The Big News in my feed this morning is the story on the obscure Beijing bureaucrats who have caused a 2% drop in Apple shares by banning the sale of ancient iPhones in the old city, phones that Apple is currently phasing-out of their sales channel.

I am a long-term holder of shares in AAPL, otherwise I would be buying on this dip, but I try to adhere to strict Principles of Allocation in my portfolio. I am Most Comfortable as my cost basis in AAPL is a mere fraction of it’s current “depressed” asking price.

I have already written of my aversion to investing in things Indian so let’s move further Eastward into this morass that is Asian Finance. Or at least my limited experience with it. Years ago, while it was still fashionable and in a Moment of Weakness, I “invested” in a coal-mining company in fucking Inner Mongolia. The Maven is not proud of this but it was long ago and illegal substances as well as copious amounts of legal alcohol could possibly have been involved. Things were going smoothly for awhile, quarterly reports came in with steadily increasing earnings, astute acquisitions were made, the coal industry was booming, and goddammit I was going to do pick up the White Man’s Burden and help the fine people of Inner Mongolia obtain cheap fuel and electricity.

And then it all vanished, literally overnight, in a frenzy of financial chicanery not seen since the days of the river boat gamblers fleecing rubes on the Mississippi. The CEO was accused of Crimes Against the State and apparently whisked into the gulag never to be seen again until properly reprogrammed.

Your Maven shound have been risk-averse to anything remotely Chinese at that point – and I was, for years. Yet I watched, forlornly, as company after company debuted with IPO’s worth tens of billions of dollars. Billionaires created by the hundreds with many, many hopeful speculators not far behind. I had to get back in the game, as Cramerica is always exhorted on that CNBC thing.

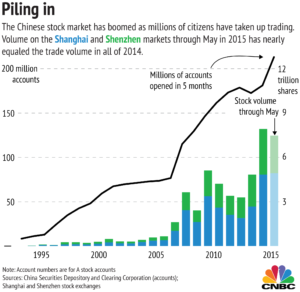

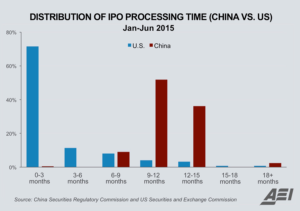

As you can see by the chart, the Chinese have been pouring money into their exchanges, mostly money flowing into IPO’s. Yet the average investor there will pull his money out just as quickly as he threw it in, as evidenced by the dramatic swings we have seen over the past 18 months. And the communists have been Most Helpful as they have made investing in IPO’s dramatically more efficient:

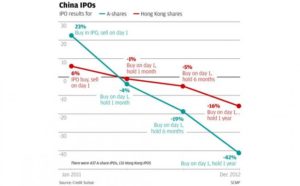

Yet the results for many enthusiastic speculators has been less than stellar. I am being kind:

And the communists hold a tight rein on your Dreams of Early Retirement when you might least expect it:

“Get back in the game”. So I did. I researched and I researched and I decided on Trina Solar (Ticker Symbol TSL). I waited for a drop, and drop it did, from dizzying heights all the way down to the teens and then into single digits. Yet the fundamentals were strong, there was growth with little debt, analysts were falling all over themselves. So I jumped in. But this time I traded it rather than treating it as a long-term play. And it worked, for the better part of a year I made good money buying dips and selling a short time later for decent, sometimes even great, returns.

Perhaps the burn from my coal debacle tempered my enthusiasm, as I am lucky that I never bought a large number of shares at one time nor held them for long periods. Yet my final buy and sell left such a taste of bullshit in my mouth that I swore off anything Chinese, forever. Read on…

You see just as it seemed TSL would rocket higher, the CEO, Jifan Gao, formed a cabal to take the company private via ADS in December 2015. Long-time holders, and there were many, who had bought at much higher prices over a few years, got rat-slapped as the price to acquire was set at about $11.60 – far below what most analysts at the time regarded as the fair price of company shares. I believe the Consensus at the time was about $18-$21/share, although Chinese co’s do tend to have depressed pricing (I wonder why). Now at the time, I was holding shares that I had bought in the range of $7-$8 so I could not complain too loudly. But the sheer timing of the announcement pretty much destroyed the capital of those bagholders who believed (rightly, according to the data) that they would not only recoup their losses but would be handsomely rewarded for their unwavering support of this leader in the solar panel industry.

And TSL was, and is, a leader in the industry as they also embarked on an ambitious and quite successful expansion into becoming not only a manufacturer but also an installer, and sometime operator, of large solar-power projects all over the globe. They also steadily announced dramatic gains in panel efficiency as well as impressive cost-cutting to maintain margins as selling prices continued to drop. They even won awards for environmental improvements in what is a pretty green-unfriendly manufacturing process.

So the whole thing just stinks to high heaven from the perspective of western traders accustomed to at least some semblance of rules and fairness. There is just too much uncertainty surrounding the idea of throwing greenbacks at a bunch of unsavory communists. The word unscrupulous, resurrected from an old Charlie Chan flick, should be added to any sane investor’s lexicon.

We note that Alibaba is once again mired in various allegations of flim-flammery and Shenanigans. We tend to notice these things. Have a wonderful weekend.

If you enjoy the content at iBankCoin, please follow us on Twitter

I confess I was BABAed. Who among us hasn’t been bamboozled by the Chinese? We should form a support group.

It will be a long time before I invest in a Chinese company again. For a trade though? Sure. I conjecture price action is more predictable in the Chinese markets because they don’t have as many hedge funds or algos running amok. You just have to make sure to exit before the inevitable rug pull.

I’m never averse to making a quick buck. You just have to verify the news that spurs you to throw your money at these things.