Ever wonder why you see a stock go up or down for no reason; especially with no news.

Have you ever sat and watched level 2 all day and witness the melt up or meltdown of a stock on seemingly insignificant volume? Then at the close or even after, you get a huge buy imbalance or sell imbalance.

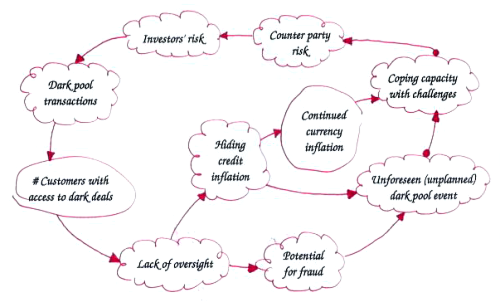

Strange trading like this seems to be occurring more and more. Let me introduce to you the Dark Pool.

Apparently, a lot of firms and even exchanges have Dark Pools that allow for trading large blocks of stock with almost complete anonymity.

Those who have Dark Pools maintain that the execution of their orders will take place off the trading floor giving more stability to prices within the market place and allowing for better executions.

I’m not sure about executions, but I seem to remember that volatility and major price fluctuations have been plaguing this market for quite some time now.

While the SEC will remain an observer, for now, there are wide implications that this is offering more improprieties within the market place.

Since I’m always thinking of how I may be getting ripped off, I figure it would be simple for a firm to issue a recommendation and then quietly trade against that view.

It brings to mind the days of the dot com bubble when analysts were recommending a particular issue and then selling for their own personal account or dumping institutional blocks onto retail.

by GW

http://en.wikipedia.org/wiki/Dark_pools_of_liquidity

http://www.nysun.com/business/dark-pools-threaten-wall-street/64598/

http://www.advancedtrading.com/directories/darkpool/

[youtube:http:www.youtube.com/watch?v=N39T7QmdEKI 450 300]

If you enjoy the content at iBankCoin, please follow us on Twitter

Interesting. I had not heard about this.

Bloomberg has had some articles about the dark pools from time to time over the last six to eight months. The way I understand it, the dark pools are unregulated and provide a way for major investment firms to trade with each other without the obligation to report the transactions to the public at the time they occur. Goldman is one of the firms who participates in this. More frackery by Wall Street, imo.

Nice article GW.

Here’s an example of a recent article about dark pools on Bloomberg:

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a7QVLhrDkVxI

i am a software engineer, and about a year ago i interviewd at a suprisingly large hedge fund here in the midwest.

side note: i have a unique ability to gain peoples confidence, and i can get people to divulge things that they wouldnt normally tell anyone. often times, when i am working this mojo, you should see the look on the persons’ face…its like “i cant believe i just told him that”….its hilarious. but they cant help themselves. its a gift.

anyway, i plied my trade with the CEO and CFO in the interview with this hedge fund. so much so, that after 30 minutes of what was supposed to be a 2 day interview, the interview “observers” came in and awkwardly terminated the interview. it was a hoot.

i learned a lot that day, more than any stupid job would ever pay me.

bottom line. when you watch the tape, you have no idea what it really happening. you have no idea what real money is doing.

if you think the game is rigged (in the words of jim cramer):

“you have no idea”

dark pools are only the tip of the “iceberg”.

Insitutional investors got sick of being front runned by the specialists. CalPERS kicked everything off when it sued the NYSE and its crooked specialsts for front running back in 2003. Other large institutional investors did the same.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7B982FFD36-77C7-43BC-AD69-713F4CE21096%7D&siteid=mktw

http://www.nypost.com/seven/09212006/business/nyse_specialist_faces_27_months_for_trades_business_paul_tharp.htm

This is speculation on my part, but I believe dark pools emerged in part as a response to that. The technology had become sophisticated enough that institutional investors could give the middle finger to the specialists who were ripping them off.

The specialists screwed themselves because of their greed.

ITG-N is a instituional trade executioner who has dark pools. They employ mathematicians and scientisits who create trading algos.

Check out their website for many articles detailing their algorithms and trade methods.

http://www.itginc.com

huh

Boca,

Definitely “frackery”…they do have to show thw trades once they are done. They may come after the fact during market orders in very small lots or as large blocks at the close.

Nullpointer,

Please tell us more…perhaps a PG article?

Satanic’,

How Devilish of you to support…just kidding. Seems very possible, but as you can see the anonymity poses many problems for investors.

anjing’,

Thanx {sic}

GW-

i have considered writing numerous PG articles, but i am busy, and lazy (a bad combination).

i will follow up and say this though: the tape tells you only what they want you to see. which is fucked. the game is truly rigged, and is merely a mechanism to transfer wealth from retail to institutions.

to that end, the only way to have a shot is to momo trade like you guys or have balls of platinum and buy value stuff when its out of favor. joe six pack and his 401k, where he buys a stock (or an index fund) and holds it 10 years, is fucked. he will get nowhere.

I have always believed that much of the game is rigged. I have been full time trading for over ten years and part time for about 12-15 before that. It gets worse every year IMO. For a daytrader to survive one has to find his edge (niche) and do it over and over again like a monkey on crack. Wash, rinse, cycle, dry and then do it over and over and over…. Some day I would let to get a real job and do something useful with my life before I die or retire (whichever happens first).

TC-

your lament is not isolated to you alone.

the lives of most people, even those with “prestigous” careers, amount to nothing more than the exercise in futility you described.

to whit: i write essentially the same code, day in and day out, and what i do provides zero benefit to humanity. true, i make a decent living, but the fruits of my labor provide negligible benefit for society at large.

to compensate, i volunteer for a number of worthy causes. it helps a little.

i used to work for an institutional firm, and they spend a significant part of their time finding ways to trade anonymously. CalPERS was one of the clients we ran money for, but they weren’t specifically the impetus for the effort.

“. . .merely a mechanism to transfer wealth from retail to institutions.”

I see a lot of this “the hedge funds are out to get your money” stuff on the internets.

Does the retail chump have enough money to bother stealing? With his 10 shares of SHLD he bought because Cramer said it was the next Berkshire Hathaway? etc

BH-

institutions are pitted against one another as well, this is true.

but that money is a difficult fight, as opposed to retail which is easy pickens.

think about it this way: why do analysts upgrade/downgrade?

do you think GS cares if C downgrades SNDK?

do some research on the reelative amounts of retail vs institutional money.

back of the envelope calc: if 300 million people had $1000 in a 401k….thats real money. think about it.

Very interesting post. I had never heard of dark pools before. Loved the links.

Good work!

-Phil

Thanx Phil

Nullpointer,

I agree for the most part.

Low down dirty shame.

Tradercaddy,

Take your experience and write a software program that makes you $ and helps out the novice.

I’ve been in the game for 14 years and I agree with you…

I like to build positions and trade some for momo and some for longer term plays.

I have not day traded fulltime, but all my buddies are trying to convince me to just go for it.

Aris,

Much time and $…

All this when we need transparency.

DevilDog has even referenced DarkPools.

It’s one of the conspiracy memes in trading circles.

But think of it this way, if you are a smart krill and know how to read the water as it’s pushed ahead of an Orca, and you have serious stones, perhaps serious coin can be banked.

I refuse to simply just say “the game is rigged”. I know stats well enough that a rigged game can be gamed easier than a fair one with a small house advantage.

After all when the probability goes to 1, it’s so much easier to know which side of the bet to be on, no?

Forgot the ‘h’