Roughly 400 days ago, your dear correspondent JG was trapped in a faux “resort” on the Big Island. It was conference time and boy were the participants mesmerized by the fire-throwing “natives” that blew the conch shell at sunset. Not too different from the bagpipers that carry out the same task at The Inn at Spanish Bay, come to think of it. Unsurprisingly, nary a proper dining establishment was to be found on premise, despite “five-star” accomodations.

There are few hotels that that offer a truly differentiated experience. Business travellers really don’t need anything but a clean commode and some speedy internet during these jaunts, increasingly opting for ALOFT (Starwood), Hyatt Centric, Moxy (Marriot), Canopy (Hilton). Pretty much all the same product. The leisure set, sip on $14 Coronas in every corner of the world, thumping on the butt of a stubby bottle of Heinz Catsup. The high end bars are Diageo vendors. The food Sysco central. Homogeneity pervades. Homogeneity pervades. Is there really that much of a difference between the Lotte Seoul and the St. Regis in Aspen? Aside from the TOTO toilet that splashes your bum in Asiatic lands? I think not.

Anyhoo, thanks to The Grande Ol’ Internet, we’ve been blessed with the ability to sort through said homegeneity with a few clicks, opting for whatever suits our fancy. The burning question is — why the fuck would anyone use this shit to book?

Having pondered this question for hours on end, I suddenly realized it was much more simple that I had imagined. These bogus sites are a centralized location to look at pictures!

Who the hell wants to leap from site to site comparing the lifeless stock images from big chain hotels. The websites are just about as bland as the contienntal breakfast under Jeeves’s steel dome.

That said, the world of Online Travel Agencies [PCLN, EXPE, HRS, TRIP] is a vertiable rat’s nest. Trying to wrap your head around the dynamics at play is akin to threading a serpentine belt in your brain.

Back in the stone ages, hotels published rates 12-15 months in advance. Pricing was fixed. Overestimating or underestimating demand was the implicit risk. In effect, prices in the hotel world have always been “fixed” to some degree. The rationale: simplification of revenue management and distribution channels.

With the advent of The Grande Ol’ Internet, a veritable transmorgifier for forecasting demand and discounting in real-time, pricing became a bit more dynamic, with suppliers and OTAs haggling behind the scenes.

But, front-facing pricing is still theoretically standardized with hotels unable to undercut OTAs (by mandate). A concept known as “rate-parity” — some blowhards still call it olde fashioned price-fixing.

Quoting industry pundit/apologist @rockcheetah:

This is where uninformed accusations of “price fixing” fall apart. Hotels independently set prices based on market conditions, not under the collusion-inspired duress wrought by competitive hotels and/or intermediaries, as imagined by delusional conspiracy theorists. Rate parity is used to effectively manage the frequent price variations across multiple business models and distribution channels for a perishable product.

Public discourse has been hovering around the issue of “rate parity” for years, both in Europe and the US. And of course the rules are different in the US and Europe, so bear with me.

Since 2012, many European authorities—including the UK, Germany, Austria, Belgium, Denmark, Switzerland, France, Sweden, Italy, Ireland, the Czech Republic, and Hungary—have launched investigations concerning parity provisions in contracts between OTAs and hotels. OTAs, such as Expedia, enable customers to search for and reserve hotel rooms, flights, and other travel-relat- ed services through their online platforms. A common model for their agreements with hotels gives the hotel responsibility for setting and listing room prices on OTA platforms, and the OTAs collect commissions upon booking. The parity provisions at issue require that hotel room prices offered through the OTA are the same (or better) than prices offered through the hotel’s other sales chan- nels, including competing OTAs and the hotel’s own website. Typically, this parity requirement also covers other conditions, such as cancellation terms or inclusion of breakfast in the room price. Expedia, Booking.com, and HRS, three of the largest OTAs for hotels in Europe, have all come under scrutiny for requiring such provisions.

European regulators have been concerned that these parity provisions have an adverse impact on competition among OTAs. Because each of the major OTAs requires parity, in practice, the provisions guarantee that the price of a particular hotel room is the same across all online platforms. Knowing that room rates will remain in line with their competitors, regulators believe that OTAs have little (if any) incentive to compete against one another on commission rates charged to hotels. That is, OTAs could raise commission rates to hotels without losing business to one another because the room rate would remain unchanged (at the expense of the hotel’s margins). Alternatively, if the hotel did increase room rates, this increase would apply to their competitors as well. According to national competition authorities, this arrangement eliminates price competition between OTAs and “risks leading to higher commission rates, which in turn risks leading to higher hotel room prices.”

European regulators also have expressed concern that pricing parity reinforces the position of incumbents at the expense of new entrants because pricing parity impedes their ability to increase share by discounting commissions or room rates. As a result, these provisions arguably preserve the concentrated structure of the OTA market, and impede entry from innovative new players. OTA pricing parity thus is at odds with the European Union’s desire to facilitate growth and innovation in e-commerce.

The hucksters at Expedia and Priceline control an inordinate portion of the market. By some counts, Expedia runs about 75% of the market in the US and Priceline is in the mid 60% range in Europe. Together they’re at about 95% in the US. Line extention is their game. Meanwhile, commision levels are 15-30% and the hotels don’t seem to give a fuck. Especially if the extra bps paid out bolster search rankings. Why? Pretty much because they are a bunch of lazy buggers who haven’t prioritized investing in digital assets. Inertia is a bitch when you’re sitting at the buffet. And with little incentive (can’t undercut on price) why the hell would they bother? The power dynamics at play in terms of search are also of import. With one flip of an algo, your stupid little hotel can be relegated to the far reaches of search results. Might as well play ball with the OTAs.

Of course the Europeans are all over the monolith that is Priceline.

In April 2015, Booking.com (PCLN) announced its support of recent decisions by the National Competition Authorities in France, Italy and Sweden to accept amendments to Booking.com's parity commitments with respect to hotels located in those countries. A bit hokey as hotels still had to offer the same rates and booking conditions on Booking.com as they do through their own direct website. The only real change was that competeing OTAs could have different prices, theoretically promoting competition. Note: HRS and Expedia are small fries in Europe.

What a crock of shit. Did those concessions do jackshit for consumer (lower prices), new entrants, or even hoteliers?

The bottom line is that these fuckers are (sort of) in the drivers seat. And guess what? Hotel owners on the whole do not give shit about dismantling parity. Partly because its a lazy-man’s distribution channel and partly because competing on price with distribution partners simply puts them in the line of fire in terms of search rank. Hoteliers need OTAs. Just as OTAs need hotels. According to one prominent Palo Alto hotelier, “All hotels rely on Expedia. Period.”

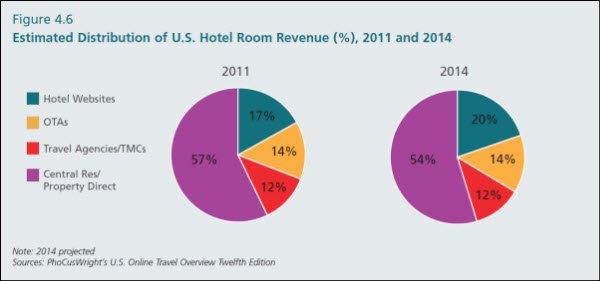

On one other hand, industry data (PhocusWright) suggests that hotel bookings from OTAs are flat between 2011 and 2014. See chart below. No one wants to go to stale hotel websites. But guess what? They still do! Reservations coming directly are growing, per this industry mouthpiece while OTAs are flat. Could that really be so?

One the other hand, quoting some boss-huckster:

“We are entering a new era of online distribution and digital marketing in which just having a website, a few paid search campaigns and occasional email marketing initiatives no longer allows hoteliers to achieve any level of real success and only deepens their dependence on the OTAs, with or without rate parity provisions.”

Furthermore, a hawker of digital media services, chiming in:

“The continuing OTA consolidation created, de facto, a market duopoly, thus further eroding hoteliers’ negotiating and marketing power. With many hoteliers underfunding their direct online channel presence, the OTAs continue to win the “first and last touch” travel consumer engagement battle. Contrary to what some industry “experts” claim, the looming threat of removal of rate parity coming from Europe provides serious competitive advantage to the well-funded, digitally-savvy OTAs, who control the conversation with the online travel consumers. Many hoteliers, who have plainly ignored or underfunded the direct online channel for years and have not acquired digital technology, marketing skills, and know-how, are already “feeling the pain” from these new highly negative developments, whose real impact the industry will feel in 2016 and beyond.”

Who to believe?

Meanwhile on the regulatory front — Zee Germans are coming! Zee Germans are coming!

A December 23, 2015 ruling from the Federal Competition Authorities ordered the platform Booking.com to halt its strategy and remove all rate parity clauses from its contracts before January 31, 2016. The company still has the right to appeal to the Higher Regional Court of Düsseldorf, just like its competitor HRS unsuccessfully did a year ago after a similar decision from the Bundeskartellamt.

Don’t worry, HRS got nowhere with that.

Guess what else? The European Commision is coming too. They will be handing down a pan-european decision on the matter (no date), and I’d venture to guess it’s gonna be a big fuck you to “price-fixing”. But friends, at this juncture, I could give two shits about “price-fixing”, “resale price maintenance”, or “rate parity”. This here inane industry has invaded my dreamscape and I do not appreciate that one bit.

What does this all mean for EXPE, PCLN and its ilk?

Are we’re looking at a race to the bottom in terms of pricing? Will margins get squeezed at OTAs? Will volumes drop on OTAs if regulation comes down in the US/Europe? Will regulation ever come down in the US? Is the hotel industry in for a massive repricing? Or are hotels so dependent on this teat, that it will take at least a decade to make a dent in the prowess of these click farms-cum-merchandisers?

Frankly, independents may not even have the budget or inclination to bother with a digital strategy.

In the US, where EXPE is dominant — this spectre of rate-parity abolition is not as imminent as in Europe. But, you have to wonder if its coming down the pipe.

In a post-parity world, I suspect the situation will be choppy at best.

All in all, PCLN has some headline risk in the near term, Expedia is a shitty rollup that just bought a four billion dollar melting ice-cube in HomeAway, and I don’t really give a fuck about either. There is no spicing it up. Fuck that little mini-Tabasco bottle. Know’msayin?

JG

ps: TRIP is also sashaying its way into the fray, undercutting commissions by 50% per some sources . . . yawn

pps: take a gander at core bookings growth. organic.

ppps: market soaking up the supply

pppps: final thought – middling opportunity either way at pixel time

Seriously though, a bit more economical on the wordage.

thanks for the feedback.

Disagree. I say yak away to your heart’s content.

?

??

Nice! Interesting piece. You have a good voice. My favorite line “I could give two shits about “price-fixing”, “resale price maintenance”, or “rate parity”. This here inane industry has invaded my dreamscape and I do not appreciate that one bit.” <- I so often feel this when diving down rabbit holes of technical financial landscape issues I feel I should be informed about.