy.

Now imagine the Fed gov’t writing off $700 billion. Not good, but, as apocalypse goes, meh. There’s a debtor on the other side who benefits.

Not silly at all. Please refer to the disconnect of the real data above, and note how unprecedented the times we are living in are.

It goes without saying the damage could range anywhere from 0-100%. I don’t know why you’d even try to throw out a guess at this point. So I opted for max assessment.

Student debt doesn’t go away for the borrower. They will hunt you down and empty your pockets, even if it takes your entire lifetime.

This is a good investment. Your government has to invest in young people. Sure some it will be a waste, but that’s what governments do, right?

I understand that. But refusing to write down a bad investment, when someone isn’t paying you, is still a loss

rp1 the government does not necessarily have to invest in people and what are we getting for the money? 10,000 more poly-sci majors pushing idiotic ACA-style reforms who also can’t setup a fucking website?

There are serious education/work requirement issues in this country and a trillion dollars of direct aid and super-legal protections for student loans isn’t going to help that