The outlook for crude oil has not been this gloomy since January.

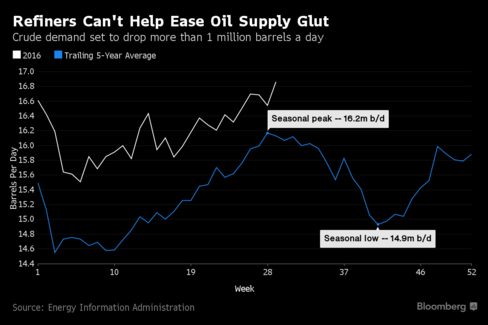

Beware, oil bulls: Just as U.S. oil production sinks low enough to drain supplies, demand is about to fall off a cliff.

With weekly Energy Information Administration data showing U.S. gasoline stockpiles at the highest seasonal level since at least 1990, refiners may shut sooner and for longer ahead of the Labor Day holiday in early September, the end of the driving season.

“With gasoline supplies the highest since April, refiners may pull some projects forward,” said Tim Evans, an energy analyst at Citi Futures Perspective in New York. “This will take more support away from the market and add to the broader problem of excess supply.”

Hedge funds’ net-long position in WTI fell by 23,665 futures and options combined to 156,804, CFTC data showed. Shorts surged 24 percent, while longs, or bets on rising prices, increased 1.4 percent.In other markets, net-bullish bets on Nymex gasoline dropped 18 percent to 1,020 contracts, the lowest since November. Gasoline futures fell 3.8 percent. Net-long wagers on U.S. ultra low sulfur diesel decreased 19 percent to 16,640 contracts. Futures slipped 5.4 percent.

“If we’ve gone through the bulk of the summer driving season and haven’t done much damage to gasoline supply, refiners are going to react,” said Michael D. Cohen, an analyst at Barclays Plc in New York. “It will be hard to find investors that are willing to go long.”

Source: Oil Demand Is Headed Over a Cliff Just as Refinery Shutdowns Loom

If you enjoy the content at iBankCoin, please follow us on Twitter