2017 Population of India 1.4 Billion

2017 Population of China 1.8 Billion

That is well over one-third of the world population, folks.

1st Qtr 2017 China GDP Growth = 6.9%

1st Qtr 2017 India GDP Growth = 6.1%

You do not have to be good with numbers to come up with the conclusion that energy demand cannot be met without substantial capital investment in exploration. There is, however, a rather large elephant in the room and that is the fact that CAPEX has dwindled to almost nothing since the oil market collapsed in 2014-2015. There is simply no money available to companies that have been losing money on every barrel they have produced since the heady days of $100 Oil.

You do not have to be good with numbers to come up with the conclusion that energy demand cannot be met without substantial capital investment in exploration. There is, however, a rather large elephant in the room and that is the fact that CAPEX has dwindled to almost nothing since the oil market collapsed in 2014-2015. There is simply no money available to companies that have been losing money on every barrel they have produced since the heady days of $100 Oil.

For the second year in a row, proven world reserves of crude oil have fallen. One can rightly assume that lack of exploration would have something to do with that.

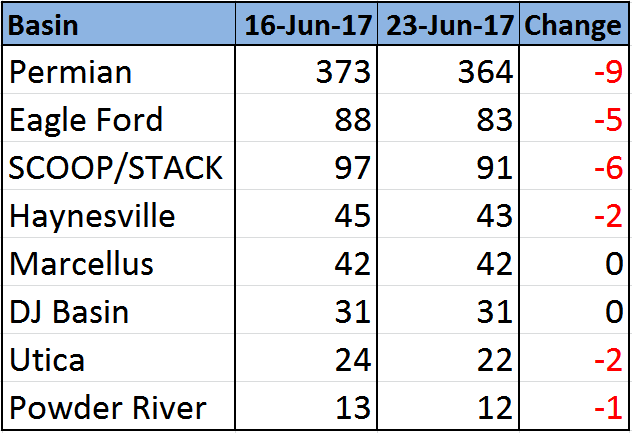

This shit is going to hit the fan, people. In fact, the shit-train has already left the station. Here are this week’s numbers for rigs in the places that matter (data courtesy shaleexperts.com):

Shale Experts Rig Count

Contrary to Baker Hughes, the rig count is down in the Permian, Eagle Ford, SCOOP/STACK, and many other basins:

Of course the Headline News is that the Baker Hughes Rig Count that many traders rely on has risen for 21 weeks straight. This mantra is being repeated in just about every article I have read this week.

There is an old trading adage that says when the noise is loudest, the market has hit a bottom. The noise right now is deafening. Case in point, the “Commodity King” David Gartman has just said that the price of crude is basically going to zero and that the Saudi Kingdom will soon be broke. The man should be called the Contrarian King as he has been 100% wrong for the past there years.

Yet if you look at yesterday’s Baker Hughes data, you will see that the bulk of the rise last week was in the category of “Other”, essentially meaning areas outside the more efficient production areas of Texas, New Mexico, Oklahoma, Louisiana, Alaska and South Dakota. In other words, current drilling contracts in areas that are most certainly not about to make money actually pumping crude oil.

Why a DUC?

What we are talking about here are DUCs (drilled but uncompleted wells). It is a common misconception that the weekly rig counts are tied to actual production of crude oil.

DUCs are everywhere. Over a year ago, DUCs were said to be at the highest percentage ever recorded. The BAKKEN play is inundated with DUCs. And with the frenzy over the stacked plays in the Permian Basin, with tens of billions being thrown at the area by the Oil Majors like Exxon, Apache and Pioneer, (not to mention private equity investors like Blackstone or blank-check firms such as Silver Run Acquisition Corp), the number of DUCs has continued to soar.

For more info on the current state of, and influence of, DUCs, see this fine article from 2016 in Oil & Gas Investor

“But wait”, you bleat. “Shale production is soaring”. Well yes, yes it has been. It has also begun to level off. Nobody wants to sell oil at $43. Some have no choice but the slow bleed they have been producing for the better part of three years.

The firms financing this fiasco have been covering and extending credit during this downturn. Don’t expect that trend to continue. M&A has been ramping and as hedges come off and the banksters come calling, I expect to see a lot of blood in the streets over the rest of 2017.

Crude Futures have been trading purely on emotion during this current downturn. Investors do not trust OPEC, even though available data shows the cartel’s compliance on the agreement to limit production is currently at 106%.

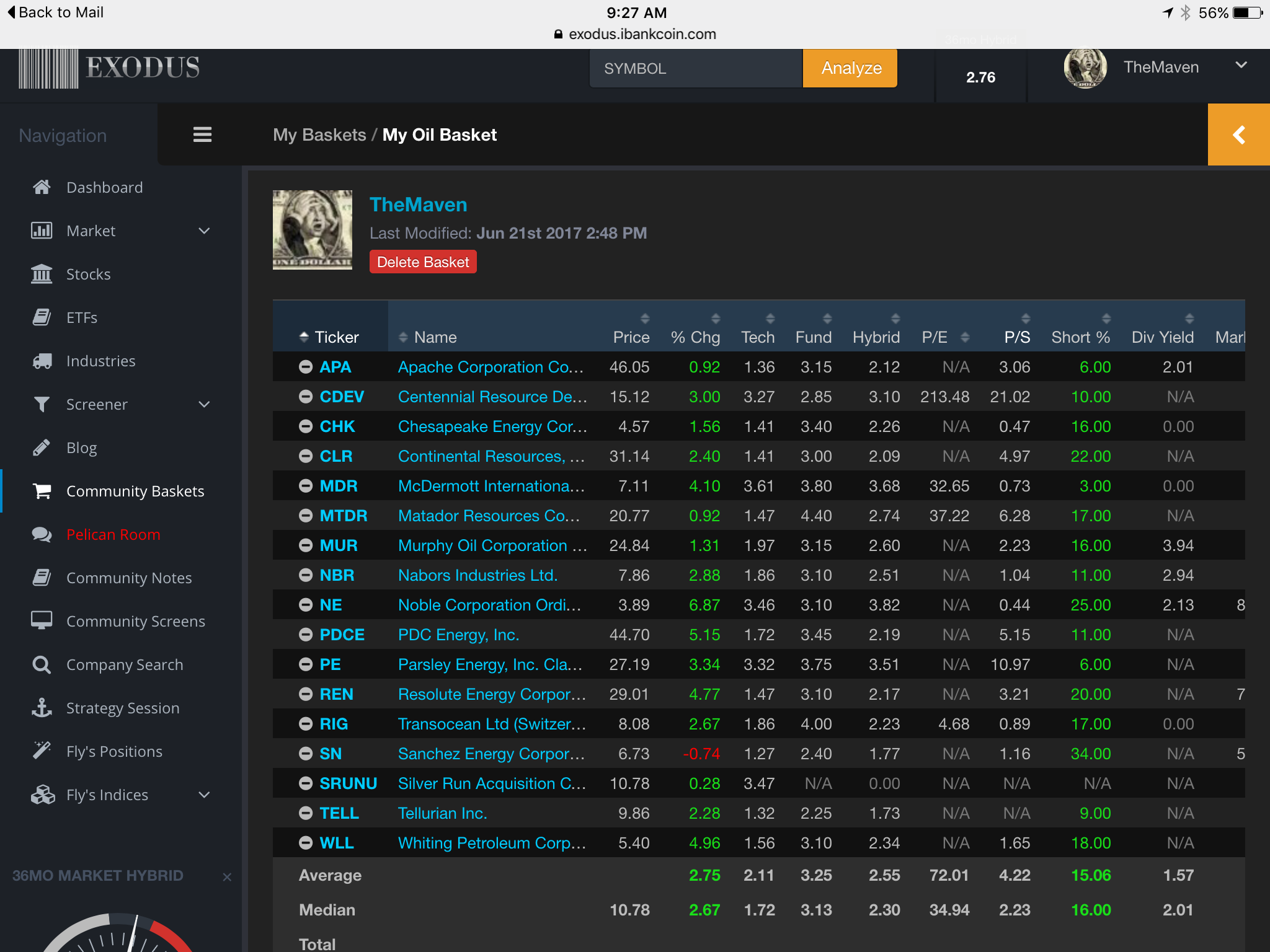

Below you can view my current “Oil Basket”, which is a table of energy stocks I currently own (subscribers to Exodus have the ability to share our investment ideas). It exploded higher yesterday on a rise in the futures price of thirty-eight cents. Take from that what you will, Thursday’s and Friday’s action signaled the first inklings of bullish enthusiasm in weeks.

My Oil Basket is now comprised of 17 equities ranging from mega-caps like $XOM to pure-plays like $CDEV to blank-check acquisition companies like $SRUNU which have not even completed one transaction yet. From risky bets like $CHK and $WLL to bets on valuation like $APA, $PDCE and $MDR. Many of these names were beaten to shit before the latest downturn, and that is when I did some buying recently. Look at the Short Percentage of Float!…an Epic short squeeze will be the reward for my patience.

As always, betting on the volatile commodity is not a game for the weak. The swings in the value of my Oil Basket over the past two weeks would curl your hair. I have daytraded in and out of some of the stocks listed but many will be held through 2018-2020 time frame.

Have a Ducky Saturday.

If you enjoy the content at iBankCoin, please follow us on Twitter

Thanks for this analysis Maven. Very thorough.

Africa is going to join India and China in terms of large population numbers and even higher economic growth rates over the coming decades. Huge demand on the horizon.

Any official numbers coming from China or India are fake, contrived and manipulated. Global economy slowed down and will continue to get slower. Especially in China, India and Africa.

I echo your thoughts as well,….

its not about being good with numbers maven,..

its whether to believe China and India’s erroneous, manipulated and fake numbers,

China is full of shit,.. period, plain and simple,

sure there will be tradable OS bounces, but more blood is needed

reality is,… lower for much longer