Oil, that is. Black Gold. Texas Tea.

Oil, that is. Black Gold. Texas Tea.

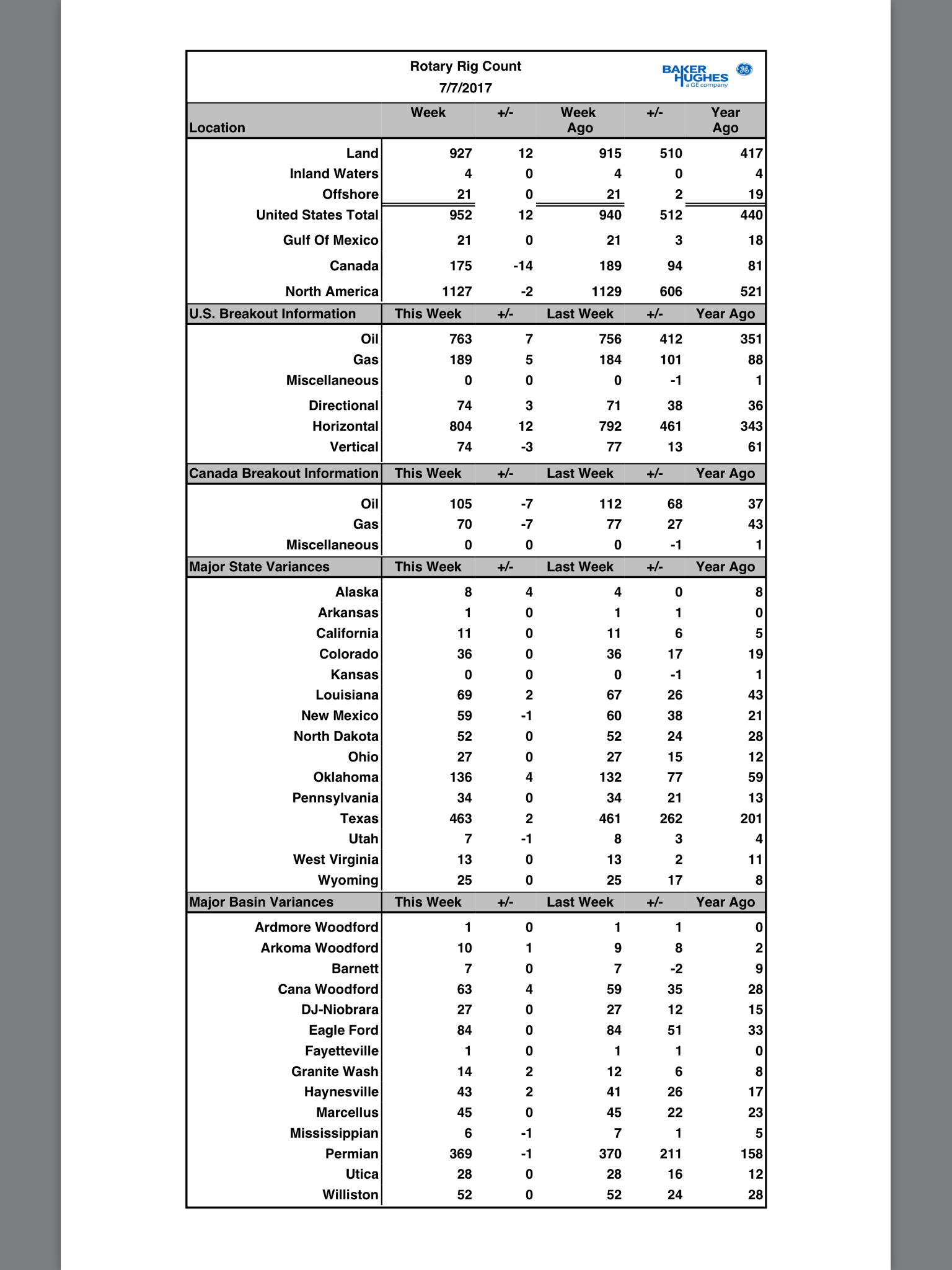

A +12 rise in the total (oil+NatGas) Baker-Hughes AHEM “Baker-Hughes-General Electric” (hereinafter referred to as BHGE) weekly drilling rig count report once again reveals serious weakness in the current frenzy of short-selling. This has not dissuaded hedge funds as they continue to hold a record number of short positions in WTI futures.

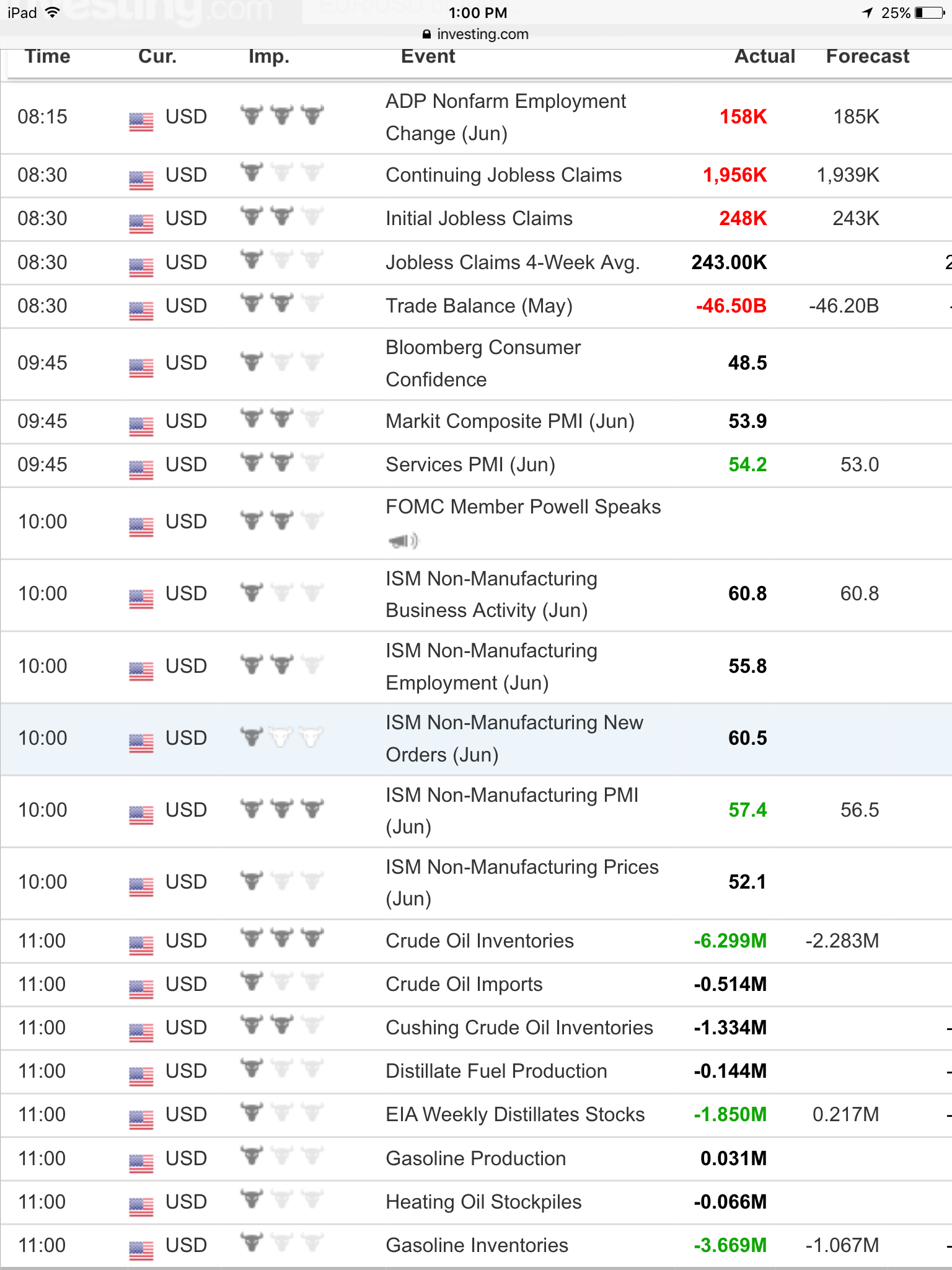

For the umpteenth week in a row, oil in storage is down. This week’s numbers are scorching to any bearish thesis on a further drop in the futures price of crude. Storage at the Cushing, OK hub is of particular note. But we are talking about an enormous amount of money staked against crude oil at the moment.

A rational mind looks at the following and says “Buy”. But this is crude oil, and rational thought only bears fruit over a period of months, not days or weeks.

Of particular note is gasoline inventories. These numbers, at the beginning of fucking July, are poison. Refineries are pumping out gasoline in record numbers. They cannot keep up with demand.

“Ahhh, but hedge funds are holding record positions!”, you bleat. Yes, but if one looks at the actual performance of hedge fund managers over the past five years (dismal) perhaps it would give you pause. Perhaps.

Something is going to snap here. It will be brutal and it will be swift.

For the second week in a row, active drilling rigs are down in the Permian Basin. And flat in the Eagle Ford. The bulk of added drilling rigs in the entire 50-state region was in fucking Alaska, which increased it’s total rig count to 8 from 4. All horizontal. All meaningless.

Everything is meaningless outside the Great State of Texas, and specifically the Permian when it comes to crude oil in 2017. Everything.

The following comes from BHGE and it is not bearish at all:

If you enjoy the content at iBankCoin, please follow us on Twitter

Only a good, old fashioned, global war can fix this. Oil prices are not determined in the US. It’s a total global decline. The US economy is the least dirty shirt. Global demand for oil is decreasing while OPEC and other producers are pumping. Total miles driven by trucking industry have been declining for years, malls are closing, people are drowning in debt and driving less, wages are stagnating, consumption is down, airlines are cutting routes, etc. etc. This is a permanent bear market w/o good war in ME to halt production.

Global demand for oil is not decreasing. I don’t know where you got that info.

@maven, one can slice and dice the market any way one chooses to support his own agenda. With so many attempts at rigging the crude oil market by different actors (i.e. producers UP, propaganda DOWN [to punish Russia]) one should come to conclusion that short-term price can be affected either way but the overall trend cannot. The global crude market is too deep and liquid to affect its trend by rigging. Therefore, it would be counterintuitive to think that the price per barrel decline is due to increased demand (consumption). The more likely scenario is that falling price of crude is a result of forward-looking decline of expected demand into environment of increased production. So that’s where I got that info…since official reports and self-serving analysis is horseshit. Needless to say, one still has to look into overall exchange rates since crude is priced in USD and how that affects global demand. With increasing USD exchange rate, crude becomes more expensive for everybody else relative to their currency; thus, clamping down further on demand.